Canadian Manufacturing: Better Than Numbers Say

If you take the numbers at face value, the Canadian manufacturing story looks negative. The energy sector’s weakness has swept its way through the data, but gradual recovery in oil prices, a possible easing in trade tensions, and solid domestic demand are enough to make us think the sector isn’t as bad as it looks.

Recent manufacturing data is poor

On Thursday we received manufacturing data for December and it wasn’t great. Sales decreased for the third consecutive month in a row (-1.3%), with the most notable declines in the petroleum and coal products industry. December’s oil price weakness was largely to blame, and as a result, Alberta’s manufacturing levels took the brunt of it; Statistics Canada reported that sales in this province fell 4.0% in December – the second consecutive monthly decline.

The Alberta government-enforced mandatory oil production cuts starting 1 January, alleviating pressures on crude producers by helping to lift oil prices. But a reduction in output only implies that production within this province will remain on a lower trajectory despite our reasonably upbeat outlook for oil prices more broadly.

Increased inventories, good or bad?

Inventory levels rose 0.3% month-on-month, leading the inventory-to-sales ratio to tick up from 1.48 to 1.50 in December. But the question is why have they increased?

- Good: Businesses are looking ahead and aren’t seeing the widely-expected economic slowdown as a major headwind to sustaining decent levels of demand this year.

- Bad: Insufficient demand has resulted in the growth of firm’s inventories, and if the ratio continues to trend higher – ie, build-up of inventories outpaces demand, and there’s a risk that businesses may have to offer discounts or slow production in order to shift their products.

If this is the case of increased inventories then it is something worth watching, but for now, we think there are enough reasons to think things won’t deteriorate much further from here.

3 Reasons why the manufacturing sector isn’t as bad as you think

1. Our commodities team project both for Brent Crude and Western Texas Intermediate (WTI) oil prices to edge slightly higher throughout this year and next. This should help stabilize production, given they were the largest factor dragging sales down in December.

2. US-China trade talks drew to a close on Friday, and the signs are still mixed. There is still a possibility of the 1 March US tariff increase on Chinese goods being extended, which might imply that our house view of ‘things could get worse before they get better’ could be avoided, though nothing as of yet is set in stone. Our team wouldn’t rule out the additional tariffs being imposed over the next few months.

But one way or another – be it the next few months or the end of the year, our trade team believe a deal is possible as the 2020 US Presidential Election comes into view. This would likely help commodity prices and general global sentiment, strengthening our view that the solid US consumer backdrop and healthy jobs market isn’t likely to fade anytime soon. And given the US is by far Canada’s largest export market, strong US demand is something Canada’s manufacturing sector can be reassured by.

3. January saw wage growth finally pick-up for full-time workers (see here), and we don’t expect this to just be a temporary relief. If we continue to see wages heading in this direction, we anticipate that household activity will perform well despite the environment of higher interest rates and a housing market correction. This bodes well for domestic demand, offering some support to the manufacturing sector going forward.

What are the risks?

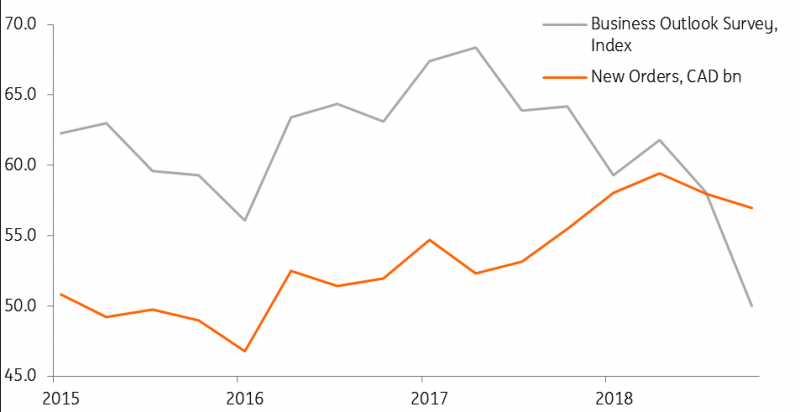

As you can see from the chart below, new manufacturing orders and business confidence have tracked each other pretty closely – until the past year or so. In late 2017 business confidence and new orders began heading in opposite directions, and by late 2018 the two series crossed paths. But why?

Business confidence and new orders unusually have crossed paths

(Click on image to enlarge)

Source: Macrobond

It’s likely that, prior to reaching the United-States-Mexico-Canada-Agreement (USMCA), business sentiment was feeling the strain from uncertainty concerning future trading terms. However, the most recent data shows further divergence – business confidence dived down to 50 in the fourth quarter of 2018.

We are cautious that this could begin to feed into business investment – one component of the growth outlook that has looked pretty positive picture for this year. It will be interesting to see how confidence holds up in the first quarter of this year – a lack of recovery could require a reassessment of our growth expectations for 2019.

Nevertheless, labor market fundamentals are good, core inflation remains around the Bank of Canada’s 2% target and – despite the numbers, the manufacturing sector should contribute a decent amount to growth this year. All of which supports our view that the central bank won’t be hitting the brakes just yet – we see the next rate hike likely to be in the third quarter.

Disclaimer: The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial ...

more