Canada's Trade In Summer

The trade outlook is not promising, suggesting that the Bank of Canada will not delay much longer in cutting interest rates.

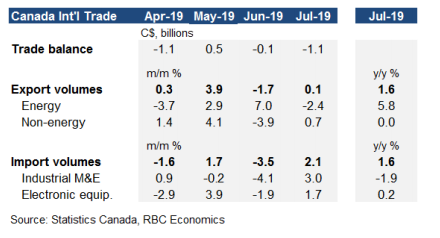

“After a strong decline in imports and exports in June, imports rose 1.2% in July, while exports fell 0.9%. As a result, Canada's merchandise trade balance with the world went from an essentially balanced position in June (slight deficit of $55 million) to a $1.1 billion deficit in July.” (Statistics Canada, July 19, 2019)

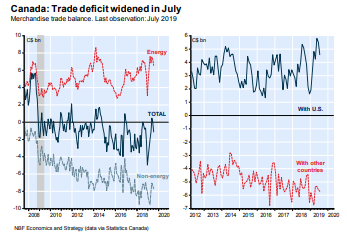

The three most interesting developments on Canada’s merchandise trade front in July were that the trade deficit rose in nominal terms to $1.1 billion, exports fell 0.9% largely due to lower energy prices, and Canada’s trade surplus with the US narrowed to $4.58 billion from $5.52 billion in the previous month. After accounting for price effects, Canadian export volumes declined 0.1% in July, whereas import volumes increased by 2.3%.

Trade tensions continue to remain the chief downside risk for Canada’s economy in the near term.

Canada’s manufacturing exports are heavily integrated into the US manufacturing sector, thus any slowdown in the US has a dramatic impact on this country’s trade numbers. In July manufacturing activity in the US contracted, as the ISM manufacturing index fell below 50 for the first time in three years.

Essentially, Canada’s export growth over the past year have been uninspiring.

Nonenergy export volumes were flat over the year, while energy shipments, mainly to the US, were much stronger in volume terms. On the import side, the two important sectors that count heavily in terms of Canadian manufacturing and processing are industrial and electrical equipment. Import volumes in both categories has been very weak over the past year.

Unfortunately, there is little reason to believe that Canada’s real exports have any growth potential in the year ahead given the headwinds of slower international growth and the US-China trade dispute. Canada is heavily engaged in the world trading economy and the weakening in manufacturing across most industrial countries is a limiting factor for Canada’s economy.

Consequently, this writer expects the Bank of Canada to somewhat reluctantly shift its policy stance and start cutting interest rates, perhaps as early as October.

Indeed, it is entirely possible that the Bank of Canada will cut interest rates once or twice before the end of this year.

(Click on image to enlarge)

(Click on image to enlarge)