Canada: One More Rate Cut Early Next Year

Domestically, the Canadian economy looks in good shape. However, trade tensions and concerns regarding the vulnerability of the country to global demand and commodity prices mean we suspect the Bank of Canada will step in with one last rate cut in early 2020. Despite this, fundamentals favor CAD over other currencies.

Bank of Canada Governor, Stephen Poloz, may well be considering another rate cut early next year

Relative resilience

The Bank of Canada has been sounding relatively relaxed of late regarding the risks facing the economy. The press release from the December 4 policy meeting talked of “nascent evidence that the global economy is stabilizing”, with Canada’s growth likely to “edge higher over the next couple of years.” They suggested little appetite to embark on renewed policy easing by stating that downside risks from trade conflicts need to be set against “the sources of resilience in the Canadian economy – notably consumer spending and housing activity.” In this regard, the economy is experiencing average wage gains of 4.4%YoY right now, which should certainly underpin consumer spending over the coming months.

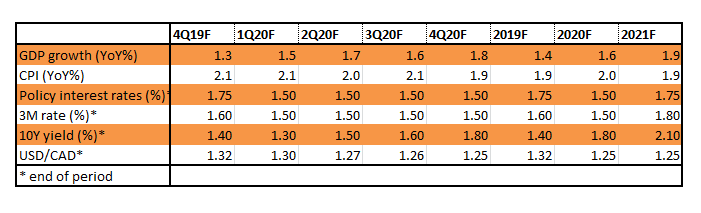

ING's Canada summary forecasts

(Click on image to enlarge)

Source: ING Forecasts

Yet while acknowledging that Canada’s economy has held up relatively well through 2019, we are more nervous about the threats to future growth and suspect the BoC may reluctantly have to step in to provide a little more support for the economy in early 2020. After all, recent data flow has shown that Canada is not immune to the global slowdown. GDP rose just an annualised 1.3% in 3Q 2019, recent retail sales have been subdued despite strong pay gains and even housing activity has shown evidence of slowing; building permits have fallen in six of the past ten months, for example.

Downside risks are emerging

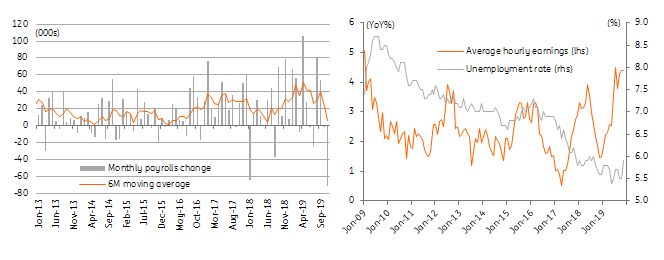

Moreover, the latest jobs report is likely to have been a wake-up call for some on the BoC's monetary policy committee. Employment fell 71,200 in November, the steepest monthly decline since 2009, while the unemployment rate jumped 0.4 percentage points to 5.9%. The private sector is bearing the brunt of the weakness, having experienced four declines in the past five months. Wage growth is rising rapidly for now but, given the loss of momentum in job creation, we suspect pay gains will moderate through 2020 and this source of support for domestic consumer spending will weaken.

Pay is rising fast, but the loss of momentum in the jobs market is a worry

(Click on image to enlarge)

Source: Macrobond ING

External threats persist

Canada continues to face a tough external environment. The global growth story is subdued with US activity decelerating at a time when Europe’s economy is stagnant and Asia's is softening. Canada is heavily exposed to these threats given the economy is relatively open with trade accounting for more than 30% of economic activity versus little more than 10% for the US. Canada is also more dependent on commodities with mineral extraction and agriculture, representing more than 10% of the economy.

Given the lack of progress on the proposed phase 1 trade deal between the US and China and suggestions that President Trump is happy to have it delayed until after next year’s election this will continue to be a source of uncertainty for business. US-EU tensions also appear to be on the rise. The US is threatening tariffs on $2.4 billion of French exports in retaliation for a digital tax imposed by France (replicated elsewhere) that is primarily raising revenues from American tech companies. Hints that the USMCA trade deal may finally be signed off by Congress are a positive for Canada. Still, with the global backdrop remaining highly uncertain, the upsides for activity will be moderated.

