Canadian Housing Starts Declined In December

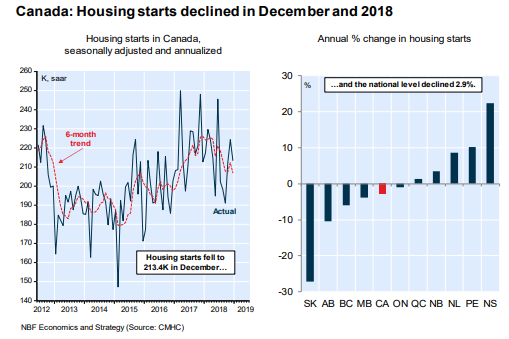

“Housing starts declined in December on the back of a stronger than expected print in November. Both the multiples and singles categories deteriorated, with the latter segment settling at its second-lowest level in the post-recession period. That said, most of the drawdown in the headline number was due to multiple starts, with the brunt of the decline occurring in Ontario where starts for multis dropped 14.4K.” (National Bank, January 9, 2019)

Canada’s housing starts declined in December, and new housing starts in all of 2018 dropped for the first time in five years.

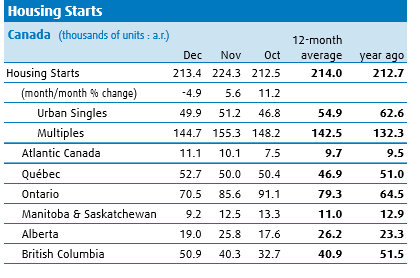

The CMHC data are preliminary and subject to revision. Nonetheless, they show that there were a total of 214,020 new housing starts in all of 2018 compared with 219,763 in 2017. Housing construction in 2017 was extremely strong, so the slight pullback in 2018 still represented an unusually strong year for housing starts.

The seasonally adjusted annual rate of housing starts in Canada was 213,419 units in December, down from 224,349 units in November.

Urban starts dropped by 5.8% to 194,594 units in December, as multiple-unit projects (condominiums, apartments, and townhouses) declined 6% to 144,728 units. Single-detached urban starts also fell by 2.5% in December to 49,866 units.

Looking ahead, the outlook for the construction side of the industry is still stronger than in the re-sale housing market, where higher interest rates and regulatory tightening has cut into demand.

Despite relatively strong housing construction push towards year-end in 2018, we still expect home building to be a drag on the economy next year. The tighter mortgage financing environment in Canada will ultimately reduce housing starts as well.

Housing starts will likely ease back a bit to about 195,000 units this year, following the downward trajectory of home sales.

While the interest rate environment is very important both for home sales and housing construction, slower housing markets and slower growth in household debt has removed some of the urgency for the Bank of Canada to hike interest rates in the near-term.

As expected, the Bank of Canada left its trend-setting interest rate unchanged at 1.75% on January 9 due to the dimmer economic outlook, plunging oil price and a slowing housing market.

Disclosure: None.