Bank Of England: Cautious Optimism Reduces Need For Negative Rates This Year

The rapid vaccine rollout and the corresponding likelihood of a spring recovery has taken the pressure off the Bank of England to offer further stimulus. Policymakers will be careful not to shut the door on negative rates, but we don't expect further rate cuts this cycle.

The brighter outlook has taken the pressure off the Bank

The Bank of England is poised to unveil its latest decision this Thursday, and it’s now widely expected that policymakers will shy away from taking the plunge into negative interest rates this month. In fact, we think it’s unlikely they will do so at all in this cycle.

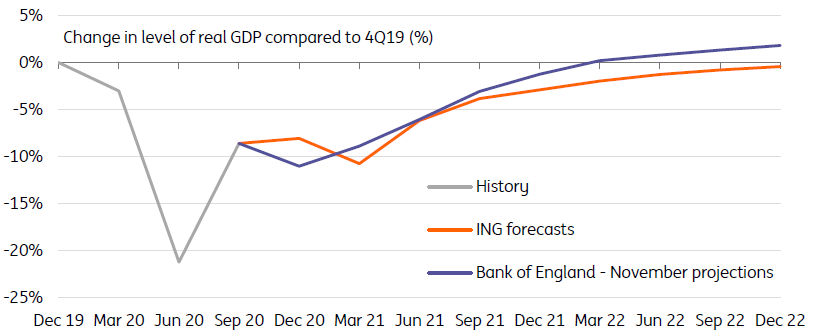

The outlook is brighter, and we expect the Bank’s new forecasts to continue to signal a full economic recovery around the turn of the year (albeit with some inevitable downgrades to growth this quarter). We are a little more cautious - we expect the combination of higher unemployment and ongoing disruption related to Brexit to prevent a full return to pre-virus levels for at least another 18 months.

But the conclusion is the same - with the vaccine rollout going well, and cases now falling rapidly, there is a good chance that the economy will record a rapid bounce in activity through the middle of the year. That in turn reduces the pressure to inject additional stimulus.

The BoE's November forecasts assumed more-or-less a full recovery this year

(Click on image to enlarge)

Source: Bank of England, ING

Negative rates unlikely this cycle, but don't expect the BoE to close the door on them

Of course, there are plenty of uncertainties in the outlook - not least how the new Covid-19 strains will affect the current batch of vaccines and therefore the need for future restrictions. But even so, what’s become increasingly evident from MPC commentary over recent weeks is that the willingness to enact negative rates is mixed.

Some ‘external' committee members, most notably Silvana Tenreyro, have signaled it is a move they are willing to make - though we suspect there won’t be any dissent this week. But the overall majority, including Governor Andrew Bailey, have played up some of the challenges.

On that note, we will get an update this week on the review that's been carried out with the banking sector to see how negative rates might play out in practice. We suspect the general conclusion is likely to be that there are challenges, but that the sector could probably cope.

What’s less clear is how far the committee will go in passing judgment on how these findings affect the policy outlook. In theory, the findings are coming from the Prudential Regulation Authority (PRA), so it is entirely possible that the MPC passes no further judgment at this stage. However, the findings could prompt the MPC to formally reduce its estimate for the ‘effective lower bound’ this week - which is a fancy way of signaling they are prepared to take rates below zero.

Either way, the key message is likely to be one of cautious optimism. We don’t expect negative rates in this cycle, though we could at some point see a step in this direction if the Bank decides to offer a negative rate on its Term-Funding Scheme, a policy designed to incentivize lending to SMEs.

If the outlook goes as planned, we also don’t foresee a further extension in the Bank’s QE program beyond this year.

GBP rates: one last hurrah for negative Sonia forwards

The BoE meets at a time of benign market developments, with an improving economic outlook but still significant discount for negative rates. Something has to give. As we explained above, we do not see a strong case for taking the Bank rate below zero, but the conclusion to the PRA’s review on negative rates, and possible dovish dissent at this meeting, could be the cause of greater confidence in negative rates in the near term.

We think this would be misguided. As the outlook improves, the case for negative rates will weaken. In a sense, some of the easing benefit of negative rate expectations has been achieved already with 1Y1Y Sonia swaps staying below zero since June last year. After a possible dovish reaction on Thursday, we expect this rate to move back above zero, and eventually above Sonia fixings (currently around 0.05%).

Sonia 1Y1Y to cross above zero, but curve flattening potential limited

(Click on image to enlarge)

Source: Refinitiv, ING

In the grand scheme of things, this would be a fairly mild re-adjustment and not something that threatens to invert dynamics at the long end of the curve. A more significant force in the pricing of longer rates is the impending recovery, and eventual tightening of policy.

As Bailey has stated, the BoE might start balance sheet reduction (quantitative tightening) before or during its rate hikes. This normalization at both ends of the curve implies the flattening potential could be more limited than in the previous (shallow) hiking cycle in 2017-18.

GBP - Our new FX forecasts

For a discussion on what the Bank of England story means for sterling, read our latest article on the GBP outlook.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more