Canada’s Job Market Recovery Will Be Painfully Slow

“(Canada’s) unemployment rate fell 0.7 percentage points to 10.2% in August. As a result of the COVID-19 economic shutdown, the unemployment rate had more than doubled from 5.6% in February to a record high of 13.7% in May. By way of comparison, during the 2008/2009 recession, the unemployment rate rose from 6.2% in October 2008 and reached a peak of 8.7% in June 2009. It took approximately nine years before it returned to its pre-recession rate.” (Statistics Canada, Sept. 4, 2020)

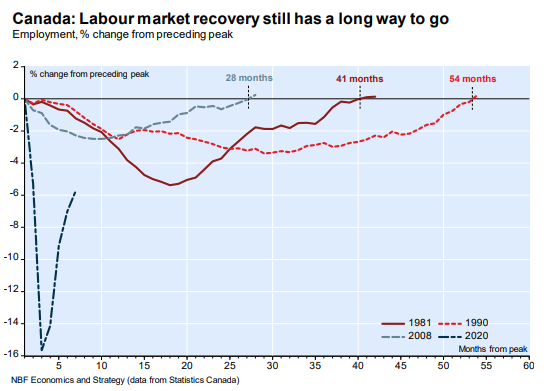

In March and April, the Canadian economy lost nearly 3 million jobs due to the coronavirus and the economic shutdown. Obviously, these heavy job losses were far higher than the maximum losses suffered during Canada’s last recession in 2008-09.

However, since May, the economy has been restoring jobs at what might appear to be a fast rate. But of course, we are in unusual times, and the response to pandemic itself accounts for these misleading rapid monthly job gains.

What follows here is a snapshot of Canada’s job market and the economy since the coronavirus recession began.

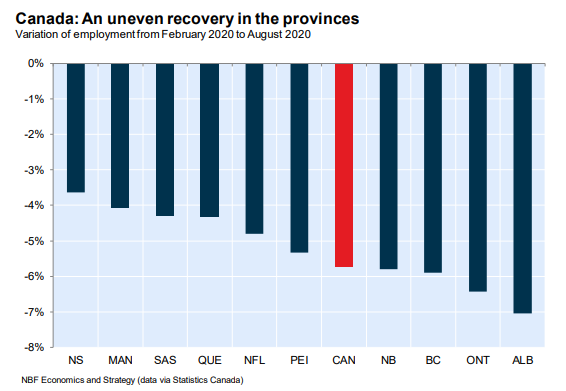

As of August, the economy had restored some 1.9 million of the 3 million lost jobs, but as the charts and table illustrate, Canada’s jobs recovery has a long way to go to reach former peak levels of employment.

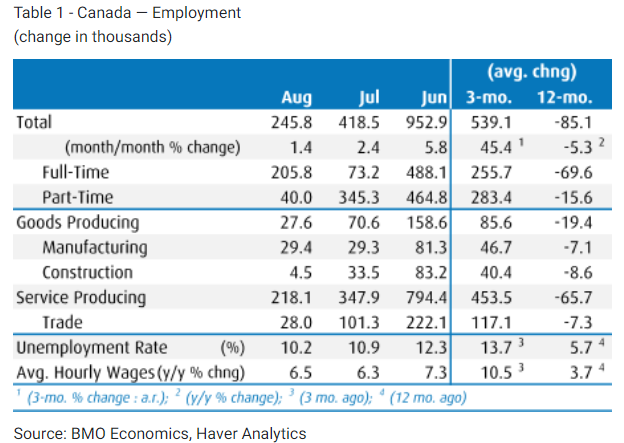

Canada’s economy added 246,000 jobs in August, 418,000 in July, and nearly 1 million in June.

Of course, the total number of jobs lost in March and April numbered close to 3 million so that as of last month Canadian employment was still 5.7% below February’s pre-pandemic peak.

Even worse for the economy and the job market, however, is the observation that total hours worked in August was 8.6% below its February peak level.

(In comparison, payroll employment in the US was down 7.6% from its previous peak level.)

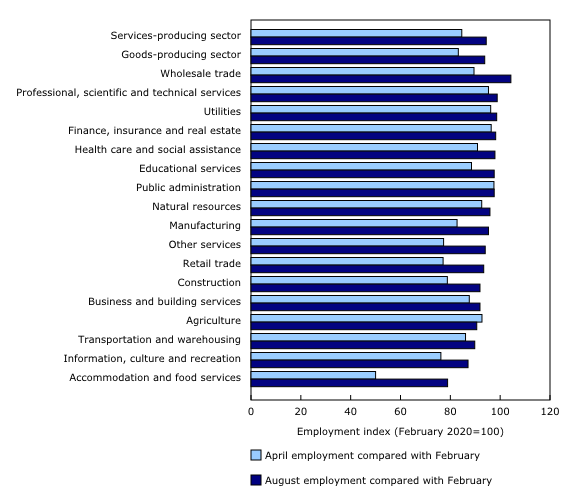

Based on the latest August employment figures, Canada’s service sector continues to record much higher job losses than the goods-producing industries.

Accommodation and food services as well as retail trade were among Canada’s hardest-hit industries by the pandemic. Indeed, in April accommodation and food services employment fell 50% from its pre-pandemic level. The contraction in retail trade employment was 77.1%.

Fortunately, an employment rebound in both services and goods sectors started in May, and as of August employment in accommodation and food services rose to 78.9% of its February level.

The next worst job loss sector was information, culture, and recreation, where employment in August was still substantially lower than its previous peak.

In the final analysis, restoring the more than 1 million lost Canadian jobs will become harder from now on, as the monthly job gains shrink towards the end of the year.

Moreover, the current steep 10.2% unemployment rate does not fully reflect the damage imposed on the economy and its labor market. As Statistics Canada points out, if those who wanted to work but did not actively look for a job were counted as unemployed, a more realistic unemployment rate in August would have been 13%.

Unfortunately, we cannot count on a rapid recovery of the Canadian economy back towards the more comfortable status quo which existed before the pandemic. After all, Canada is a small, open economy with little external leverage on its trading partners.

Moreover, COVID-19 pandemic is a global crisis without any recent parallels. We know that a globally coordinated approach for propelling a recovery will be necessary, but given current circumstances, may not materialize.

With respect to certain vulnerable Canadian industries, employment in such fields as travel, dining, and entertainment may never return to pre-pandemic levels.

While the high technology information and communications sectors of the economy appear somewhat impervious to the pandemic, nonetheless in perspective these industries only account for about 5% of Canada’s GDP.

A recent projection by BMO Capital Markets projected Canada’s GDP to contract by 6% this year — “by far the deepest annual decline in economic activity in the post-war era. The actual GDP growth was 1.7% in 2019. Canada’s economy is optimistically projected to rebound by 6% in 2021.

Nonetheless, the unemployment rate outlook for Canada remains extremely bleak.

Canada’s average unemployment rate was 5.7% in 2019, which was close to a full-employment measure. The Canadian unemployment rate this year is expected to average 9.5%, and barely decline to 8% in 2021.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

Employment Growth In Services Outpaces Growth In Goods-Producing Industries

(Click on image to enlarge)