Bank Of Canada Preview: The End Is In Sight

The Bank of Canada is set to taper QE purchases further to C$1bn per week with the program likely concluded in December as the market increasingly prices in 2022 rate hikes. We expect a neutral impact on CAD, which seems to have most of the positives in the price and may experience corrections in the near term.

QE set to end in December

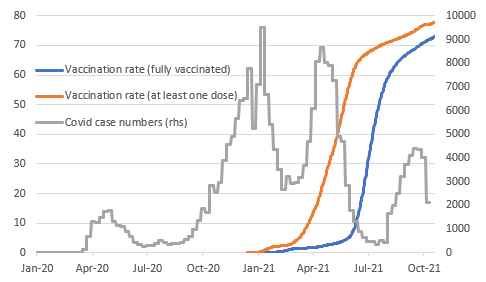

The Canadian economy is growing, creating jobs, and is experiencing inflation pressures that are likely to keep CPI above target for the next couple of years. This argues strongly for a further dialling back of the Bank of Canada’s stimulus efforts with next week’s policy meeting set to see weekly asset purchases cut to C$1bn from the current C$2bn per week. Given the successful vaccine roll-out programme and declining Covid case and hospitalization numbers, we expect the December policy meeting to result in asset purchases being halted completely.

Canadian Covid cases and vaccination rates

Source: Macrobond, ING

Inflation pressures set to persist

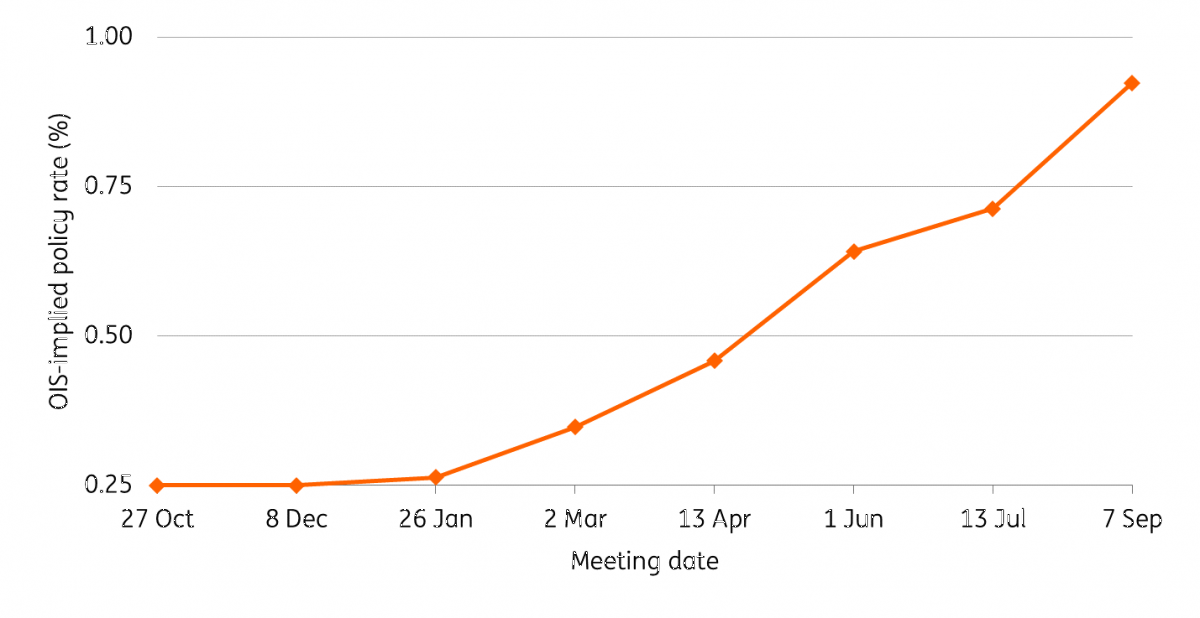

None of this is controversial with the debate now rapidly switching to the outlook for interest rate increases. This time last month futures contracts implied markets were looking for just one 25bp rate hike in 2022, but rising inflation fears have seen a shift to pricing three interest rate rises from the Bank of Canada next year.

Inflation is permeating throughout the economy with September CPI coming in at an 18-year high of 4.4% year-on-year, while the core trimmed measure is at a 30-year high. BoC Governor Tiff Macklem admitted last week that supply chain strains and production bottlenecks “are not easing as quickly as we expected”, which means that inflation is “probably going to take a little longer to come back down”.

There is a growing risk that these price pressures become entrenched with the recent Bank of Canada quarterly business outlook survey showing 45% of businesses expecting CPI to average more than 3% in two years’ time (above the 1-3% control range where 2% is the midpoint target) while household expectations are at 3% for the same time frame. Rising energy prices are likely to keep inflation expectations elevated.

While the economy continues to strengthen

Economic activity is looking in decent shape with the flash August monthly GDP reading showing MoM growth of 0.7%. The level of economic output is still around 2 percentage points below pre-pandemic levels, but we expect that to be fully recovered by the end of this year. The outlook for next year remains positive especially when we consider that the energy sector makes up around 10% of the Canadian economy and the surge in prices will stimulate more drilling.

