Canada Shifts Its Strategy To Finance COVID-Induced Deficits

The pandemic is raising havoc for government budgets globally. The major economies will experience deficits ranging from 6% of GDP (Germany) to 18% of GDP (UK). The severity of the global downturn is captured in an extraordinary claim by the UK chancellor that the UK economy will contract this year by about 11%, the largest fall in output for more than 300 years. Martin Wolf of the Financial Times, in discussing the UK situation correctly argues that:

“The old fiscal rules, notably the fixation with the deficit and the ratio of public debt to GDP, were a mistake. Now they are quite grotesque. Governments should focus instead on their long-term balance sheets, the maturity of their debt, their costs of borrowing, the relationship between these costs and returns on investment, and the strength of demand. Provided they have their own currency and a competent central bank, these things alone matter.”

Wolf further argues that some scarring will inevitably occur from the lower business investment, the actual destruction of capital in a number of specific industries, and the harm to the labor force from long term unemployment. Now is not the time to restrain spending or tighten monetary policy, he stresses. Rather the greatest need is to stimulate aggregate demand and promotion a recovery.

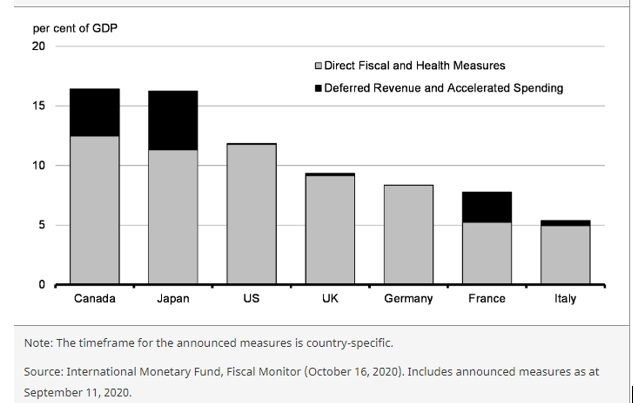

The Canadian Government just released an economic statement that measures the budgetary impact since March of this year. The fiscal impact is expected to reach 19 percent of GDP, one of the largest among G7 countries (Figure 1). The deficit is expected to hit C$ 381 billion (US$ 295 billion). The government has also set aside an additional C$ 100 billion in unspecified expenditures over the next three fiscal years.

Figure 1 Fiscal Impact of Government Support in G7Countries

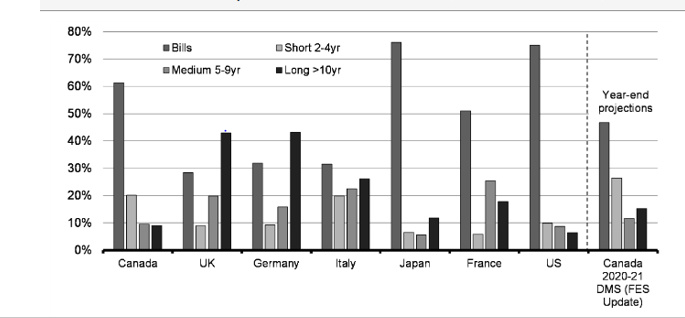

As Martin Wolf stresses the focus should be on how to manage this debt load over the longer term. In the past, governments have financed the bulk of their debt in the very short-end of the debt market, that is with 2yr-3yr and 5-yr bonds (Figure 2). Governments are now recognizing that the plunge in long-term interest rates represents a once in a generation opportunity to issue multi-year bonds across the entire yield curve. Canadian 30-year bond yields, currently at 1.20 %, are some 40bps below US Treasuries. Economic growth allows for government revenues to increase without increasing tax rates and, in turn, reduces the burden of deficit financing. Should national output expand by even a modest rate of 1.5-2%, the deficit carrying costs will ultimately decline overtime. The issues concerning debt retirement will have to wait for several more years while the world struggles to survive the pandemic.

Figure 2 Debt issuance in G7 Countries, Post-Mar2020

Source: Finance Canada

Certainly the increasing debt must be considered, mostly relative to who gets how much benefit from that debt. And the presumption that the reduced interest rate will never change is not what I would call wise. No matter what, things can change for the worse. Certainly the scars from this pandemic will linger long, even if it ended today. The repeated waves of infection certainly show that the solution and salvation are not yet on the horizon, even. Given the continuation of the strings of poor choices the playing out of this pandemic, or plague, will leave those remaining in a rather different world..

Couldn't agree more with you and Wolf. Maintaining perspective and filtering priorities is paramount.

Agreed.