Canadian Housing Lousy In 2018

2018 Was Canada’s Worst Housing Market Year Since 2012

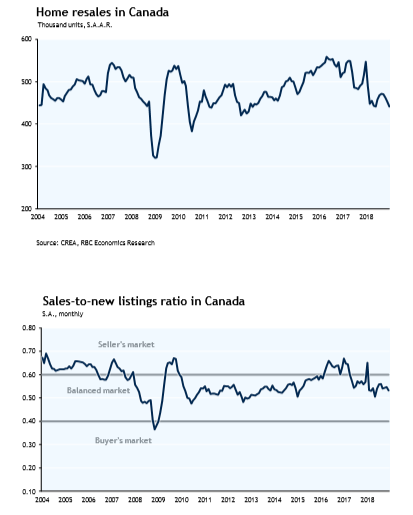

“2018 was the softest year for Canada’s housing market since 2012. Home resales fell 11.1% to 458,400 units last year. This followed a 4.7% decline in 2017. …With interest rates likely to rise further and pressure on homebuyers to remain intense across Canada in the short term, there’s still a risk of a harsher market outcome. Nonetheless, we believe that the odds of a US-style housing collapse are low as long as our economy continues to grow and the job market stays strong.”

(RBC Economic Research, Monthly Housing Market Update, January 15, 2019)

Here are the main themes from a recent RBC housing market update for Canada.

- Resales housing fell to a six-year low in December of 2018. The resales fell for the fourth consecutive months, and as expected, the resales slump was much sharper in the slumping Vancouver market.

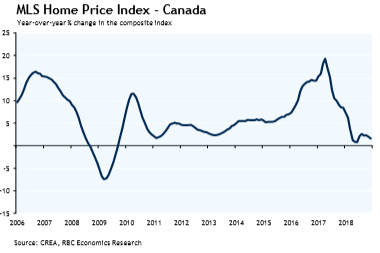

- Housing has been in a decline in Vancouver for a full year now. Vancouver resales declined 18% since October, and prices have fallen sharply as well.

- Toronto’s pricey housing market was more stable at the end of the year. While resales remained stable at the end of 2018, in December housing prices increased marginally to 3% y/y from 2.7% in November.

Behind the housing market slowdown in Canada are three key issues - the challenges posed by higher interest rates, Canada’s mortgage stress test, and specific local housing policy measures in BC which sharply reduced buying pressures.

In BC, the local and provincial government introduced a range of interventions designed to improve housing affordability, (an increase in the foreign buyer tax last year and the imposition of an empty unit tax in Vancouver).

Unfortunately, there is little on the horizon to suggest that Canada’s housing sector will shortly rebound.

(Click on image to enlarge)

(Click on image to enlarge)

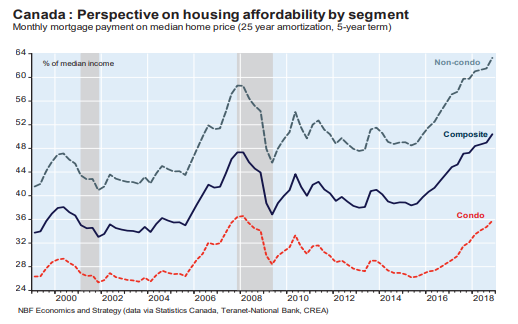

Finally, housing affordability is a real problem in Canada, particularly in pricey Toronto and Vancouver markets.

As the National Bank data indicate, housing purchase affordability in Canada deteriorated significantly over the past 3 years.

Interestingly, the negative affordability trend was less pronounced in the condo market, which likely explains why condo prices were still increasing at a solid pace last year (+6.2% y/y vs. 1.2% for non-condos).

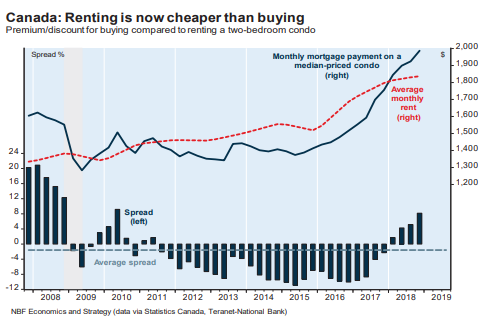

In addition, it has now become cheaper in Canada to rent a two-bedroom condo than to buy one.

(Click on image to enlarge)

(Click on image to enlarge)

Disclosure: None.