Brexit Latest: UK Deal Concession Sparks Rally In GBP/JPY, GBP/USD Rates

AVOIDING A ‘NO DEAL, HARD BREXIT’

The British Pound is rallying as UK Prime Minister Boris Johnson is said to have conceded demands on fisheries in order to help get a Brexit deal across the finish line. The previous demand that the UK retain some 60% of international fishing waters has been dropped to 33%, contingent upon the EU making concessions elsewhere; the EU’s position regarding fisheries has been steadfast at 25%.

Avoiding a ‘no deal, hard Brexit’ is a top priority for the UK, particularly as a new mutation of COVID-19 has sparked swift lockdowns in London and by foreign neighbors. At the time of writing, GBP/JPY and GBP/USD have reversed their daily losses – which exceeded -1% at times – and are now positive on the day.

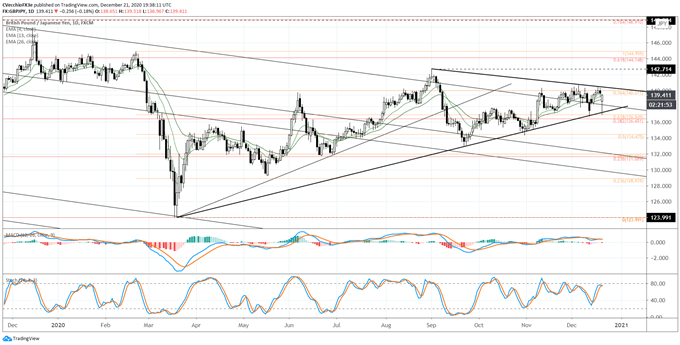

GBP/JPY RATE TECHNICAL ANALYSIS: DAILY CHART (DECEMBER 2019 TO DECEMBER 2020) (CHART 1)

(Click on image to enlarge)

A lot of volatility has yielded little by way of direction in GBP/JPY through December. To this end, the forecast from early-December holds: “GBP/JPY rates have traded sideways through the second half of November, but the consolidation appears to be occurring within the context of a symmetrical triangle dating back to the March coronavirus pandemic low. Resistance has been found around 140.01, the 76.4% Fibonacci retracement of the 2020 high/low range. A bullish piercing candle on the daily chart on Monday, November 30 suggests that topside pressure remains. Similar to GBP/USD rates, traders should be on alert for bullish breakout potential in GBP/JPY rates. “

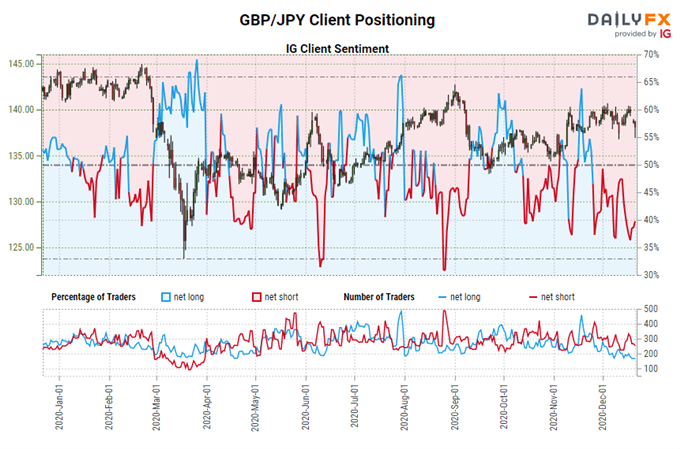

IG CLIENT SENTIMENT INDEX: GBP/JPY RATE FORECAST (DECEMBER 21, 2020) (CHART 2)

(Click on image to enlarge)

GBP/JPY: Retail trader data shows 50.89% of traders are net-long with the ratio of traders long to short at 1.04 to 1. The number of traders net-long is 36.53% higher than yesterday and 20.63% higher from last week, while the number of traders net-short is 17.29% lower than yesterday and 18.22% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/JPY prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/JPY-bearish contrarian trading bias.

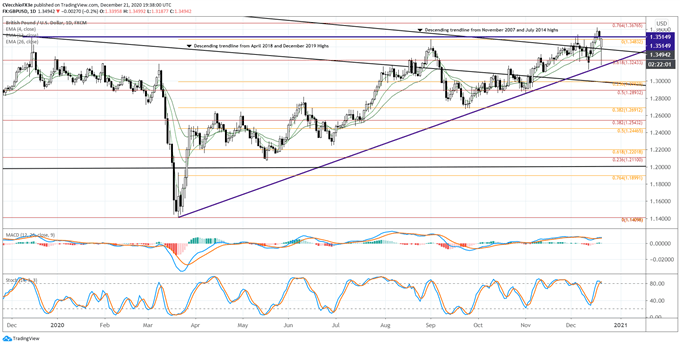

GBP/USD RATE TECHNICAL ANALYSIS: DAILY CHART (DECEMBER 2019 TO DECEMBER 2020) (CHART 1)

(Click on image to enlarge)

GBP/USD rates have jumped from the rising trendline from the March and November lows, experiencing a high degree of volatility in recent weeks with the fate of a Brexit deal on the line. Although fresh yearly highs were achieved last week, resistance remained in the form descending trendline from the November 2007 and July 2014 highs – that is, until today, with the large bullish hammer candle forming on the daily chart. It’s been previously noted that “breaching 1.3539 and sustaining a breakout move higher would indicate a long-term bottom has formed in GBP/USD rates.” With a Brexit deal in sight, a bullish breakout may soon gather pace in GBP/USD rates.

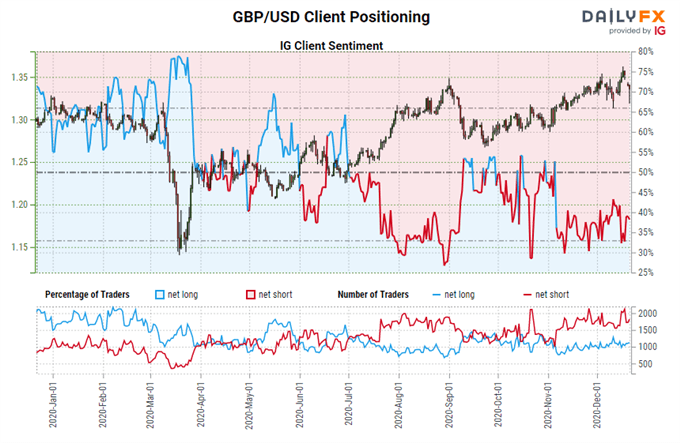

IG CLIENT SENTIMENT INDEX: GBP/USD RATE FORECAST (DECEMBER 21, 2020) (CHART 2)

(Click on image to enlarge)

GBP/USD: Retail trader data shows 46.83% of traders are net-long with the ratio of traders short to long at 1.14 to 1. The number of traders net-long is 24.80% higher than yesterday and 34.05% higher from last week, while the number of traders net-short is 9.46% lower than yesterday and 23.83% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon reverse lower despite the fact traders remain net-short.