Carrefour Stock Struggling With Lack Of Space

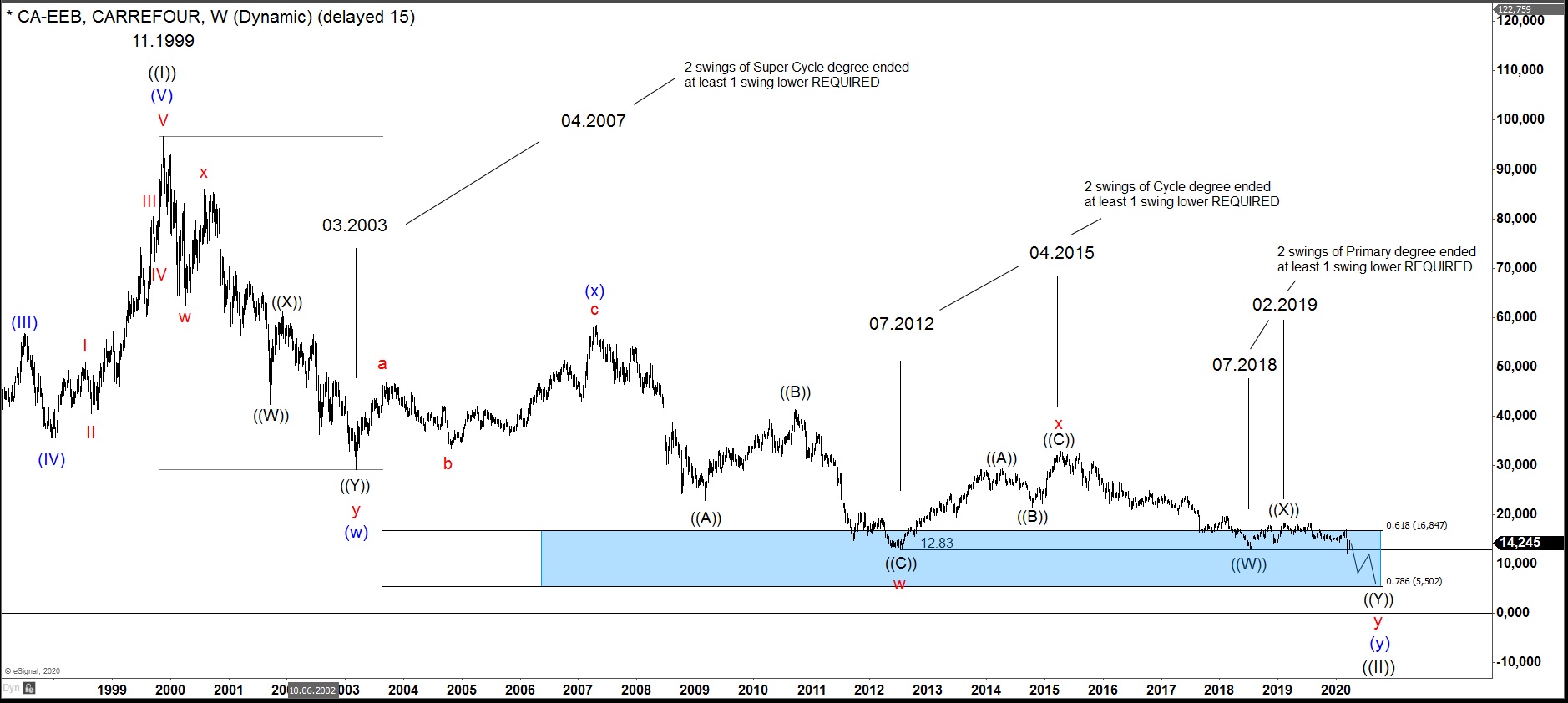

The weekly technical structure of the Carrefour (CA) stock price is a good example of a market correction struggling with the lack of space. Hereby, we observe a situation where the price extends lower in a double three pattern of multiple cycle degrees. However, the view of the bottom line forces the stock price into a truncation. If it would extend in a usual way, Carrefour would dive below zero, which is not possible. Technically, it can become zero, which would mean the end of the French supermarket chain.

1999-2007: 2 swings of super cycle degree calling for one leg lower

The weekly chart below shows a cycle in black ((II)) to a super cycle degree. It corrects the bullish cycle in black ((I)), which has printed the all time high on November, 1999. From there, we observe a 3 swings correction in a blue wave (w) which had bottomed on March, 2003. After a connector wave (x) towards April, 2007 highs, we see another swing lower in (y).

Even though the world indices have bottomed on 2009 to resume the rally, Carrefour price has not reached the extension area of at least 0.618. The blue box shown on the chart expects the price to truncate at the 16.85-5.5 area. There, the buyers may enter the market to resume the rally. In fact, usual extension towards equal legs does not apply as the price would dive under zero (not shown).

2007-2015: 2 swings of cycle degree calling for one leg lower

The cycle lower from April, 2007 highs in blue (y) could have finished in 3 swings on July, 2012, at 12.83. Technical indicator RSI has confirmed that the bigger correction from 1999 highs could be over. So technically, from July, 2012 lows, the rally may resume. Indeed, the bounce in price has occurred.

Unfortunately, it has failed in 3 swings on April, 2015. The first two swings are, therefore, counted as red waves w and x. From April, 2015 highs, another leg lower in red wave y can be witnessed. Similar to before, one should expect the extension area of 0.618 in order for price to stay above the zero line.

Carrefour extends lower in a truncated form

2015-in progress: 2 swings of primary degree calling for one leg lower

The cycle lower from April, 2015 highs had finished the first wave ((W)) of primary degree on July, 2018. Thereafter, the bounce higher occurred in black ((X)), which has printed a top on February, 2019. Finally, one leg lower in black ((Y)) can be expected. And again, it should truncate at an 0.618 extension in order for the price to stay positive. Clearly, Carrefour is struggling with the lack of space to the downside.

Outlook: Carrefour to bounce soon

Now, by breaking the July, 2018 lows at around 12.80, Carrefour has opened a bearish sequence against February, 2019 highs, related to April, 2015 highs. While below 2019 highs, expect the price to extend down to the inflection area of multiple degrees towards 5.50. If the price will achieve that level without RSI divergence, the grand super cycle wave ((II)) may finish, and Carrefour can resume the rally to the new highs towards 100, and even higher.

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more