Canadian Lagging Exports And The Future Of The Canadian Dollar

Canada has long been a nation that depends heavily on its export markets, deriving roughly 25% of total income from external trade. Thus, one of the best measures of the health of the Canadian economy is its performance in international trade. The recently concluded re-negotiations of the NAFTA agreement resulted in a major sigh of relief for the Canadian manufacturing sector when it learned that the conditions affecting the auto trade and related manufacturing went largely unchanged. In its most recent report on monetary policy, the Bank of Canada, expects the economy to continue to be supported by expanding foreign demand for Canadian goods and services. Bank officials are quick to point out that Canadian exports will rebound in the next couple of years and will contribute significantly to overall growth.

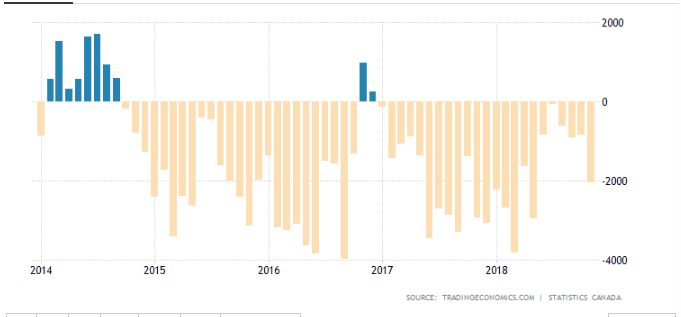

Yet, Canadian trade balances have been deeply in the red for the past five years, as exports have declined faster than imports (Figure 1). Canadian export volumes have been underperforming and with oil prices nearly halved since 2014 Canada can no longer rely upon favorable terms of trade to make up for the losses in trade volumes.

(Click on image to enlarge)

But now that we are clearly in a much softer commodity price environment it is hard to fathom where we can look to find sources of future export expansion. One does not have to be a pessimist to conclude that the Canadian trade balance will continue to be negative given the current US protectionist policies and the accompanying general slowdown in trade.

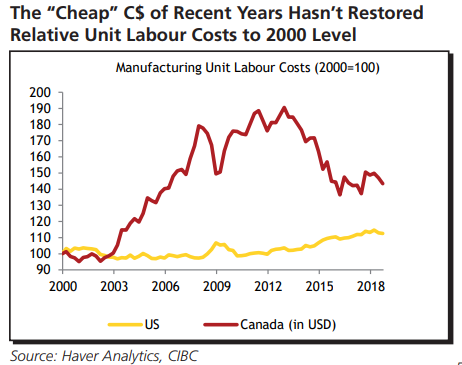

A recent report by the CIBC Capital Markets[1] examined the relative performance of key export industries. The report notes that “Back in 2005, autos and parts were Canada’s largest export, and volumes have declined outright since then. But there’s a broader range of goods where Canada has seen disappointments on the export side, with declines or less than 1% annual growth rates for forest products, consumer goods, and electronic/electrical products, categories that had been in the top six sectors in importance back in 2005.”

The report goes on to examine relative labor costs and concludes that the relatively “cheap” Canadian currency has not sufficiently lowered Canadian wages and unit labor costs to allow manufacturing to be competitive. (Figure 2)

(Click on image to enlarge)

So, what are the choices facing Canada in the international trade field? In order to improve our competitive position, we need the currency to weaken further or we have to suppress wage gains without commensurate productivity gains to keep costs in check. The CIBC concludes its report with a forecast that calls for the prospects of further declines in the Canadian dollar when it suggests that “Don’t be surprised to see dollar-Canada sport a 1.40 handle again in the next five years as the Bank of Canada is pressed to set interest differentials at a level that will give us the currency, we might need to bring exports back to life”

The Bank of Canada does not explicitly set an exchange rate target. However, in the past, when the interest differentials resulted in a dollar that harmed the export market, the Bank was forced to reconsider its rate policy. We are likely to witness a repeat of the past in which the Bank will set policy with one-eye our international competitive position.

[1] CIBC Capital Markets, “Teen Angst: Canada’s Export Struggles Turn 14 “ by Avery Shenfeld and Royce Mendes

Prof, suppress wage gains? That is what the Fed has been doing a long time. Why did the Bank of Canada favor workers? Well, it was the right thing to do, but it blew a giant housing bubble and also made Canada less competitive due to unforeseen changes. I am sorry, but Trump as also done a number on Canada and it is a very disgusting way to treat your neighbor.

In the CIBC report ( not in my article) they have a chart showing that Canadian productivity gains lag behind the US so that is why ULCs are higher in Canada. Business in Canada has to watch its wage rates or face the consequence of pricing itself out of international markets. You are right that Canadian consumption aided by rising asset prices have driven the economy more than anything else, especially in central Canada. Now, that there is a clamp down on mortgage lending coupled with a weakness in resource exports, national income will suffer.