Central Bank Watch: BOE And ECB Interest Rate Expectations

KEEPING CALM AND CARRYING ON

In this edition of Central Bank Watch, we’ll cover the two major central banks in Europe: the Bank of England and the European Central Bank. As time has pressed forward and vaccination supply issues have been sorted, we’ve started to see expectations around the two major central banks in Europe converge. The UK’s near-term supply issues have been sorted; the EU’s medium-term vaccination rollout efforts have seemingly been resolved. But it’s still early days, meaning that both central banks are unlikely to misinterpret recent positive developments as signs that economic concerns have disappeared.

BOE SITTING ON ITS HANDS

The BOE has been a non-factor since mid-March and is unlikely to be a significant factor soon with the next meeting scheduled for May 6. But BOE Governor Bailey is speaking in the coming days, and like any time that a central bank head speaks, market participants are likely to pay attention. Yet like many of his counterparts at other central banks, particularly the European Central Bank and the Federal Reserve, BOE Governor Bailey is unlikely to stray from the script of ‘low rates until the pandemic is over.’

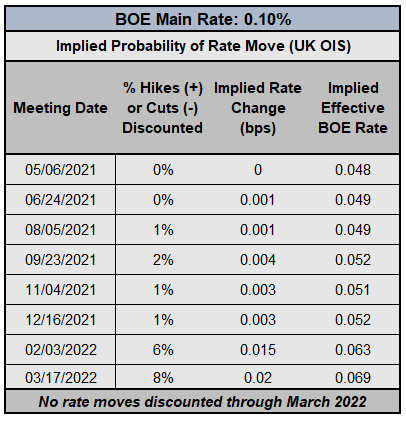

BANK OF ENGLAND INTEREST RATE EXPECTATIONS (APRIL 20, 2021) (TABLE 1)

Rates markets continue to take BOE policymakers at their word that interest aren’t going anywhere any time soon, nor will the main rate move into negative territory. According to overnight index swaps, there is only a 1% chance of a 25-bps rate hike in 2021, and there is an equally meager 8% chance of a hike through March 2022.

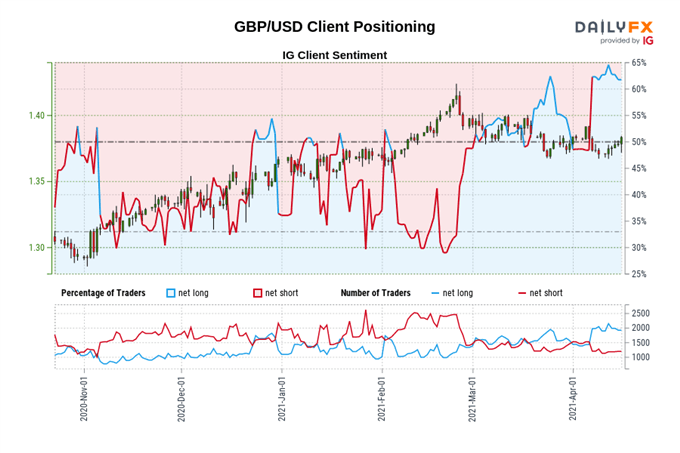

IG CLIENT SENTIMENT INDEX: GBP/USD RATE FORECAST (APRIL 20, 2021) (CHART 1)

GBP/USD: Retail trader data shows 54.04% of traders are net-long with the ratio of traders long to short at 1.18 to 1. The number of traders net-long is unchanged than yesterday and 28.17% lower from last week, while the number of traders net-short is unchanged than yesterday and 8.14% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.

ECB MAY RECONSIDER STIMULUS PAUSE

When the ECB meets this Thursday, there are two sets of comments in recent weeks that provide context to the rate decision. The first comes from mid-1Q’21, when the ECB acknowledged that "if favorable financing conditions can be maintained with asset purchase flows that do not exhaust the envelope over the net purchase horizon of the PEPP, the envelope need not be used in full.” ECB President Christine Lagarde has reinforced the idea that the ECB stands to provide ongoing support, with or without the PEPP.

The second set of commentary revolves around rising yields, to which ECB Governing Council member Klaas Knot has said “what the market is actually doing is pricing that optimism” about a recovery in the second half of 2021. Now that global bond yields have settled down, it may be the case that the ECB feels less pressure to make any changes – even incremental – and rather save its ammunition for later.

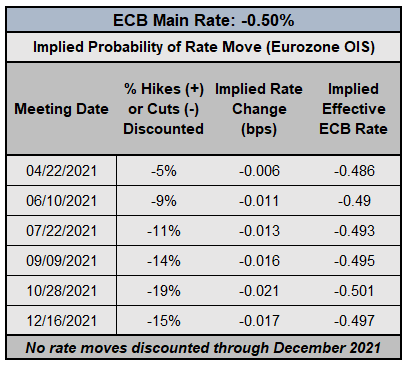

EUROPEAN CENTRAL BANK INTEREST RATE EXPECTATIONS (APRIL 20, 2021) (TABLE 2)

According to Eurozone overnight index swaps, stability in global bond yields influenced a softening in ECB interest rate cut expectations. In mid-January, there was a 54% chance of a 10-bps rate cut by December 2021; that probability now stands at a comparatively meager 15%. This is a stark change in from where we were at the end of 2020, when rates markets were pricing in a 10-bps rate cut in July 2021.

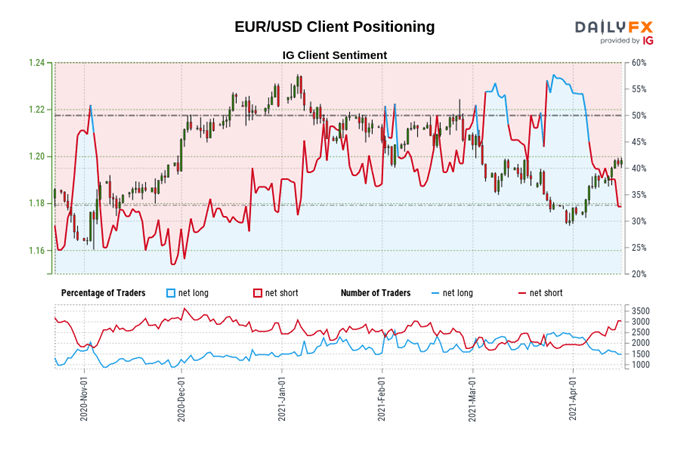

IG CLIENT SENTIMENT INDEX: EUR/USD RATE FORECAST (APRIL 20, 2021) (CHART 2)

EUR/USD: Retail trader data shows 35.39% of traders are net-long with the ratio of traders short to long at 1.83 to 1. The number of traders net-long is unchanged than yesterday and 13.23% lower from last week, while the number of traders net-short is unchanged than yesterday and 3.92% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.