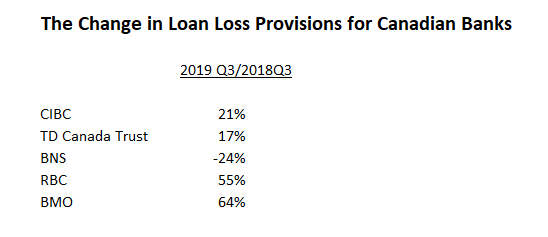

Canadian Banks Brace For A Downturn In The Economy

The Canadian banking community is leaving little to chance as it prepares for a downturn in the economy. This year’s third-quarter financial results feature a decidedly conservative approach to lending, as five of the Big Six banks, increase their loan loss provisions, that is, monies set aside for bad loans. In the first half of the year, loan loss provisions jumped 28%, only to accelerate further in the third quarter. The banks cite that their operating outlook is not immune to the deteriorating macroeconomic environment internationally, and more specifically, to the US situation. There are no illusions that the fallout from the China-US trade war, a continuing slowdown in Europe, especially in Germany, and the sharp decline longer-term interest rates worldwide will impact Canadian banks.

(Click on image to enlarge)

Figure 1 Loan Loss Provisions

Domestically, the commercial banks are anticipating that higher consumer debt levels will result in greater credit card delinquencies and in non-performing personal and commercial credit facilities. The oil/gas industry continues to struggle with low energy prices and the lack of adequate transportation facilities for the export market. Housing sales and prices have picked up this past spring, however, the banks are more cautious regarding their mortgage portfolio. For example, the CIBC, the largest lender in the mortgage industry, experienced a 1% decline in their mortgage book last quarter.

No bank thrives in a world of falling interest rates. The TD, for example, warned net margins will continue to be compressed. Negative interest rates have introduced a chill throughout the banking industry. Analysts are warning that North American banks should take careful notice of the wave of negative bond yields sweeping through Europe and Japan. After a couple of years of margin expansion, the banks are now reversing course and are bracing for a rate compression, especially since the Canadian 10yr-2yr spread is now inverted and this is putting downward pressure on mortgage rates. The Bank of Canada has taken any future rate hikes off the table and the betting is that we now can expect rate cuts later this year.

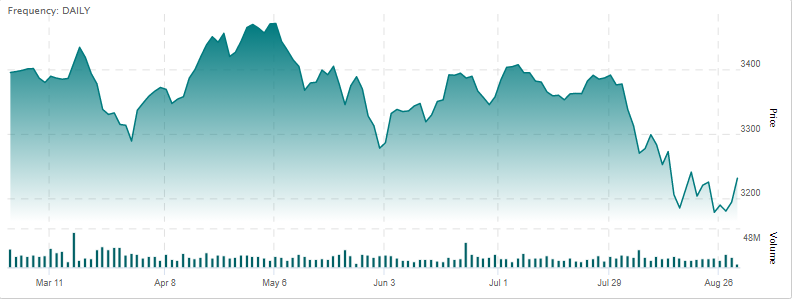

(Click on image to enlarge)

Figure 2 Canadian Bank Index

Investors have taken these challenges into their calculations. The TSX bank index is now down about 6% from a recent high reached in May and no doubt the current climate for interest rates and economic growth will likely to continue to hold bank equity prices down at these levels.