Thursday, April 2, 2020 4:59 PM EDT

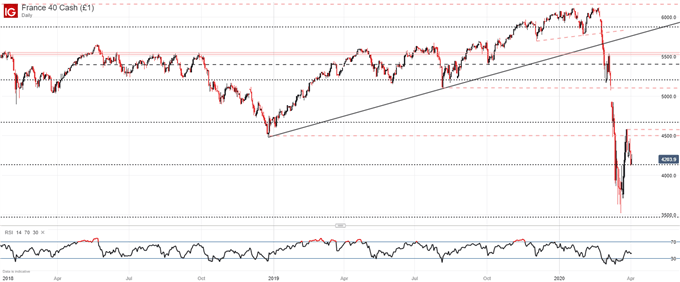

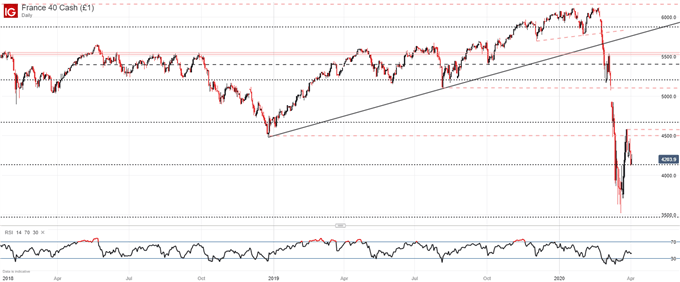

The CAC 40 moved lower on Thursday as it backed off resistance around 4,500. Despite Thursday’s price action, the bullish break above the 2018 low is an encouraging development for bulls looking to continue the run higher in the weeks ahead. In the meantime, price action would suggest traders are apprehensive stocks can continue higher. At this stage, consolidation above the recent swing-low on March 19 may actually be a healthy development in pursuit of a longer-term recovery rally.

CAC 40 Price Chart: Daily Time Frame (March 2018 – April 2020)

(Click on image to enlarge)

Therefore, the nearby Fibonacci level at 4,140 offers bullish traders an early opportunity to keep price afloat before the swing-low and subsequent Fibonacci level are required. Should the outlined levels fail, a lower low would be established, and the CAC 40 would be more vulnerable to further losses. On the other hand, consolidation above 3,528 would suggest investors are comfortable with the resultant valuation, providing cause to explore bullish opportunities.

In the meantime, however, IG Client Sentiment data suggests the CAC 40 may fall further before it can continue higher once more. Ideally, a deeper pull back and consolidation above the 3,528 level might provide a more attractive risk-reward profile for exploring topside opportunities, but price action rarely unfolds so cleanly.

Disclaimer: DailyFX, the free news and research website from IG, is one of the world's leading sources for news and analysis ...

more

Disclaimer: DailyFX, the free news and research website from IG, is one of the world's leading sources for news and analysis on the currency, commodity and index trading community. With nine internationally-based analysts publishing over 30 articles and producing 5 video news updates daily, DailyFX offers in-depth coverage of price action, predictions of likely market moves, and exhaustive interpretations of salient economic and political developments. DailyFX is also home to one of the most powerful economic calendars available on the web, complete with advanced sorting capabilities, detailed descriptions of upcoming events on the economic docket, and projections of how economic report data will impact the markets. Combined with the free charts and live rate updates featured on DailyFX, the DailyFX economic calendar is an invaluable resource for traders who heavily rely on the news for their trading strategies. Additionally, DailyFX serves as a portal to one of the most vibrant online discussion forums in the forex trading community. Avoiding market noise and the irrelevant personal commentary that plague many forex blogs and forums, the DailyFX Forum has established a reputation as being a place where real traders go to talk about serious trading.

Any opinions, news, research, analyses, prices, or other information contained on dailyfx.com are provided as general market commentary and does not constitute investment advice. Dailyfx will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

less

How did you like this article? Let us know so we can better customize your reading experience.