Bank Of Canada Preview: The Tapering Tightrope

The BoC is likely to respond to the more positive macro outlook with the second tapering of its QE programme; we expect weekly purchases to be cut from CA$ 4bn to 3bn, in line with consensus. The recent spike in virus cases in Canada suggests it shouldn't surprise on the hawkish side, despite a more benign bond environment, and the impact on CAD may be neutral.

Bank of Canada Governor Tiff Macklem

Hopes for a full recovery in Canada

This week’s Bank of Canada meeting is expected to result in the weekly government bond purchases being cut from C$4bn to $3bn as evidence mounts that the Canadian economy will make a full recovery from the pandemic within the next six months. We think that the bank will broadly match such expectations.

The overnight lending rate will remain at 0.25% and the BoC will continue to emphasise the accommodative overall stance of their policy, but new forecasts will be published to accompany the decision and the news conference is likely to see significant upward revisions to GDP with inflation predictions also likely to be higher in the near-term.

With the trimmed core inflation rate broadly in line with target, 90% of the jobs lost during the pandemic regained and GDP set to break above pre-pandemic levels in the second quarter there is less need to have the accelerator peddle pressed to the floor.

Canadian employment and GDP growth

Source: Statistics Canada, ING

Fiscal policy doing the heavy lifting

Fiscal policy is increasingly going to be doing the heavy lifting with substantial fiscal stimulus set to help maintain economic momentum. Additionally, the huge accumulation of household savings means there is plenty of cash ammunition to spend as confidence continues to improve on economic re-opening. On top of this, there is the rally in commodity prices which should further spur output and investment spending.

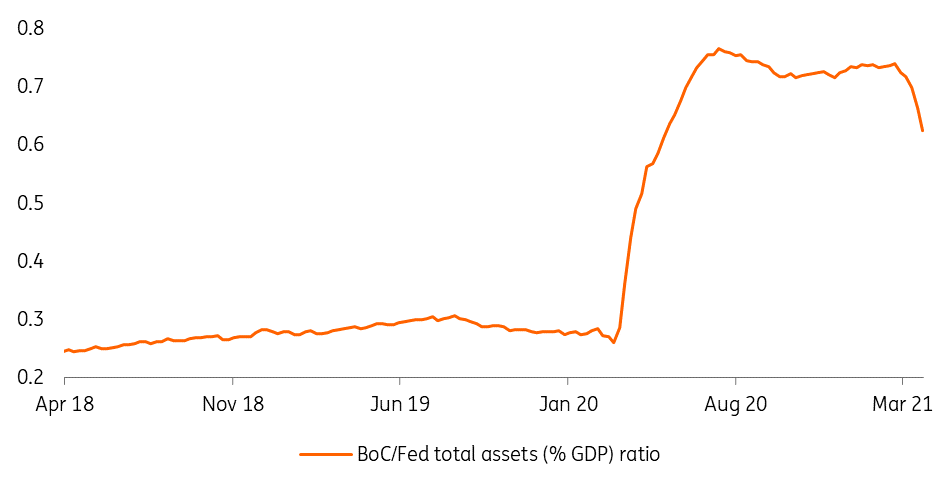

Assuming the vaccination process continues successfully and there are no major setbacks regarding new virus strains we expect to see additional tapering in the second half of the year. Moreover, the BoC already owns 35% of the government bond market and there are concerns about market liquidity should these holdings continue to grow as quickly as they have been. As shown in the chart below, BoC total assets (as a percentage of GDP) remains considerably high when compared to the that of Fed despite the ratio between the two balance sheets having shrunk in the past few weeks.

BoC and Fed total assets

Source: Bank of Canada, Federal Reserve, ING

We are currently forecasting the first rate hike to come in early 2023, but as in the case of the US, the probability of a late 2022 move is growing.

Market reaction: Consensus move may leave CAD vulnerable for a little longer

Markets are likely fully factoring in CA$m1bn per week worth of tapering by the Bank of Canada this week, and we think that it may not deviate much from expectations. We highlighted above how a well-paced economic recovery provides the main reasoning behind trimming bond purchases and reducing the size of the balance sheet. The reason why we suspect the BoC will refrain from “going big” with its tapering announcement is the recent spike in Covid-19 cases and fresh restrictions in Canada that are forcing a re-rating of the country’s recovery expectations.

At the same time, should the Bank trust the faster vaccination roll-out in the country – Canada’s is administering more per-capita doses than the UK and EU (but fewer than the US) at the moment – we could surely see a more hawkish statement than expected this week. After all, the recent drop in sovereign yields might have made the Bank less concerned about dealing a hit to the bond segment by delivering a hawkish surprise.

Improvements in the country's virus situation should allow CAD to benefit from its exposure to a strong US recovery

Looking at the FX impact, a consensus tapering announcement (1 bn per week reduction) should not cause significant moves in the Canadian dollar, leaving any market reaction mostly driven by the BoC's comments on any target for sovereign bond ownership, how upbeat will the new forecasts on the Canadian economy will be and any other comment about the direction for policy later in the year.

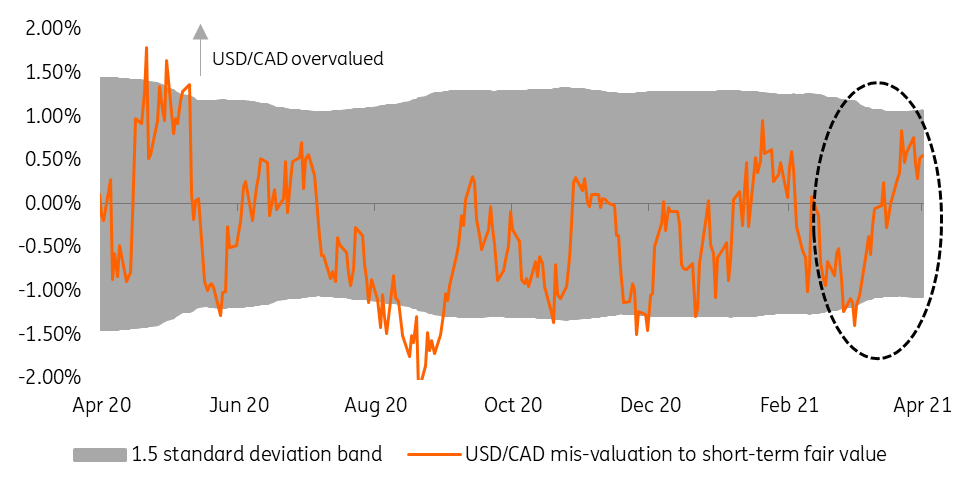

CAD has been lagging other pro-cyclical currencies lately, largely due to the worsening contagion situation in Canada and fresh containment measures. As shown in the chart below, USD/CAD has moved from a material undervaluation in mid-March to overvaluation territory, and the re-rating of Canada’s growth outlook due to new restrictions has surely played a role. A consensus move by the BoC would likely leave CAD vulnerable in the short term, but moving ahead, improvements in the country's virus situation should allow CAD to benefit from its exposure to a strong US recovery and the BoC scaling back asset purchases.

USD/CAD mis-valuation

Source: ING, Refinitiv

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more