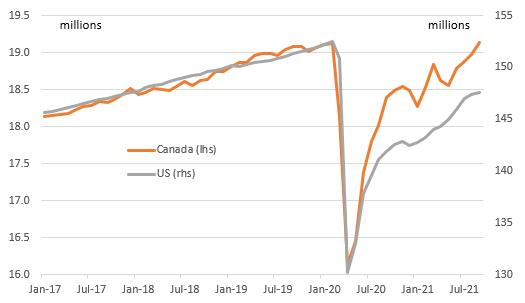

Significantly, employment is already at an all-time high with 900 more people in work in September 2021 than in February 2020 while business surveys suggest a strong appetite to continue hiring. Labour shortages are an increasing problem with 36% of companies experiencing them to such an extent that they are restricting their ability to meet demand with a net 64% of firms suggesting that labour shortages are intensifying – a record high. In an environment of vibrant demand this runs the risk that wage inflation builds and contributes to more prolonged price inflation in the economy.

Employment: Canadian jobs market has outperformed the US' with all jobs lost now recovered

Source: Macrobond, ING

Three rate hikes priced, but BoC may be reluctant to shift too far too quickly

For a long time, our house view had been that the Bank of Canada would raise interest rates twice in the second half of 2022. The guidance from the BoC itself states they will start hiking interest rates “economic slack is absorbed so that the 2 percent inflation target is sustainably achieved”, which on their forecasts is also the second half of 2022. The obvious risk is that this is achieved sooner and the BoC adjusts its language next week and we could conceivably start to see the prospect of an April move being priced in. However, we suspect that this more likely at the December meeting when they bring QE to a conclusion.

CAD: Not enough to drive a new rally

USD/CAD is finding some consolidation in the 1.23/1.24 area after a marked correction from the 1.27 level where it used to trade at the end of September. The move has been in line with the rally in other commodity currencies, which was exacerbated by the sharp rise in energy prices.

Domestic factors have also contributed, as the data flow has proven particularly supportive for the loonie, as a tighter jobs market and rising inflation kept strengthening the case for more Bank of Canada tapering. As discussed above, we expect the BoC to taper asset purchases again next week and in December, formally ending QE by the end of 2021. We think this is very much in the price, and we doubt CAD can receive any significant lift from the tapering announcement next week.

Any material FX impact from the BoC announcement will likely rely on the degree by which the BoC will address the current market expectations that see a first 25bp rate hike almost fully priced in for the April 2024 meeting (as shown in the chart below).

Markets now almost fully pricing in a BoC rate hike in April

Source: Refinitiv, ING

We suspect that the BoC may fall short of explicitly endorsing the current market pricing, but a generally upbeat tone on the economic outlook may, all the same, prevent a significant re-pricing of hawkish expectations.

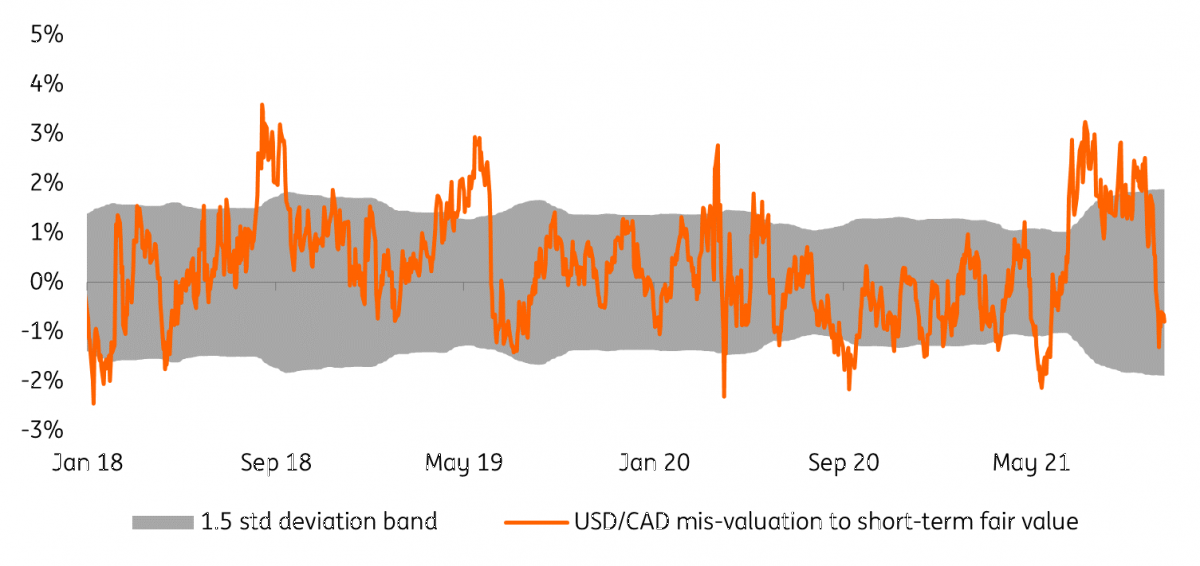

We expect the impact of the policy announcement to be broadly neutral on CAD as the BoC may try to avoid providing strong hints about the timing of tightening. More in general, we think the rally in CAD is starting to look a bit tired, as a lot of positives appeared to have already been in the price, in particular when it comes to the positive implications of rising energy prices. As shown in the chart below, our short-term fair value model is now showing that USD/CAD is around 1.5% undervalued. We, therefore, see a non-negligible risk of an upside correction in USD/CAD in the near term.

USD/CAD recently moved into undervalued territory

Source: NG, Refinitiv

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more