Bank Of Canada To Hold Fire, But Not For Long

We expect the Bank of Canada to stay on hold on Wednesday, and that's the predominant market view. There's a case for a rate cut early next year though, due to global concerns. That should not be a significant drag on the currency, which should retain its rate advantage in the G10 space.

Bank of Canada Governor, Stephen Poloz

We still see a cut on the horizon

The Bank of Canada will probably leave interest rates unchanged at the upcoming meeting but don't entirely dismiss the risk of surprise action. Given the recently stated concern about the global backdrop, and the vulnerability of Canada to global demand and commodity price moves, we suspect it is only a matter of time before interest rates are cut again.

We suspect it's only a matter of time before interest rates are cut again

The Canadian economy is not immune to the global slowdown with the latest 3Q GDP growth rate (1.3 % annualized) underlining this point. Nonetheless, the story is one of relative resilience for now, as indicated by a firm jobs market with rising pay. With inflation broadly in line with target, we don't expect to see any policy change at tomorrow's meeting.

However, faltering global demand and lingering trade uncertainty mean that officials are warning of the potential for weakness ahead. BoC officials have suggested that interest rates can do little more and they would be looking to see whether fiscal policy can provide a lift. We see limited chances of this coming to fruition in the near term.

Moreover, with US-EU trade tensions on the rise and tariffs being reinstated in other countries, we see more risks ahead for global growth. Consequently, we suspect the BoC will reluctantly cut interest rates again in early 2020.

CAD will retain the best G10 carry

The Canadian dollar has remained anchored around the 1.33 level vs the USD in the past two weeks. It's likely to be a busy period ahead for CAD as investors will get information regarding the three key drivers of the currency:

- Monetary policy: the BoC will almost surely hold fire tomorrow, but the language will tell us more about the future policy path. We continue to expect the BoC to cut rates early next year and, in line with this view, we assume the Bank will not display any hawkish tilt in its policy message tomorrow. Markets are not pricing in any easing, so the risks for the CAD in this regard seem slightly tilted to the downside before the meeting.

- Trade wars: the US-China trade deal is facing a number of hurdles and may be delayed to 2020. In that case, the question remains whether President Trump will implement the tariffs in two weeks' time. The US protectionist moves of the last few days towards European and South American countries don't seem to bode well for the global sentiment and growth outlook.

- Oil: the OPEC meeting this week has three possible scenarios (see our commodities team preview here): a) An extension of the current output cuts deal and the announcement of deeper cuts (positive for oil prices); b) An extension of the deal but no deeper cuts (likely mildly bearish for oil); c) No extension of the output cut deal (highly bearish impact on oil).

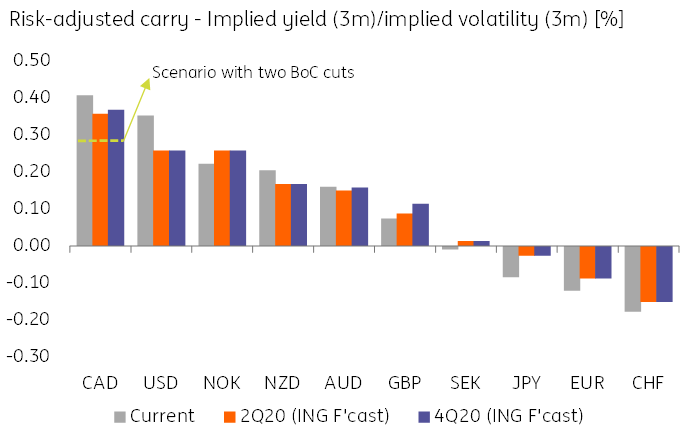

While all these factors tend to suggest a downside-tilted balance of risks for CAD in the near term, it must be considered that the loonie remains the most attractive carry currency (on a risk-adjusted basis) in the G10 space at the moment. This means that barring a major re-escalation in trade tensions and a sizable risk-off reaction in the markets, the pursuit of attractive returns may put a floor below the Canadian dollar. Do note that a rate cut by the BoC should not, in our forecasts, dent the leadership of the loonie in the G10 space in terms of risk-adjusted carry, as you can see in the chart below.

Fig 1 - CAD rate advantage immaculate even if BoC cuts

Source: ING, Bloomberg

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more