CAD Stalled With Oil, GDP In The Limelight Now

- USD/CAD advanced on weak Canadian data, as oil failed to advance.

- Canadian GDP stands in a week dominated by the Fed.

- The technical picture is mixed for the pair.

This was the week: Weak data all around

The Canadian Dollar was on the back foot as data missed expected. Manufacturing Shipments fell by 1.4%, Wholesale Sales by 1% and most importantly, Retail Sales dived by 0.9%. November was not a great month for the Canadian economy.

Oil prices did not help. After three consecutive weeks of significant advances, the price of the black gold stalled, consolidating previous gains. A buildup in inventories weighed.

In the US, the US government shutdown continued. The debacle hurts the economy as 800,000 are not paid. Also, quite a few economic releases were postponed. We did learn that Existing Home Sales continued falling, exposing the weakness of the sector. However, Jobless Claims set a new multi-decade record low, showing that the labor market is resilient.

Talks between China and the US did not go anywhere fast, slightly weighing on the loonie, a risk currency. The same goes for the release of Chinese GDP: showing that 2018 saw the weakest growth in 28 years.

Canadian events: GDP

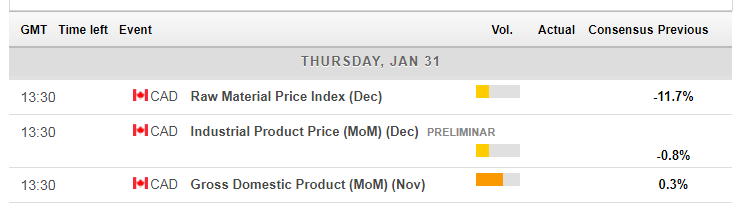

The Canadian calendar is quite light as January draws to an end, with the Gross Domestic Product report the only data point that stands out. The Canadian economy grew by 0.3% in October, a promising start to Q4. The figure for November may be somewhat weaker. The publication is accompanied by the Raw Materials Price Index (RMPI) and the Industrial Product Price which provide insights into inflation.

Oil prices may play a more significant role in setting the next moves for the C$ as they may wake up after a quiet week.

Here is the Canadian calendar for this week:

US events: Fed, NFP eyed

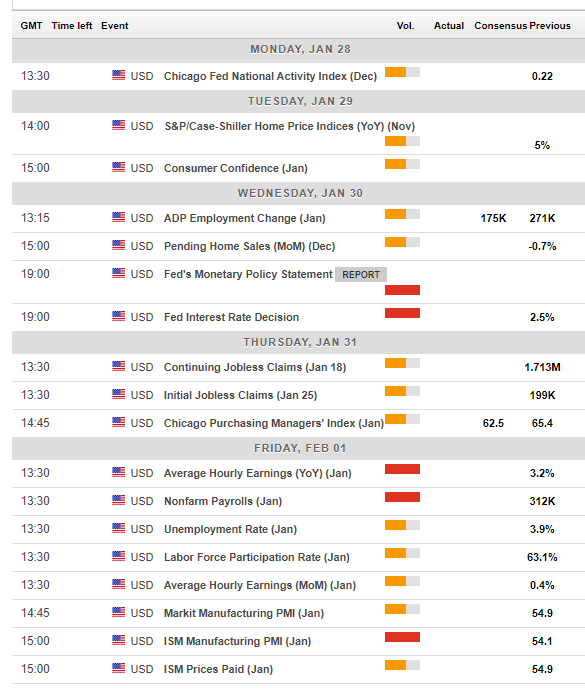

The US government shutdown removes the all-important GDP release from the American macroeconomic calendar. Nevertheless, the turn of the month is quite busy.

The CB’s Consumer confidence is set to drop, following the parallel UoM measure. Things warm up on Wednesday with the ADP Non-Farm Payrolls report, which is a leading indicator towards the official Non-Farm Payrolls report. After a blockbuster 275K in December, January’s report will likely be more moderate.

The central event is the Fed decision. In December made only a modest downgrade in rate hike projections for 2019 and Chair Jerome Powell said that the balance sheet reduction program would remain on auto-pilot.

However, the tune changed afterward, with Powell and his colleagues calling for patience and opening the door to changes in the Quantitative Tightening program. No changes are likely in the upcoming decision. However, markets will await a confirmation that the Fed is in no rush to raise rates and will be tuned to any statements about the balance sheet. A dovish shift is priced into the US Dollar, but to what extent?

The second-most-important event of the week is the Non-Farm Payrolls report for January. December was superb, with 312K jobs gained, and wages rising by 0.4% MoM and 3.2% YoY. A moderation of sorts is likely, especially as the shutdown continues.

The ISM Manufacturing PMI will also be eyed after it suffered a considerable drop in the previous publication.

Here are the critical American events from the forex calendar:

USD/CAD Technical Analysis

Dollar/CAD advanced but then stalled. The pair is far from suffering overbought conditions as shown by the stable Relative Strength Index (RSI). USD/CAD is capped by the 50-day Simple Moving Average and is trading well above the 200-day one.

Initial resistance awaits at the recent highs of 1.3375 which also separated ranges early in the year. 1.3420 was a swing low around the end of 2018 and switches to resistance. 1.3560 provided support around Christmas. 1.3670 capped the pair in December.

1.3304 was the recent low and also held USD/CAD down early in the month. 1.3230 was the bottom of the range before the pair moved higher. Three consecutive support lines follow: 1.3185 was a low point early in the month, 1.3160 cushioned USD/CAD in December, and 1.3135 held it in November.

-636840089198888112.png)

USD/CAD Sentiment

The Canadian Dollar could continue suffering a bit more, as oil prices and the Canadian economy are not going anywhere fast and as the Fed decision may not be dovish enough for markets.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk appetite and ...

more