Bitcoin’s Value: Probably A Lot Higher Than You Think

Bitcoin’s Value: Probably A Lot Higher Than You Think

Source: Bitcoin.com

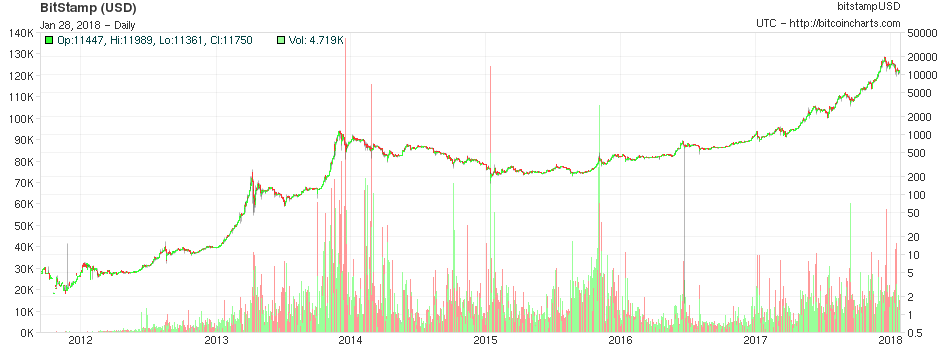

About 8 years ago a Florida programmer by the name of Laszlo Hanyecz developed a late-night craving for some pizza. It just so happened that Laszlo also had a bunch of Bitcoin around, which at that point had no particular value. This is when Laszlo came up with a brilliant idea, he decided to offer to pay 10,000 Bitcoins for two large pizzas. Despite that almost no one at that time knew what a Bitcoin was, his generous offer was accepted.

As Laszlo’s pizza related dreams came true that evening, news about the now infamous pizza purchase began to circulate around the internet, and a valuation for Bitcoin was born. A meager one quarter of just one cent was the original valuation placed on one Bitcoin. However, a few weeks later Bitcoin was officially trading at $0.06, an increase of 2,300% from the time of the pizza purchase. And the rest is history.

Fast forward to today, and Bitcoin’s current price is $12,000, so the Bitcoins that were used pay for the two pizzas are now worth a whopping $120 million today. Yes, Bitcoin has skyrocketed by a mindbending 500,000,000% since the pizza purchase. So, what’s next for Bitcoin? Is the meteoric rise likely to continue? Or is the digital asset’s recent 50% drop a precursor of what’s to come? Did the “Bitcoin Bubble” finally pop?

Source: Bitcoincharts.com

Some Bubble Like Characteristics do Exist

Bitcoin buying has been portrayed as somewhat alarming in the media lately, and it is quite possible that many people are engaging in risky behavior to accumulate Bitcoin. There have been a growing number of reports that Bitcoin-buying is entering an irrational phase. In fact, securities regulator Joseph Borg expressed concern citing that an increasing number of individuals in the U.S. are taking out mortgages to invest in Bitcoin. Furthermore, many consumers are using equity lines of credit and credit cards to buy Bitcoin. To compound the issue various exchanges such as Coinbase and others are accepting credit card payments for Bitcoin purchases. This exposes the public to immense risk as people are increasingly using cheap credit to buy Bitcoin.

Bitcoin: The Asian Mania

Perhaps most troubling are the recent reports coming out of Asia. The “Bitcoin Mania” there has reached a fever pitch, and authorities are starting to take notice. Government agencies in China, South Korea, and other nations are starting to shut down exchanges, Bitcoin miners, and are even proposing all out bans on Bitcoin trading. Essentially, these nations are attempting to tear apart the entire Bitcoin infrastructure.

Functionality Issues

Bitcoin is also facing in increasing number of functionality issues. Let’s not forget that Bitcoin ultimately derives its value from its proposed functional purposes for being an effective medium of exchange vehicle and a global store of value instrument. However, due to the high costs, slow speeds, and scalability problems surrounding Bitcoin many market participants are starting to doubt its future.

