Canada’s Current Account Deficit And Its Link To The Stable, But Weak, Canadian Dollar

Canada’s currency value relative to the US dollar and Canada’s current account deficit have kind of vanished from the investment community’s attention.

This writer finds it rather interesting that despite all of the international trade uncertainty and worries about the global slowdown, the Canadian dollar has traded in a relatively stable 75 cents US range for quite a while.

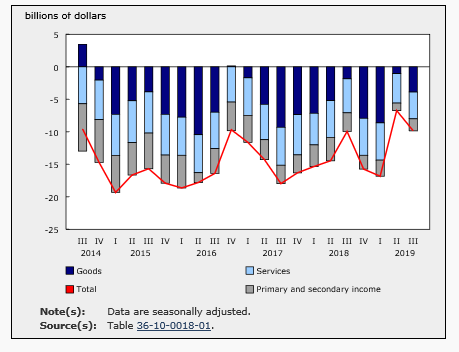

At the same time Canada’s balance of payments numbers, although not very strong, have slightly improved in 2019 compared to the previous two years.

The current account deficit is the broadest measure of the direct impact of trade on the Canadian economy. In fact, the current account balance is roughly identical to the net trade figures that are in the GDP national accounts

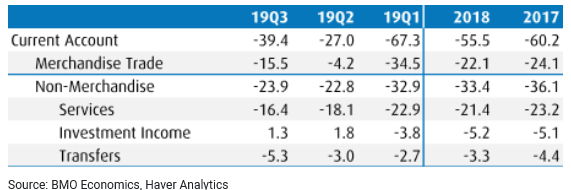

Canada’s balance of payments with the rest of the world recently worsened, as the annualized current account deficit widened to $39.4 billion in the third quarter, and net foreign direct investment showed little change in the quarter.

The recent deterioration in the current account deficit was centered in both merchandises as well as services trade, while investment income managed to remain positive in both Q3 and Q2.

Overall, Canada’s current account deficit amounted to about 1.7% of GDP in the third quarter, considerably lower than the 3% share earlier this year.

The merchandise trade deterioration in the third quarter was largely due to weak energy prices and low volume growth and there is very little improvement expected in this sector in the coming year.

Canada’s Current Account (Annual Rates)

(Click on image to enlarge)

(Click on image to enlarge)

The Canadian Dollar In US Terms (Canadian Dollar /US Dollar)

(Click on image to enlarge)

(Click on image to enlarge)