Bank Of Canada Plays The Waiting Game

A more upbeat assessment of the economy doesn't change the fact that there is a lot of spare capacity. Despite fiscal stimulus coming through, the vaccination program is slower than in the US, which implies a slower reopening process and more muted inflation pressures. Still, some tapering may be signaled at the April meeting.

Bank of Canada Governor Tiff Macklem takes questions from reporters on the phone as he participates in a news conference at the Bank of Canada

On hold, but hints of positivity

The Bank of Canada has left monetary policy unchanged, with the overnight rate kept at 0.25% and the quantitative easing program of “at least C$4bn per week” continuing for now.

The commentary surrounding the near-term story is a little more upbeat than in January with the economy “proving to be more resilient than anticipated to the second wave of the virus”. Consequently, the bank now expects a modest positive GDP number for 1Q rather than the contraction it had been penciling in back in January.

There is no talk of additional tapering (remember the BoC reduced asset purchases from C$5bn to C$4bn per week last October, but focused those remaining purchases at the longer end of the yield curve). Instead, the bank says that QE is set to continue “until the recovery is well underway”. The next meeting in April could pave the way for an additional move given that it will be accompanied by new forecasts.

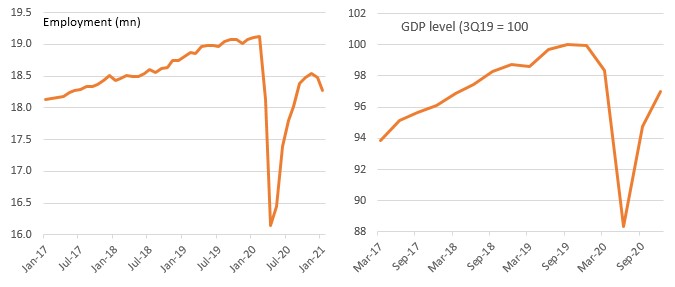

Nonetheless, the statement still warns of uncertainty and highlights the fact that there is “still considerable economic slack”. This can be seen in the charts below with employment having fallen in the past two months on the back of new containment measures and the level of GDP still three percentage points below its pre-pandemic peak.

Canada employment and GDP levels versus pre-pandemic

(Click on image to enlarge)

Sourcec: Macrobond, ING

2023 rate hike starting point looks on track

The BoC also warns that nothing can be taken for granted and while vaccinations against Covid are underway, potential new variants pose a threat with any additional restrictions on movement adding to the “choppiness” of the recovery.

Given this backdrop, the BoC continues to argue that while inflation is likely to spike in the next few months, it is unlikely that the 2% inflation target will be sustainably achieved any time soon. Based on the latest projections, this won’t happen until 2023, which is when the BoC will really start to consider raising interest rates.

As such, there is no change in the BoC's policy position and while there is a bit more encouragement on near-term data, the bank is taking nothing for granted. Moreover, with the vaccination program lagging behind that of the US – 5.2% of the Canadian population have received at least one dose of a Covid-19 vaccine versus 18.3% in the US – it will take longer for a full reopening of the Canadian economy. Consequently, while we think the Federal Reserve will end up tightening policy before the 2024 date it is currently signaling, we agree with the BoC’s assessment that 2023 is a likely starting point for Canadian interest rate increases.

CAD: More room to rise

The unchanged policy message by the BoC prompted a very contained reaction in the Canadian dollar. The loonie has been the best-performing currency of the G10 dollar bloc in 2021, which has likely been due to a combination of sharply rising oil prices and generally better resilience to setbacks in global risk sentiment.

As highlighted above, the Canadian vaccination program is not proving as successful as in other countries. Still, the US moving quickly on the vaccination side, US activity showing encouraging signs of recovery, and the Federal Reserve set to tolerate some over-heating in the economy all bode well for the US-dependent Canadian exporting sector. Accordingly, further improvements in US economic sentiment should put a floor under CAD in the coming months.

Looking at the monetary-policy factor, additional BoC tapering may be on the cards already for the 21 April meeting, when new forecasts will likely display a more upbeat view on the economic outlook and the bond market may be in a less fragile state. We may well see markets price in some BoC hawkishness in the run-up to the April meeting, and this should come to the benefit of CAD.

With the global recovery gathering pace, the USD possibly facing fresh pressure from 2Q (see the March edition of FX Talking for details on our USD views), and oil prices potentially finding a new floor, we maintain a bearish bias on USD/CAD, targeting 1.20 by year-end.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does ...

more