Altcoins

There are also a growing number of legitimate alternatives to Bitcoin. There are nearly 1,500 listed digital currencies, many of which can do everything that Bitcoin does only better. They are faster, more efficient, cheaper, can handle more transaction, etc. Thus, skeptics are beginning to doubt the need for Bitcoin altogether.

Source: Singleseed.com

But It’s Not All Bad for Bitcoin

Despite people doing crazy things to buy Bitcoin, and the endless bubble chatter surrounding the digital asset, a very small portion of the population actually owns Bitcoin. In fact, only around 0.5% of the people who have access to bank accounts have a blockchain account. The 22 million blockchain wallets indicates that despite the bubble rhetoric very few people are participating in the “Bitcoin Boom.” Personally, I’ve never seen a bubble that had a participation rate of 0.5% percent, it’s usually much higher.

News from Asia and the U.S.

Although the news coming out of China and South Korea about further crackdowns on Bitcoin’s infrastructure is somewhat destructive short term, it is far from the end of the world. In fact, most of the Bitcoin trading takes place in Japan and the U.S.

These markets are incredibly open minded towards Bitcoin and show no signs of detrimental government intervention. To the contrary, Japan has accepted Bitcoin with open arms, even calling it a form of legal tender in the country.

The U.S. has also been quite open to Bitcoin. The advent of futures trading has largely legitimized the digital asset in the eyes of consumers, the financial, world, as well as government regulators. Moreover, it is going to be extremely difficult for U.S. government regulators to impose harsh sanction on Bitcoin going forward, as it has been largely accepted into the mainstream by now.

Functionality Breakthroughs and The Bitcoin Advantage

Bitcoin has a massive first mover advantage compared to altcoins. It is by far the best known, most popular, and most widely accepted digital currency in the world. Moreover, unlike most altcoins, Bitcoin has a massive multibillion dollar infrastructure capable of withstanding the test of time.

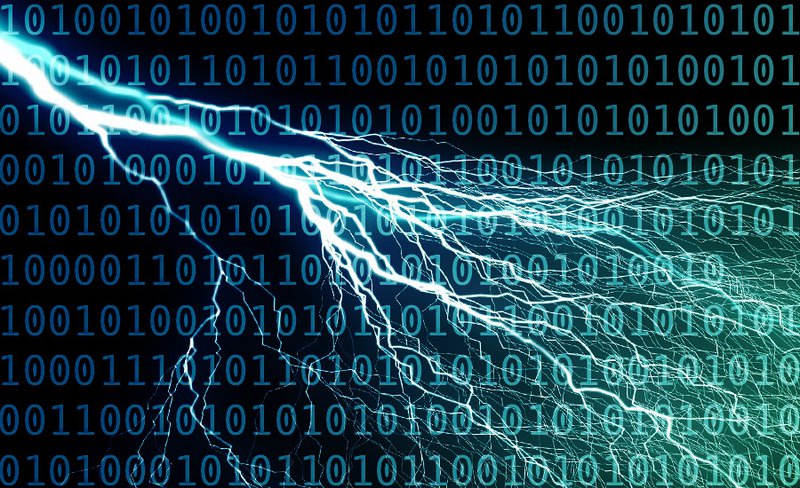

Furthermore, there are legitimate projects and proposals that plan to solve Bitcoin’s scalability, speed and price issues. Most notably, the Lightning Network promises to resolve these problems. This essential add-on to Bitcoin’s current blockchain is scheduled to be widely available by mid-2018.

Enter The Lightning Network

The Lightning Network is a protocol that creates an off-chain system by forming a network of payment channels that can be accessed by involved parties independent of the broader blockchain network. This is essentially an add-on to Bitcoin’s blockchain that solves scalability and cost issues by taking transactions off the main network and onto a more private network amongst the users of the underlying payment channel.

