CAD/CHF 1Q Forecast: Long CAD/CHF – A Combination Of Risk Trends And Positioning

2020 has been a year like no other and seared into memory. Thankfully, with multiple vaccines scheduled to be rolled out and with global monetary and fiscal stimulus here to stay, 2021 looks to be a better year. As the vaccination process gets underway, negative tail risks are likely to recede, while lockdown measures will also continue to be eased, thus allowing for a brighter economic outlook. Much like 2020, with global interest rates at the zero bound, “RORO” (Risk On Risk Off) should remain a key driver for FX. As such, my trade of the year is to position that way with a bullish outlook on CAD/CHF.

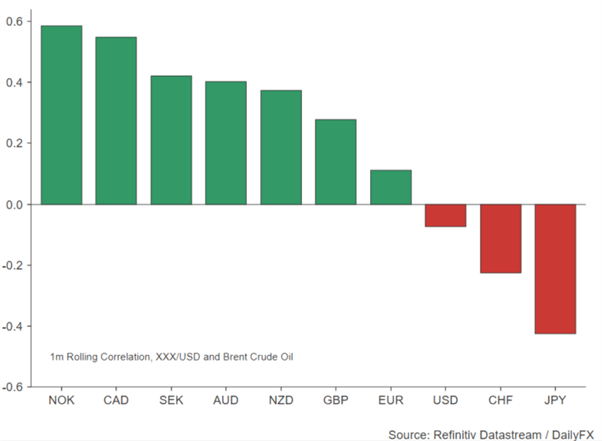

As the global economic outlook improves with pent up demand supporting growth, risks are tilted to the upside for oil prices, which in turn is likely to keep the Canadian Dollar afloat, particularly against the likes of the Swiss Franc.

G10 FX CORRELATION WITH OIL PRICES

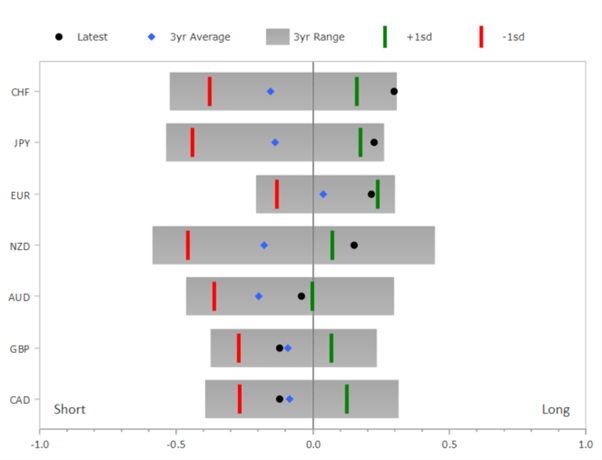

Positioning: Taking a look at institutional position, speculators continue to maintain a sizeable short in the Canadian Dollar, while Swiss Franc net longs are trading at extremes. As such, CAD/CHFupside may well be exacerbated by an unwind in short CAD/CHF positioning.

Disclosure: See the full disclosure for DailyFX here.