Bank Of Canada’s Optimism On The Rise

Canada's central bank signals ongoing loose monetary policy amidst a tough period for the economy, but with vaccines being distributed and significant fiscal stimulus working its way through, the outlook is brightening. The risks are likely skewed towards swifter policy re-adjustment, and the currency's real-rate profile is set to remain attractive.

Bank of Canada Governor Tiff Macklem takes questions from reporters on the phone as he participates in a news conference at the Bank of Canada

Canada's central bank leaves policy mix unchanged – no rate hike until 2023

The Bank of Canada maintained its target for the overnight rate 'at the effective lower bound' of 0.25% and is continuing its quantitative easing program of purchases of 4bn Canadian dollars per week.

It was only in October they announced a 'recalibrated QE' program where they shifted asset purchases towards the longer-end of the yield curve while lowering the weekly purchases from “at least C$5bn” to “at least” C$4bn.

Back then they also provided forward guidance saying the policy rate will stay at the effective lower bound (0.25%) until the 2% inflation target is 'sustainably achieved', which according to their forecasts won’t happen until 2023. All of these viewpoints and policy actions were restated in today’s announcement.

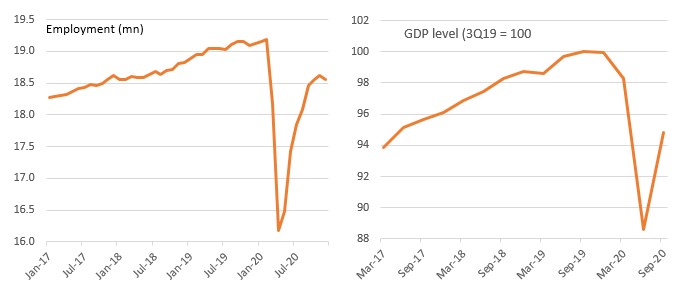

Employment and activity levels remain well below on pre-Covid-19 levels

(Click on image to enlarge)

Source: Macrobond, ING

A brightening outlook

The strains of spiking Covid-19 cases and renewed lockdowns has been seen in recent data with employment having fallen 62,600 in December.

The central bank now believes that the economy will contract in 1Q21, however, with the vaccination process now underway and the government committed to spending $100bn over the next three years to maintain the momentum of the recovery, the economic outlook is now brightening.

The central bank acknowledged that the medium term outlook is “now stronger and more secure than in the October projection, thanks to earlier-than-expected availability of vaccines and significant ongoing policy stimulus”. They are now forecasting GDP growth of 4% this year, 5% next year and 2.5% in 2023.

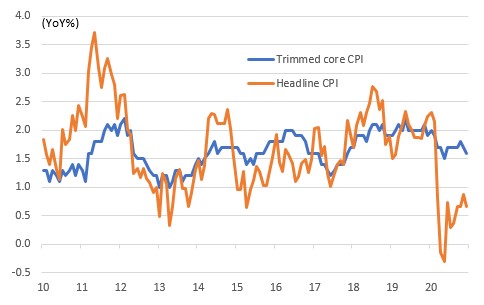

Inflation is non-threatening... for now

(Click on image to enlarge)

Source: Macrobond, ING

Inflation to stay benign

The central bank remains relaxed about inflation arguing that while it will rise in the near-term on base effects - as we will be comparing a re-opening economy with one that was experiencing price declines last year – this will “dissipate”.

The Bank continues to believe that excess supply will weigh on inflation, which is why it won’t “sustainably” return to the 2% target until 2023.

Markets appear to believe this view given break even inflation rates on 10-year index linked Canadian government bonds is currently 1.5% versus 2.1% in the US.

But hints the Bank could move quickly

Consequently, the Bank continues to signal loose policy for a prolonged period – effectively no rate hike until 2023 - with QE continuing until "the recovery is well underway”.

That said they do hint at potential tapering (having already cut purchases by C$1bn per week), by suggesting that as the Governing Council “gains confidence in the strength of the recovery” asset purchases will “be adjusted as required”.

We expect more tapering later this year given our expectations of very vigorous growth through 2Q and 3Q, accompanied by higher inflation numbers than the central bank are forecasting. We also suspect too that as the year progresses the Bank may take a less robust line on the 2023 indication for rate hikes.

Central bank to leave CAD rate attractiveness intact

From an FX perspective, the unchanged policy stance from the central bank leaves us confident in our bearish view on USD/CAD for the remainder of the year.

The risks are skewed towards some tapering rather than additional easing, which should leave CAD's relatively attractive real-rate profile in G10 intact. The contraction in inflation from 1.0% to 0.7% seen in the December figures is also beneficial to CAD's real rate.

The major risks for CAD's medium-term outlook are unlikely to come from the central bank, but are mostly connected to a slower-than-expected vaccine roll-out that may hinder the economic recovery. Another factor that may weigh on the outlook and CAD in the longer term is the stance of the new Biden administration on Canadian oil pipelines, as another important project (the Enbridge Line 3 replacement) may be at danger of being cancelled after the Keyston XL permit is set to be revoked today.

We expect CAD to remain an attractive option in a weak-USD/reflationary environment in 2021, thanks to the potential for additional recovery in oil prices.

We expect USD/CAD to touch 1.20 by 4Q21.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more