Canada: Hawkish BoC To Lead The Tightening Charge?

A second QE taper announcement and the prospect of a 2022 rate hike suggest Canada is at the front of the policy "normalisation" race. This bodes well for CAD's rate profile, which should assist a rally once the domestic virus situation improves. It will be interesting to see if this helps nudge the Federal Reserve to give a more upbeat outlook next week.

Source: Shutterstock

BoC holds rates, but tapers again

The Bank of Canada has left the policy rate unchanged at 0.25%, but has reduced its weekly asset purchases to C$3bn per week from $4bn to reflect “the progress made in the economic recovery”. This is the second taper, having already cut weekly purchases from the initial C$5bn per week back in October.

2022 rate hike firmly on the table

The Bank has also brought forward its forward guidance for when we could see the first interest rate rise. Previously, it suggested we would likely have to wait until 2023, but it's now signalling the second half of 2022.

"We remain committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved. Based on the Bank’s latest projection, this is now expected to happen some time in the second half of 2022".

This is a bolder than expected shift in light of a recent pick-up in Covid cases and some tighter containment measures. It therefore underlines the confidence the BoC has in the resilience of the economy and the likely success of the vaccine rollout and fiscal stimulus.

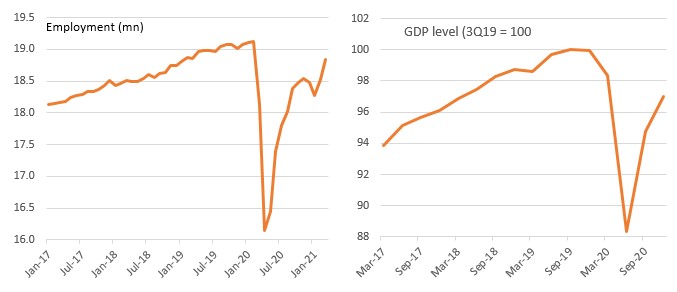

Canada is bouncing back - employment and GDP levels

Source: Macrobond, ING

Resilience is key

Indeed, the press release is upbeat, citing both an improved domestic and international outlook. The Bank acknowledges that 1Q growth is “considerably stronger” than it, and to be fair everyone else, had been predicting with the economy posting “substantial” job gains. Indeed, as the charts above show, Canada is on track to fully recover from the economic impact of the pandemic later this year. Rising commodity demand and prices are also a positive for exports and investment, with the BoC now predicting GDP growth of 6.5% this year followed by 3.75% next and 3.25% in 2023.

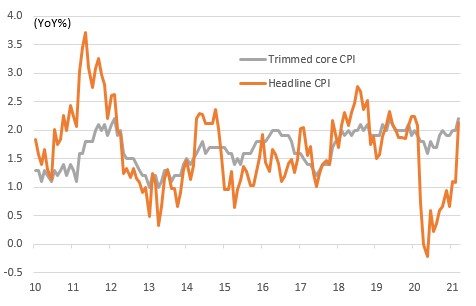

The inflation data today came in a touch stronger than expected at the core rate (ex food and energy) with the BoC now stating that “inflation should return to 2% on a sustained basis some time in the second half of 2022”.

Inflation is back in line with target

Source: Macrobond, ING

Earlier BoC move puts pressure on the Fed

With the Bank of Canada somewhat wary about the proportion of the government bond market it owns – more than a third - and the impact it has on liquidity, we expect to see further tapering in the second half of this year. The programme could potentially conclude before year-end, which would indeed pave the way for a 2H 2022 rate hike.

Today’s hawkish surprise could have interesting US implications. It will certainly put a bit more pressure on the Fed to explain why it's looking to leave it until 2024 before tightening policy given stronger growth, employment and fiscal stimulus in the US versus Canada.

Policy normalisation prospects to assist CAD in the medium term

The Canadian dollar rallied after the meeting thanks to the more hawkish 2022 forward guidance and a set of upbeat economic forecasts, while the C$1bn worth of tapering was largely expected.

In the short run, however, the loonie may struggle to emerge from the recent soft momentum, as the Covid-19 emergency in Canada is forcing some re-rating of domestic growth expectations: as acknowledged by the BoC in today's statement, the recovery prospects are strictly tied to restrictions and contagion developments. Incidentally, oil's underperformance may extend to the second half of the week as President Biden's climate summit tomorrow may signal a stronger commitment to reducing emissions. All in all, we could see CAD reversing some of today's gains by the end of the week.

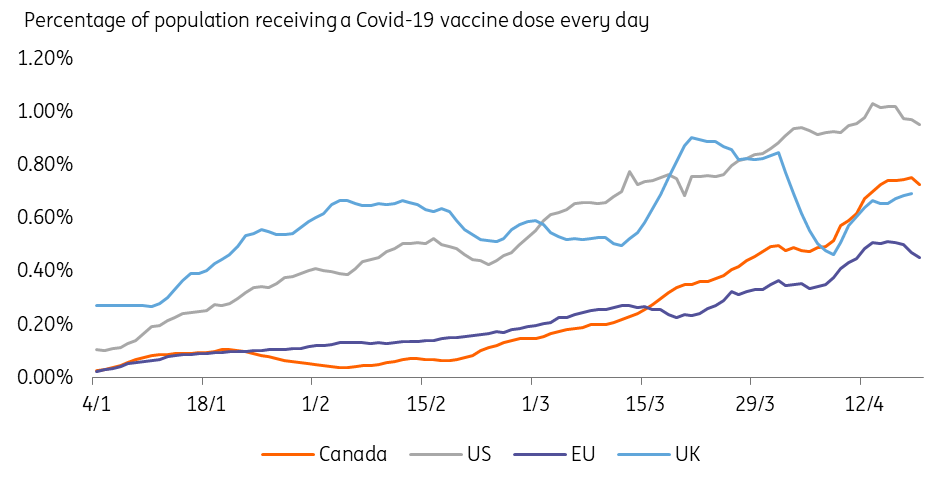

However, assuming that the current restrictions prove effective in curbing the contagion in Canada - the country has significantly increased the pace of vaccinations (as shown in the picture below) - and given that our commodities team believes oil prices will stay supportive in the remainder of the year, CAD may be left without any meaningful short-term dampening factor. An improved rate profile, thanks to markets frontloading a rate hike in 2022 and further scaling back of QE this year, all point to further strength in the loonie. In line with our bearish USD profile, we expect USD/CAD to touch 1.20 - and possibly move below those levels - by the end of 2021.

Canada is speeding up vaccinations

Source: Local sources, ING

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more