Canadian Government Budget Misses An Opportunity To Spur Economic Growth

Tuesday, Finance Minister Bill Morneau tabled a budget that falls short of providing much needed stimulus to an economy that has been slumping for nearly six months. There has been a rash of negative economic news starting in 2018 Q4 and continuing into the first quarter this year, including:

-

A decline in residential construction as sales of both new and existing homes have steadily dropped;

-

Business investment has been disappointing for the past 6 months;

-

Oil exports stagnate in the wake of a surge in US domestic production;

-

The trade deficit reached an all time high, reflecting Canada’s weakened position in the international markets;

-

Consumption remains weak as consumers continue to adjust to five rate hikes by the Bank of Canada since mid-2017; finally,

-

A widening of the output gap—the difference between potential and actual performance; unemployment has been stuck at 5.8 % for last 12 month; and there is excess capacity in key industries (e.g. oil/gas, automotive).

It is quite evident that the Canadian economy needs fiscal stimulus. It is dangerously close to falling into a recession. These developments call for measures that would stimulate growth, even at the expense of a wider federal deficit. With interest rates still historically low, we cannot look to monetary policy to promote growth. The only game in town is fiscal policy.

The budget should have recognized that the economy is not healthy. There is a need for some major tax expenditures and /or greater direct public expenditures. The opportunity to stimulate the economy is there for the taking, given that revenues were much higher than expected this past fiscal year. Yet, the government chose to keep the deficit in line with previous forecasts made a year earlier.

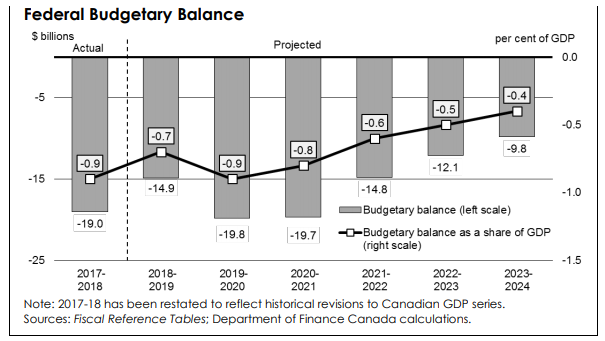

The federal authorities point out that Canada has the lowest federal debt-to-GDP ratio among the G7 countries. Furthermore, the deficit as a percentage of GDP is less than 1 % and is forecasted to drop to 0.4% by 2023. Canada maintains a AAA bond rating and domestic interest rates are the lowest since the 2008 crash. These are favorable conditions that would allow for a larger deficit without placing an undue burden on Canadians taxpayers. This is the missed opportunity.