CEE May Manufacturing PMIs: Limited Bounce-Back

The May manufacturing PMI releases across parts of the CEE remain deep in contraction territory, despite today's bounce-back.

A worker wears protective clothing at a car plant in Poland

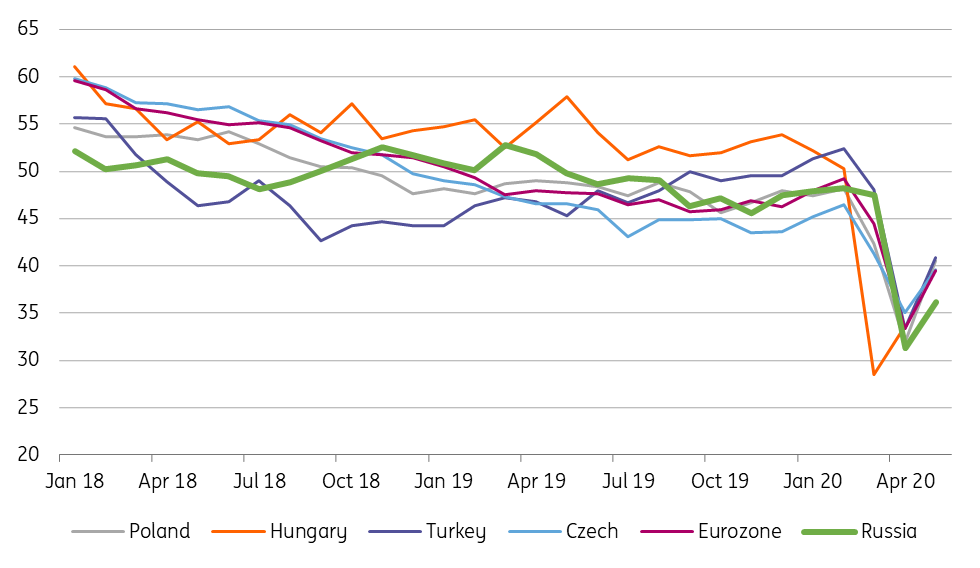

CEE May Manufacturing PMIs: Bounceback, but still contractionary

Source: Markit, ING

CEE PMIs join the Eurozone bounce back

As Bert Colijn wrote on the release of the May PMIs for the Eurozone, the bounce back in the data is broadly consistent with the easing of lockdowns but the numbers also bury any hopes of a V-shape recovery. A similar story emerges with today's releases of May manufacturing PMI releases from Poland, the Czech Republic, Turkey and Russia.

Poland: Stronger rebound than Western Europe, but index stays at crisis levels and order outlook is grim

The PMI index for the manufacturing sector rebounded from 31.9 to 40.6 points - above the market consensus (36 points) and our forecast (38 points). However, this is still a very low level, similar to the results from the 2009 financial crisis. The survey shows that enterprises still see a negative outlook for orders and employment - the respective sub-indices were ranked second and third lowest in history.

The decision to resume work in factories has improved the assessment of current production, and forecasts for the next 12 months are also better. The survey results coincide with the reports kept by the Central Statistical Office. Business climate assessments further suggest a deep scale of an economic slowdown in 2020 and we see GDP contracting by 4.5%YoY and about 9% in Q/Q and YoY in 2Q20.

Czech Republic: Large manufacturing only re-opened in late May

The manufacturing PMI slightly improved in May, increasing from 35.1 in April to 39.6, broadly in line with market expectations. The modest improvement in May is not so surprising given the fact that part of the economy remained under restrictions in May and was only just gradually re-opening. For example, a big car manufacturer, TCPA, opened just at the end of May, which likely limited the improvement in the May PMI.

According to the survey, the May print signals the second-sharpest deterioration in the Czech manufacturing sector since the Global Financial Crisis. Participants highlighted shutdowns alongside the postponement and cancellation of orders as key factors behind the fall. Due to weak demand, manufacturers reported another round of lay-offs according to the survey. As such, some firms reported using government schemes for supporting employment, but even so, the decline in employment continued amid low demand.

Turkey: Auto industry re-opening helps

After plunging in April to the lowest level since the 2009 Global Financial Crisis at 33.4, Turkish manufacturing PMI has partially rebounded to 40.9 in May. This was driven by the reopening of some big manufacturers especially in the car industry and related suppliers, though it still showed quite a rapid contraction in the manufacturing activity.

In the breakdown, we see 1) a continuation of the sharp fall in and output and new orders, 2) higher output prices driven by currency weakness despite weak demand conditions, and 3) a lack of appetite to restart hiring in the manufacturing industry. Success against the pandemic and the start of a gradual normalization process in recent weeks are both quite positive news and increase the upside risks to the growth outlook this year with further improvement expected in the PMI in the period ahead.

Russia: Gradual adjustment to quarantine reality

Russian manufacturing PMI recovered from 31.3 in April to 36.2 in May. The result is slightly worse than consensus, which however is not very representative (only 4 analysts have participated). Some recovery in the purchasing managers' sentiment from the initial April shock may reflect a gradual adjustment to the quarantine reality, however, the scale of recovery is obviously constrained by a number of factors, including an expected deterioration of consumer trends and possible redistribution of state spending from infrastructure to social support. For now, we reiterate our take that even though April drop in industrial output was not too deep at -6.6% YoY, the recovery is unlikely to be fast.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more