Boris’ Scandals Provide Opportunities To Buy GBP/USD Dips

Ignoring the suffering of a sick boy sleeping on a hospital floor – is probably not the best day on the election campaign. Prime Minister Boris Johnson dodged speaking about the National Health Service and changed the subject in a television interview that went viral – benefiting his opponent, Labour leader Jeremy Corbyn.

The PM’s bad day has stalled sterling’s advance, as investors are wary that the Conservatives’ advantage may be eroded in the last days of the campaign. Markets prefer an outright Tory victory, providing certainty on Brexit and business-friendly policies. Corbyn is feared for his left-leaning spending and nationalization plans.

Underwhelming UK data has also capped the pound’s march forward. Gross Domestic Product remained flat in October, below 0.1% expected. The economy last grew in July. Britain’s trade balance deficit unexpected widened to £14,5 billion and industrial output missed expectations with a meager growth rate of 0.1%. The only upside surprise was Manufacturing Production, which beat expectations with an increase of 0.2% in October.

Buying opportunity?

Nevertheless, the focus remains on the elections and their projected results – which continue showing Johnson well in the lead. Britain Elects’ poll tracker is showing a 9.7% gap in favor of the ruling party – little changed. If the next opinion polls ahead of the December 12 elections show stability, GBP/USD has room to rise.

Another reason for bulls to cheer comes from optimism about Sino-American relations. Sonny Perdue, the US Secretary for Agriculture, said on Monday that he does not see new tariffs slapped on China on the December 15 deadline.

The greenback is set to move by the Federal Reserve’s decision on Wednesday. The world’s most powerful central bank will likely leave interest rates unchanged but provide hints toward 2020.

Overall, any moves on the election campaign are set to rock sterling, with minimal impact from anything else. Voting begins in less than 48 hours.

GBP/USD Forecast

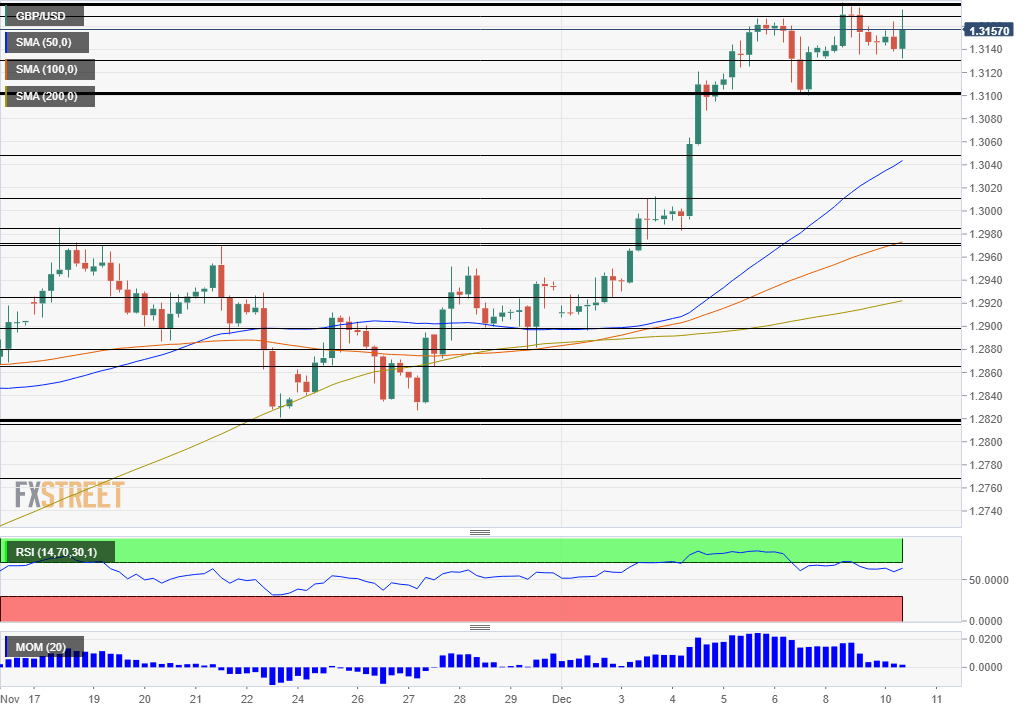

GBP/USD has broken to a new seven-month high above the previous peak of 1.3181, but the Relative Strength Index on the four-hour chart is still below 70 – thus outside overbought conditions and allowing for further gains. The currency pair continues trading above the 50, 100, and 200 Simple Moving Averages and enjoys upside momentum.

If the break above 1.3181 is confirmed, the next resistance level to watch is the round number of 1.32. Further up, 1.3275 dates back to March, while 1.3380 is the 2019 peak.

Support awaits at 1.3130, which provided support earlier in the day, followed by 1.31, a swing low last week. Next, 1.3050 and 1.3013 await sterling.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk appetite and ...

more