Being QE-Easy Could Make The FX Market Puke

QUANTITATIVE EASING IS TIRED INEFFECTIVE POLICY

I wrote a piece at the beginning of 2016 titled “The United States will not follow in Japan’s footsteps.” At the time, the Bank of Japan had just embarked on a negative rate policy and was in the midst of a QE program that has continued for the last two and a half years. Investors, at the time, were pondering the possibility that the United States would follow with ZIRP and many pundits thought the United States was at the brink of recession. We took the opposite view. Although growth was slowing, there were many reasons to be optimistic: monetary conditions were still loose, low oil prices could help rather than hinder the U.S. consumer, and the yield curve was still historically steep. Ultimately, we made an important distinction between consumer psychology in the United States and Japan—a distinction that is still relevant today. We were skeptical that the BoJ’s tactics could tackle the deflationary mindset that had taken root in Japan and concluded that, “This is the problem that the BOJ faces. Until they can change the psychology of the Japanese people, monetary policy will remain ineffective. Here in the United States, where deflationary psychology is not ingrained, and where credit demand remains intact, the yield curve is still very much relevant.”

Much has changed since 2016, at least in the United States. Jerome Powell and the Federal Reserve are intent on monetary normalization – Fed jargon for raising interest rates and shrinking the balance sheet. And they have ample justification to do so: the U.S. is close to full employment, the GDP gap has been closed, wages are rising, inflation is at their 2% target, fiscal stimulus and tax reform are being implemented, and proposed tariffs will only add to inflationary pressures. Meanwhile, in Japan, it is becoming increasingly obvious that Japanese “problem” I spoke about will not and cannot be solved through monetary policy. The effects of QE in the United States will be debated for decades, but it is highly likely that QE did almost nothing for the real economy. Excess liquidity was a boon to asset prices as it artificially lowered the cost of capital for companies and consumers, but that translated into stock buybacks, consumer refinancing, and executive compensation. In terms of organic growth, investment, and productivity, QE was a dud. Even if the U.S. economy was not experiencing above-average growth, policy normalization would still be warranted – but I digress.

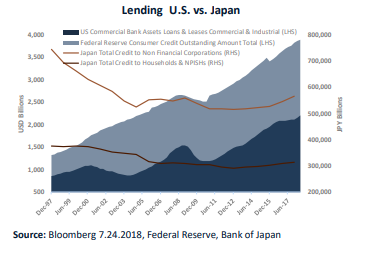

Back to the Japanese problem – two and a half years has yielded more than enough evidence that Japanese monetary policy is ineffective, and it needs to change. Inflation is still non-existent. Growth is anemic. And the capital markets are in real danger. The Bank of Japan owns 40% of all outstanding Japanese government bonds, which rarely trade. More frightening, they own 70% of the outstanding Japanese stock ETF’s. They have managed to extremely distort capital markets, without adding a bit of growth or inflation to the real economy. Consider the following chart, which tracks lending in both the United States and Japan for the last twenty years. The dark blue is commercial and industrial loans in the United States. The light blue is consumer credit in the United States. The dark red line is household credit in Japan. And the light-red line is credit to non-financial corporations in Japan.

As you can see, lending in Japan has continued to fall over the last twenty years. Simply put, there is no demand for credit in Japan, from either households or companies. And it does not matter how low-interest rates are, how steep the yield curve is, or if banks even want to lend. Monetary policy will not fix this problem. The definition of insanity is doing the same thing over and over and expecting different results. Continuing with ZIRP and asset purchases is insane Jay Powell has it figured out. It’s time for other Central Banks to climb out of the rabbit hole and admit that the policies of the last five years were ineffective. And part of that admonition means undoing it – normalizing, so to speak.

CENTRAL BANKS INTENT ON CONTINUING QE ARE ABOUT TO HAVE MONETARY POLICY DECIDED FOR THEM

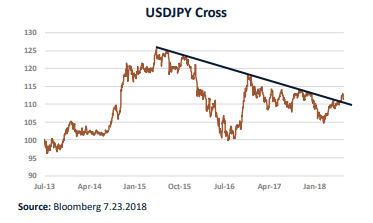

When I read anecdotal evidence that Japanese pension funds and insurance companies are dumping long-term JGB’s in favor of U.S. equities, it points to a big problem for the Bank of Japan. It means that domestic companies cannot find growth or yield in Japan and become active sellers of Yen. This is starting to happen, and the BoJ’s current response is to maintain a 10-year JGB yield ceiling at 11 bps. In the currency markets, investors chase growth and yield. Japan has neither. The yen has recently broken above a three-year resistance trendline as shown below, and the BoJ would be wise to heed this warning because current policy is a recipe for disastrous capital outflow.

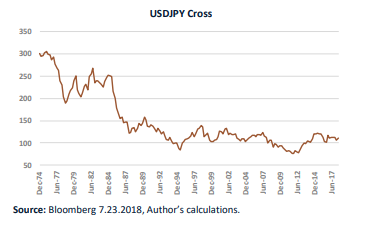

Economies and currencies rise and fall. It is the natural order of things. The causes are many: war, debt, demographics, natural disaster. Along the way, there are usually policy measures that stall or hasten the natural cycle. ZIRP and QE have been deployed under the guise that they are a reasonable policy to counterbalance slow growth and low inflation. Unfortunately, there is no evidence to support such a claim. Rather, continuation of the current monetary policy in Japan may result in accelerated capital outflow and ultimately hasten the decline of the Japanese economy. If what goes up, does come down, they could be looking at a serious devaluation. The 40-year chart of the Yen illustrates my point.

There has been no panic. And the Bank of Japan has time to reverse the ill-fated course that they are on. But it is better to adjust policy now before they are forced to in response to capital outflow.

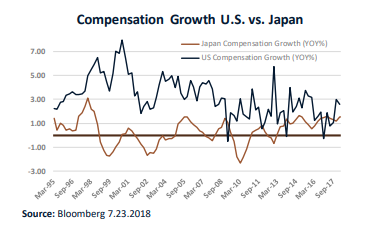

The Japanese economy is not doomed by any means. Corporations and consumers will re-leverage when the time is right. But they will do so when they are ready, and no amount of quantitative easing or negative interest rates will hasten this process. On a positive note, compensation growth registered its highest year-over-year percentage gain in twenty years. Maybe a bit more data like this will be the excuse Kuroda needs to make a change.

Disclosure: This article is distributed for informational purposes only and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. ...

more