Canada’s Tough Mortgage Rules Have Contributed To Housing Starts Lag

Canada’s housing sector has been in a funk over the past six months. Two provinces, BC and Ontario, introduced legislation to deter foreign investment in Canadian housing. As well, the Federal Government’s tougher mortgage rules have also clearly dampened demand.

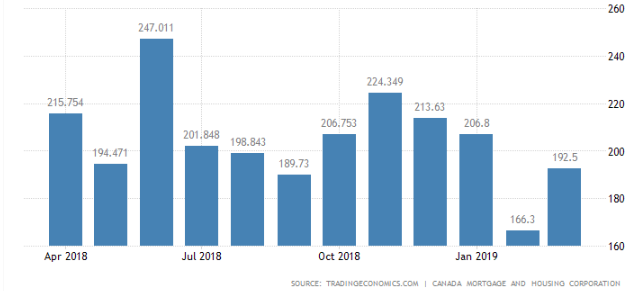

Canadian housing starts rose nearly 16% to 192,527 annual units in March of 2019 from 166,290 units in February. Nonetheless, housing starts contracted in the first quarter of 2019 compared to the fourth quarter of last year. Indeed, Canada posted four quarterly declines in housing starts in the last five quarters.

Still, the latest monthly start figures are higher than the 180,000-190,000 annual range believed needed based on longer-run demographic projections.

However, across Canada there are different regional stories at work, as well as the recent tightening up on mortgage requirements by the federal government has also had an uneven regional impact.

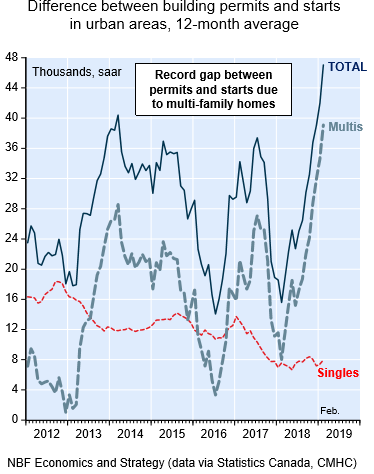

What is also quite intriguing about the recent picture is that Canadian developers have not necessarily followed up with actual construction even after they received permits to go ahead.

As Krishen Rangasamy observes in an April 8th National Bank Hot Charts report, the gap between the number of residential building permit applications and housing starts continued to widen over the past year.

Indeed, since multi-unit construction has swamped single-detached dwellings, the gap between permits and starts in the urban areas has sharply increased.

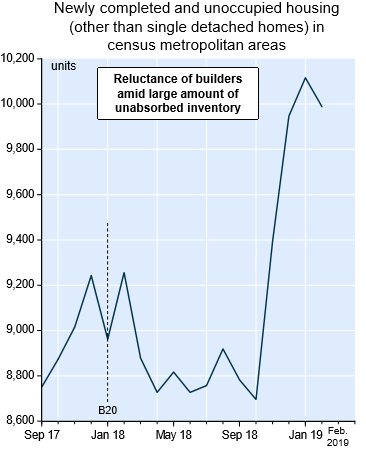

Indeed, the building permits taken out for multi-unit dwellings are not transferring into new starts in part because due to the large number of unabsorbed inventories of newly completed units.

What has happened is that the unabsorbed inventory of multi-unit buildings in Canada has surged since tighter mortgage regulations (B-20) came into effect early in 2018. The "B-20" rule was introduced in January 2018 by the Office of the Superintendent of Financial Institutions in response to concerns expressed about the high debt levels of Canadian families.

The B20 regulation, which was intended to dampen the demand for housing units, requires prospective homebuyers to qualify for mortgage rates that are 200 basis point higher than the agreed negotiated rate. This has, of course, dampened the demand for mortgage finance and has driven mortgage financing away from the chartered banks and towards alternative nonbank lenders.

Canada Mortgage and Housing Corporation data indicated that in December 2018 the debt-to-income ratio in Metro Vancouver was 242% percent—the highest in the country. Metro Toronto was in second place at 208%.

Canadian Monthly Housing Starts (Annualized)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)