Bank Of Canada Dismisses The Bond Market's Message

In quick order, the Bank of Canada dismisses the signals coming from the world and Canadian bond markets. In its Monetary Policy Report (MPR) for July, the Bank argues that

“yields of Canadian and US 10-year government bonds have dropped below three-month Treasury-bill rates, leading to inverted yield curves. Inversions like these may occur more frequently now and be less indicative of recessions than they have been historically. They nonetheless reflect a concern about the prospects for growth. Some asset prices have experienced volatility related to trade developments and changing market views about monetary policy. However, indicators such as the excess bond premium, credit spreads and equity prices suggest that economic growth will continue in the near term”.

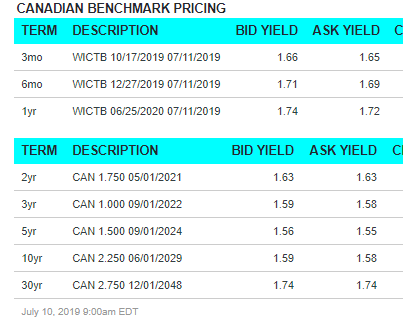

So, the Bank acknowledges that all interest rates along the yield curve in Canada are lower than its policy rate of 1.75%. That is, commercial banks pay more to borrow overnight than the Canadian government can borrow for a fixed period of 10 years. While it acknowledges that recessions have historically followed this yield curve inversion, somehow this time it is different. Why? No explanation is given.

(Click on image to enlarge)

What is even more bewildering in the Bank’s statement is the reference that “excess credit premiums, credit spreads, and equity prices suggest growth will continue”. When discounted for inflation, interest rates are negative--- the inflation rate in Canada is running just about 2% and the 10yr bond yields 1.6%. Again, how do negative real rates signify that growth is solid and will continue? In a good growth environment, there should be positive real rates and an upward sloping yield curve. This would indicate that capital investment is expanding, nominal incomes are rising and that the overall price level is at target or slightly beyond. Yet, the bond market sees none of these conditions unfolding over the next decade.

Furthermore, throughout the entire MPR, numerous references are made to the risks to global trade, weakness in growth in major economies (e.g. EU), commodity price declines and the ongoing U.S.trade wars with China and the EU. And, for a highly trade-dependent and commodity-dependent economy like Canada, we will be one of the major casualties as the economic heavyweights square off.

So, for the time being, the Bank of Canada is burying its head in the sand. The bond market is not having any part of this avoidance.