Canadian Dollar At Its Lowest Level In Two Months

Bank of Canada is to delay rate hikes due to softer data and increase in uncertainties. Long USD/CAD?

Yesterday, Bank of Canada (BoC) announced that it will be keeping its interest rates unchanged at 1.75%. BoC said, “the timings of possible future hikes have become increasingly uncertain.”

BoC says the economic slowdown that began at the end of last year is a bit worse than it was expecting, including a sharper-than-anticipated slowdown in Canada's oil patch. The bank also singled out softness in the housing market and consumer spending as reasons for a gloomier outlook.

The fall in oil prices drove Canada's trade deficit to its highest level ever at the end of last year and conditions do not appear to have improved with the IVEY PMI index falling to its lowest level since May 2016.

The consensus among economists polled by Bloomberg is that the bank will stand pat again at that meeting, but the overnight index swaps suggest there's about an 8% chance of the bank changing directions entirely and cutting its benchmark interest rate.

BoC Governor Stephen Poloz is next scheduled to meet with other members of the bank's governing council and reveal their decision on where to set the bank's interest rate on 24 April 2019.

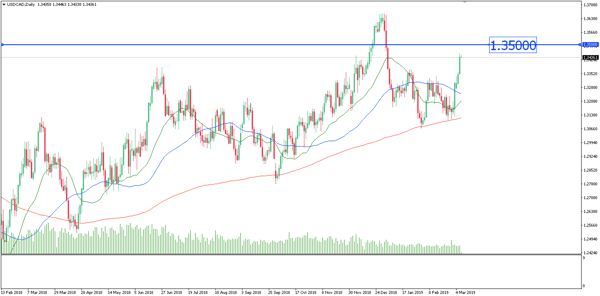

USD/CAD could head towards 1.350 after breaking all the major moving averages after BoC’s announcement yesterday.

Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more