Source: Bitcoinmagazine.com

The Lightning Network can process thousands of transactions per second. Moreover, transactions are conducted at a fraction of the current cost, which makes the upgraded Bitcoin payment system much cheaper than the current mass payment processing system, and capable of conducing millions of transactions per day much like Visa and MasterCard. The Lightning Network is scheduled to be launched sometime in mid-2018.

The Bottom Line: Bitcoin Has Nearly Unlimited Potential

The fact that Bitcoin has surged from one quarter of one cent 8 years ago to a price of $12,000 today does not mean the digital asset is in an unsustainable bubble. In fact, Bitcoin can just as easily increase in value to $100,000, $500,000, or perhaps even higher in the next 5-10 years. The reason for this is because Bitcoin is not just a product, it is not a business, but is a revolutionary phenomenon consisting of a product and a service capable of disrupting the entire global financial order.

Bitcoin can compete in the massive worldwide store of value and the global medium of exchange markets. How big are these markets? Here is a snapshot of the worldwide exchange and store of value segments:

Investable Gold: Roughly $3.5 trillion

Physical Currencies: $7.6 trillion

M1 World Money Supply: $37 trillion

World Stock Markets: $73 trillion

M3 World Money Supply: $90 trillion

Derivative Market: $544 trillion-$1.2 quadrillion

Bitcoin: $200 billion

Bitcoin is obviously not going to replace the world’s stock markets or the countless trillions of derivatives floating around the world’s financial system. However, Bitcoin can essentially compete to capture market share in the store of value and medium of exchange segments. This includes predominantly the M1 money supply, and the investable gold markets. This provides Bitcoin with a possible market share potential of roughly $40 trillion.

What is Bitcoin’s Potential Value?

Does this mean Bitcoin’s market cap will be worth $40 trillion one day? Probably not any time soon, at least. But can Bitcoin capture some, 10, 25% or maybe even half of this market share in the next 10-15 years? I think so. At, 10% market share Bitcoin would have a valuation of $4 trillion, at 25% Bitcoin’s market cap would be $10 trillion, and at 50% Bitcoin would have a staggering market value of roughly $20 trillion. So, how much would one Bitcoin be worth according to these estimates?

1 Bitcoin at $4 trillion market cap is worth: $240,000

1 Bitcoin at $10 trillion market cap is worth: $600,000

1 Bitcoin at $20 trillion market cap is worth: $1,200,000

Essentially, Bitcoin would need to appreciate by 100 times from its current valuation to capture 50% of the readily available global medium of exchange and store of value market.

Will this happen in a couple of years? Probably not. Could this happen in 10-15 years? Yes, I think so, and here is why:

When a new, better, more efficient, and more beneficial invention or technology comes along it is only natural for it to capture market share from the older, less favorable technology. We’ve seen this countless times before, Amazon and bookstores, email and correspondence letters, smartphones and cellphones, we’re now seeing it with electric cars and ICE vehicles, and we will see this with digital currencies and fiat currencies going forward.

Just because Bitcoin is not perfect does not mean it’s not better. The fundamental technology beneath Bitcoin, its decentralized nature, and its unprecedented capabilities make it a much better alternative to fiat currencies, and in large part to gold as well. Therefore, Bitcoin should continue to appreciate and capture more market share in its respective segments until it gets to a valuation consistent with its long-term functionality prospects, consisting of being the world’s predominant global store of value and a worldwide medium of exchange.

Price Targets

2018 end of year price target range for Bitcoin: $35,000 - $50,000

2030-2035 price target range $500,000 - $1,000,000

Bitcoin and Blockchain will be the future of what we call "Money"!!!

You may very well be right. But I saw that @[Dr. Duru](user:5179), said that #bitcoin fell to $6k today and @[Ernie Varitimos](user:4881) said it could drop to under $3k soon. So that future may be farther away than you think. Hard to believe it was once going for $19k!

It can still be the future without it be so overvalued. A $19,000 price level is ridiculous to me, just as a $3,000 price level. What currency trades at those kinds of levels? A $1 per bitcoin would make far more sense to me.