Where the US goes, Canada typically follows - ISM points to Canada GDP slowdown

(Click on image to enlarge)

Source: Macrobond, ING

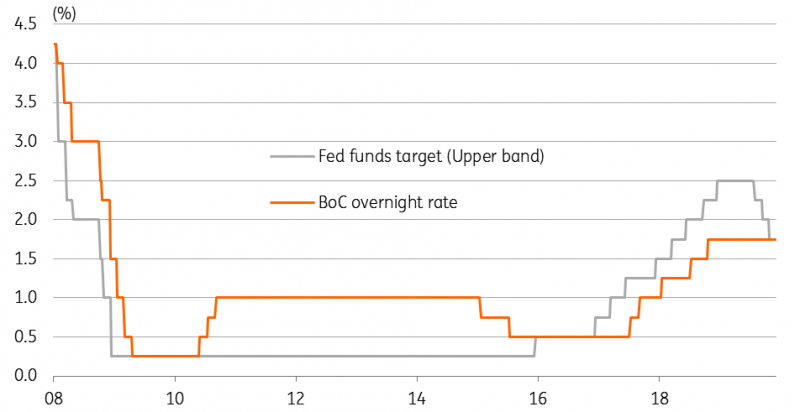

A reluctant BoC to acquiesce

Stuttering global demand and lingering trade uncertainty mean that Canadian business may become increasingly cautious on both domestic hiring and investment in early 2020. The weakness in the jobs market may also translate into slower pay growth, softer consumer confidence and slower spending growth in coming months – thereby raising a sense of nervousness over the outlook for the key “source of resilience” as described by the BoC. Inflation, meanwhile, is broadly in line with target and is not a constraint on BoC action and we feel they will step in and provide one more rate cut in early 2020.

This will be done only reluctantly. BoC officials have suggested that already low interest rates can do little more to support growth and they are looking to see whether fiscal policy can provide a lift. Unfortunately, we see limited chances of this in the near term given the challenges of building support for such policies in the House of Commons when the country is run by a minority government and the Senate is equally lacking a clear majority party. With pressure likely to build on the BoC to take action to mitigate the risks to Canada’s growth, we think they will acquiesce.

Nonetheless, it is important to emphasize that Canada is in a relatively strong position versus many other developed markets, particularly in Europe. Moreover, if we receive better news on trade tensions and global growth, Canada is in an excellent position to benefit. This reinforces our view that the BoC will only move cautiously.

Bank of Canada versus Federal Reserve policy rates

(Click on image to enlarge)

Source: Macrobond, ING

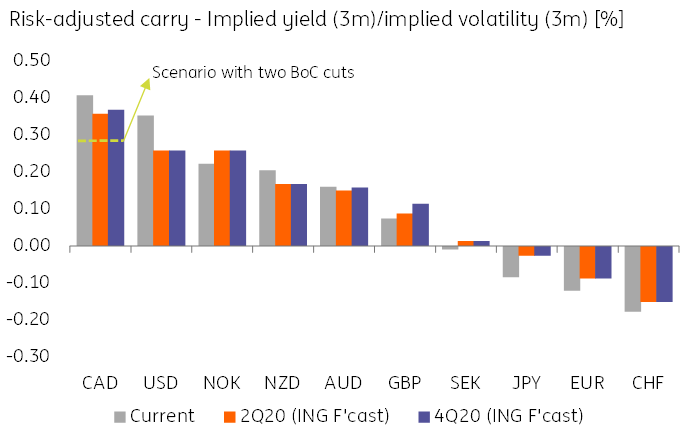

CAD: Carry advantage to prevail

The Canadian dollar has been facing the hurdles of grim data flows and subsequent increased bets on BoC easing. However, CAD is up 3% versus the dollar YTD, mostly thanks to the supportive rate environment in Canada. While we expect the BoC to deliver a cut in the next few months, we do not see this as ultimately denting CAD’s rate advantage.

(Click on image to enlarge)

Source: ING, Bloomberg

The figure above shows how – according to our forecasts – CAD is bound to retain the best risk-adjusted carry in the G10 space, even in a scenario with one or two BoC cuts. A stabilization in risk sentiment should allow, in our view, commodity currencies to outperform in 2020 and we expect CAD to lead the pack as it should be able to cash in on its attractive carry.

On the external side, our commodities team is looking at more OPEC+ cuts in 2020 (see “OPEC+ to take more action in 2020” for more details) which should put a floor under oil prices. The long-awaited ratification of the USMCA may also add to the relative positives for CAD. All these factors lead us to believe that USD/CAD will be able to move below 1.30 in the first half of 2020, despite the prospect of BoC easing. We see the pair at 1.25 in 4Q20.

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more