Bargain Hunting In Thailand

Dutch author Ruerd Heeg mentioned a terrific idea over on the Pairs Forum which got me thinking about Thailand. If you are tempted to visit, you might want to consider Butterfield & Robinson, which offers a biking trip through the country. It won't be cheap, but it won't be disappointing either. If you are planning on investing, your accountant might consider this a business expense (mine wouldn't, alas).

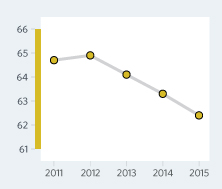

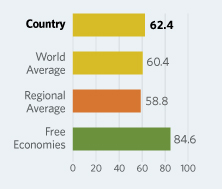

Thailand's market cap currently costs about 105% of its GDP, up from 78% a year ago and 87% the year before that. It is the number one exporter of computer hard drives and number two exporter of rice. Thailand's economic freedom score is 62.4, making its economy the 75th freest in the 2015 Index.

This is slightly above the world's average.

If you are looking for a convenient way to invest in Thailand, you should take a look at Morgan Stanley (NYSE:MS)'s Thai Fund (NYSE:TTF). It trades at a discount to NAV of over 11%, which is above its 10-year and year to date average. The exposure is balanced between financials, consumer services, and industrials. While they have not bought back any shares this year, MS has bought back shares from other funds in the past when discounts get wide. If you are looking for a hedge, you could consider writing calls or shorting some shares of the iShares MSCI Thailand Capped ETF (NYSEARCA:THD) against TTF. September 18, 2015 $83 calls last traded at $3.75 with a bid of $3.00 and ask of $4.70

Back to Mr. Heeg's idea, Asia Pacific Wire & Cable Corp (NASDAQ:APWC) is an attractive long candidate. It currently costs less than a quarter of its book value. If you want, you can short out minority shares of its publicly traded subsidiary Charoong Thai Wire and Cable (CTW on Stock Exchange of Thailand/SET) which trades for a substantial premium to book value. This may be a bit of a hassle; some US brokers such as Interactive Brokers (NASDAQ:IBKR) don't offer access to the SET. Net of shorting out CTW, you will get APWC for free. I am nearly certain that APWC is worth equal to or more than free.

Why does such a situation exist? One reason could be that CTW pays a dividend of around 5% while APWC does not. Another reason could be that APWC is listed in the US and CTW is listed in Thailand. The home bias, the tendency for investors to prefer to overweight in domestic equities over foreign equities, is a durable, statistically significant phenomenon.

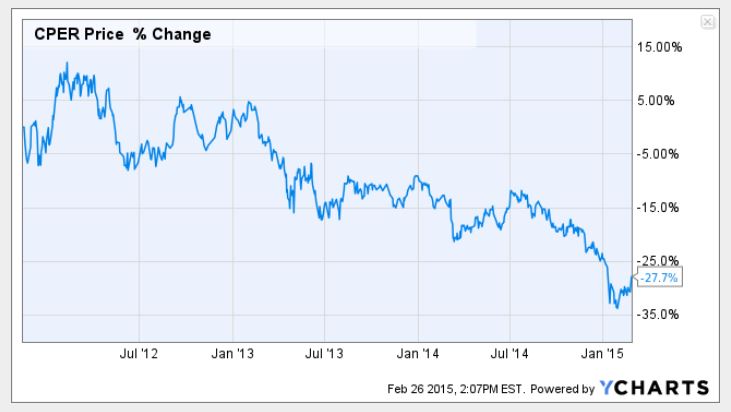

A majority of wire's cost of goods is copper, which has been weak in recent years.

Ernst & Young is the company's independent auditor, which engenders some comfort that APWC is not an utter fraud.

TM Editors' Note: One or more stocks discussed herein is a penny stock and/or microcap. Such stocks are easily manipulated; please do your own careful due diligence.

Disclosure: The author is long APWC.

Additional disclosure: Chris DeMuth Jr is a portfolio manager at Rangeley Capital. Rangeley invests with a margin of safety by buying ...

more