Brazil: A Patient Monetary Policy

The first policy meeting headed by new BACEN governor Roberto Campos Neto, taking place Wednesday, should not alter the recent policy guidance. The SELIC rate should remain unchanged, at 6.5%, and the guidance should reflect continuity and patience, in the face of uncertainties regarding the social security reform, the defining event of the year in Brazil.

Economic fundamentals could justify a slight dovish shift ...

Recent developments on inflation and, especially, activity fronts would suggest that the outlook for monetary policy in Brazil has turned slightly more dovish in recent months.

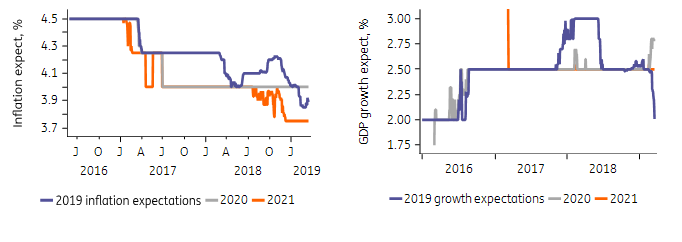

As the chart below demonstrates, inflation expectations remain fully anchored, with the central bank survey indicating that inflation should undershoot the 4.25% target in 2019, for the third consecutive year, and match the new lower targets, 4.0%, and 3.75% respectively, in 2020-21.

The survey also suggests that the outlook for economic activity has deteriorated slightly, with recovery expectations being pushed back towards 2020, as the full range of recent data, from employment to industrial activity, remained frustratingly weak.

Central bank surveys reinforce prospects for subdued inflation and a delayed recovery

(Click on image to enlarge)

Source: Macrobond

Even though confidence indicators have surged since last year’s Presidential election, persistent uncertainty regarding fiscal challenges suggests that investment decisions and credit growth may take a bit longer to materialize, limiting the near-term activity momentum.

But, as seen in the successful auction of 12 airport concessions last week, investor appetite is not as grim as activity data currently suggests, which bodes well for a relatively speedy post-reform recovery.

... but additional monetary stimulus remains conditional on fiscal progress

Lingering uncertainties regarding the approval of the all-important social security reform also continue to loom large for the monetary policy outlook. In fact, so long as reform approval is uncertain, policymakers may continue to opt to proceed more cautiously than inflation and economic activity data may justify.

This suggests that, even though the characterization of the economic activity outlook may acquire a marked dovish undertone, with the large negative output-gap expected to remain in place in the foreseeable future, policymakers may continue to characterize the balance of risks for inflation as asymmetrical, skewed to the upside.

This asymmetry should prevail so long as reform approval is uncertain. As such, we expect central bankers to keep the SELIC policy rate unchanged, at 6.5%, in the nearer term.

As/if fiscal reforms advance in Congress, the BRL should rally, improving inflation forecasts, and local markets should start testing more forcefully the case for SELIC rate cuts. In our view, current expectations for economic growth and inflation suggest that if the reform is approved by 3Q, the subsequent BRL rally and lower risk-premium could justify about 100 basis points in rate cuts in the subsequent quarters.

The debate over what’s the neutral level for the policy rate could also provide support for a more dovish monetary stance, post-reform. As we’ve discussed before, several reasons should contribute to lower estimates for Brazil’s neutral policy rate, including the structural changes in local credit markets, especially as it pertains to lending practices by public sector banks, the firmer credibility of the inflation-targeting regime, and prospects a forceful tightening bias to fiscal policy in the foreseeable future.

Some progress on the social security reform debate

After a frustratingly slow start, the outlook for the social security reform improved somewhat with the more forceful defence of the reform by President Bolsonaro, who used social media to highlight that the reform aims to eliminate privileges and make the system more just, with the introduction of a progressive contribution scheme that would allow low-wage earners to contribute slightly less than they do now, while demanding more from higher earners.

Tomorrow’s expected announcement of the pension reform proposal for the Military should also help advance the debate and could be a catalyst for a positive investor reassessment of the reform's success. In particular, a rigorous proposal for the Military, often seen as a protected group by the current administration, could provide crucial political cover for the administration to insist on a substantial reform for everyone else.

This would reduce the risk that Congress would water-down the administration’s proposal substantially, keeping the estimated 10-year savings from the reform closer to the BRL1.1tr included in the current draft, than BRL500bn.

As it stands, the proposal is ambitious enough to accommodate a moderate watering-down by lawmakers. Investor consensus is that the reform will generate about BRL700-800bn in the next 10 years. Less than BRL600bn in savings would likely trigger a tepid reception by investors, forcing the administration to propose additional reforms to keep fiscal accounts on a sustainable long-term path.

The reform is currently in the Constitutional and Justice Committee (CCJ) and expectations are that it could pass this first hurdle by the end of next week. Approval is likely as the government has a solid majority in this committee.

Before being voted by the entire Lower House, the reform must also be approved by the Special Committee. This stage should last much longer and is particularly risky as it could result in considerable changes to the reform’s draft.

In the best-case scenario, the proposal should not reach its final Lower House voting stage until June. But, in our view, late August, appears to be a more realistic time-frame for the final Lower House approval.

Our main takeaway from the initial votes by the new Congress over the past month is that the opposition is not large enough to block the approval of the reform. However, lawmakers also signaled that they will not rubber-stamp the government’s agenda.

The administration appears to have accepted the negotiation of small budget allocation and some second-tier executive positions in exchange for Congressional support.

Such negotiations appear to be ongoing but it’s still hard to envisage how successful they will be. Government leaders continue to sound optimistic about the existing support for the reform. We also remain confident that the reform will eventually be approved, but suspect the process may take longer and be more volatile than currently expected.

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more