Bank Of Canada To Pause Rate Hike For Now

Bank of Canada may pause rate hikes due to concerns over the slump of oil prices. Short CAD/CHF?

The Bank of Canada (BOC) held its interest rate steady at 1.75% yesterday, in line with expectations, but left a significant question mark hanging over the outlook for monetary policy through the rest of 2019.

BOC said, "The appropriate pace of rate increases will depend on how the outlook evolves, with a particular focus on developments in oil markets, the Canadian housing market, and global trade policy."

They also cited that a temporary slowdown due to weaker-than-expected consumption and housing activity could lead to a modest amount of excess capacity and curb inflationary pressures.

However, BOC is still sticking to their view that multiple hikes are still needed to reach the “neutral range,” which officials estimate to be between 2.5 and 3.5%.

With growth forecast to be an annualized 1.3% for the last three months of 2018 versus the estimate in October which was 2.3%, we expect the economy to slow further in Q1 2019 by an annualized 0.8%.

In our opinion, we could expect some weakness in Canadian dollar for now until oil prices improve. The inflation outlook has been revised lower by BOC to reflect the fall in gasoline prices, which means an improvement in the oil prices will bring BOC’s monetary policy back on its path.

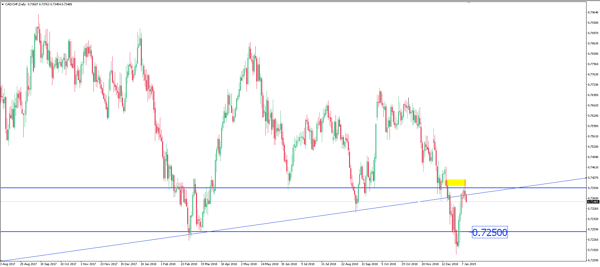

CAD/CHF has broken its daily support on the weekly chart and price on the daily chart has since rejected the 0.7400 resistance. We expect a further slide in this pair to the 0.7250 price level.

Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more