@[Richard Shaw](user:5170) was kind enough to share this article with me:

money.cnn.com/.../index.html

Looks like hackers stole $530 million worth of digital currency yesterday. That's even more than the famous $400 million hack of Mt. Gox back in 2014. This is one of the greatest risks of #cryptocurrency and why I enjoy the peace of mind of my FDIC insured #cash.

Every time I think bitcoin can't go any higher, it does!

I know, there is no end in site.

It is unbelievable to me how #Bitcoin keeps going up and up. Don't people realize all the risks involved? This is not a real currency, could easily be hacked, and governments could deem it illegal at any moment. $BITCOMP

If Bitcoin is not a real currency, then what is? And what make it a real currency and not Bitcoin? Also, bitcoin exchanges can get hacked not the actual Bitcoin blockchain/network. The major governments where the bulk of Bitcoin action occurs, U.S., Japan are going to have difficulty deeming it illegal after legitimizing Bitcoin.

Here are some articles which have helped to shape my view on #bitcoin and the #crypcurrency craze:

Why Bitcoin Is Not A Real Currency

by @[Modest Money](user:49086)

www.talkmarkets.com/.../why-bitcoin-is-not-a-real-currency

When Someone Asks, 'Should I Own Bitcoin?'

By @[Richard Shaw](user:5170): www.talkmarkets.com/.../when-someone-asks-should-i-own-bitcoin

Bitcoin Can't Win Against Fiat Currency

By @[Richard Bookstaber](user:35121)

www.talkmarkets.com/.../bitcoin-cant-win-against-fiat-currency

Also some very good articles by @[Mish Shedlock](user:5141) and @[The Heisenberg Report](user:37642).

I found this article by @[James Altucher](user:4999) to be very helpful in explaing Bitcoin:

www.talkmarkets.com/.../everything-you-need-to-know-about-bitcoin

@[Nathan Feifel](user:56139) has some good stuff too.

Thank you for the tip.

Thank you!

Tearing down the bitcoin structure is not most governments attempt. What they are fighting against is the illicit use of crypto as with other forms of monetary exchange that violate sanctions (S. Korea), cut holes in foreign exchange policies (China), avoid taxes (US and European countries), or support criminal and illegal things. These things have to be addressed. The sooner they are resolved the better for everyone. You can't just shrug your shoulders as N. Korea uses crypto to funnel money to building nuclear weapons and missiles to threaten the US. That is the main why South Korea is desperate to stop the illicit flow until it is fixed along with the suspicion N. Korea is amassing a stockpile to potentially attack their economy if it becomes too big and influential in their economy.

@[Moon Kil Woong](user:5208), the issues that you stated can not be resolved. The whole purpose of #cryptocurrency is avoid gonverment regution and a paper trail. Without that, all you have is #Paypal or #ApplePay.

There will be solutions, although a bit artificial, contrived, or enforced. We already see solutions although they are not beautiful and takes away some of the benefits to its freedom.

Would love to hear your ideas for solutions. And have there been any concrete moves by governments to take any sort of action one way or the other?

I just read in this article here: www.talkmarkets.com/.../heres-why-crypto-is-correcting--and-why-its-temporary

by @[Adam Sharp](user:15144), that South Korea has banned annoymous crypto currency trading. Though for the life of me, I don't understand how that would work. Perhaps someone here can explain it to me.

I'm far from an expert in bitcoin or crypto currencies. Perhaps the author, @[Victor Dergunov](user:59967) or one of the other experts here knows more

Can you give some examples? For the life of me, I can't think of any solutions that would rectify these problems without inherently and fundamentally changing what cryocurrencies are.

I can't think of a thing either. Solving one problem would only create another. It's really a tradeoff of anonymity vs. control.

The question is, did the guy who sold the pizzas for 10,000 #bitcoins, still have those bitcoins? If so, being valued at $120 million now, I bet he's no longer selling pizzas!