Bad News Piles Up For ECB As Deflation In Germany Hits Five Year High

As if Christine Lagarde didn't have her hands full with what appears to be an incipient revolt by the dwindling handful of Northern European hawks at the central bank, earlier today Germany delivered the worst possible news for the ECB when it revealed that its latest inflation rate fell even further below zero as a fresh wave of the coronavirus pandemic hit domestic demand, adding to the case for more monetary stimulus from the European Central Bank.

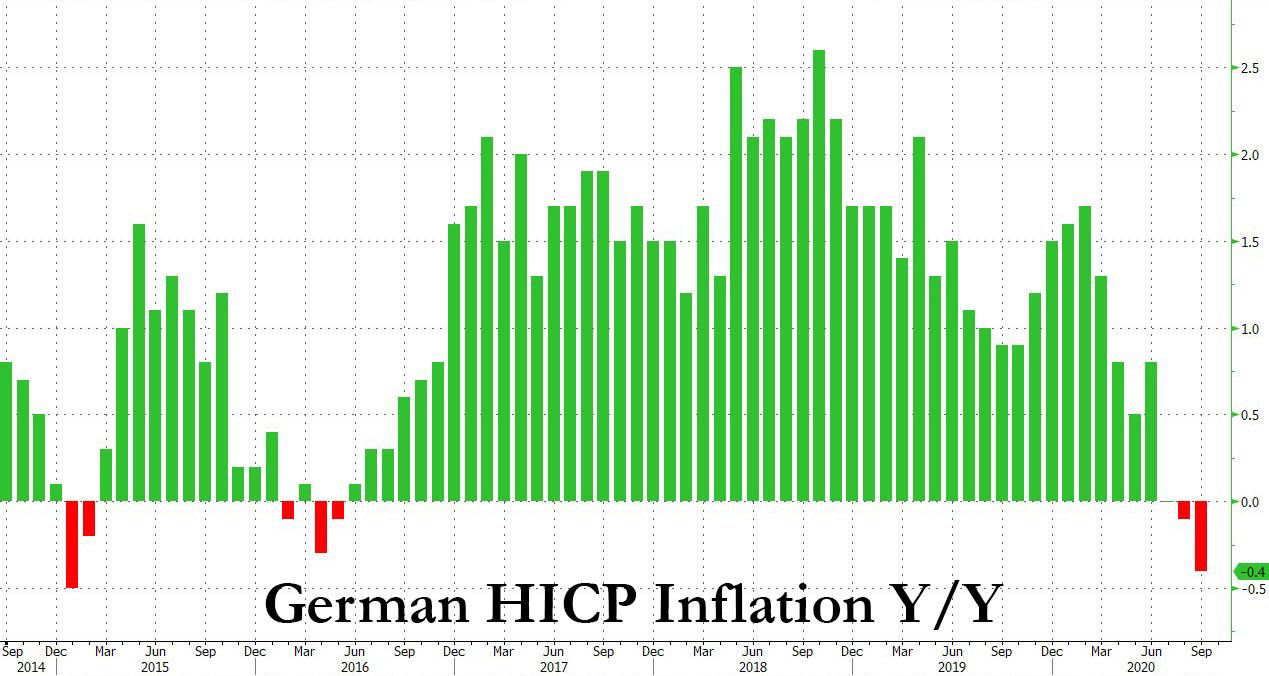

German consumer prices dropped 0.4% y/y in September, the biggest drop since the start of 2015. Europe’s largest economy is suffering a double blow from tepid consumption and a sales-tax cut the government introduced earlier this year to bolster the economy.

(Click on image to enlarge)

The drop, which was larger than all but one economist forecast polled by Bloomberg, followed a report showing consumer prices in Spain slid for a sixth straight month, and suggests broader euro area inflation may print below the -0.2% expected by economists. September data for the 19-nation bloc are due on Friday.

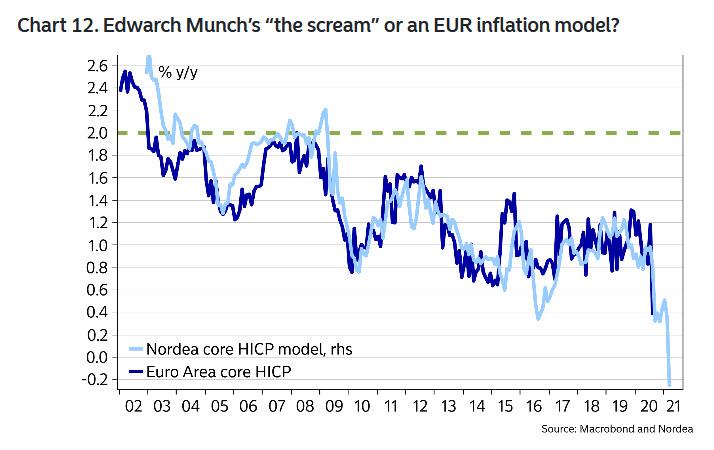

The dismal German inflation print validates Nordea's forecast for Thursday's euro area print: according to Andreas Steno Larsen, European HICP will see 0% core inflation and -0.5% in headline inflation "with the risk tilted to the downside."

(Click on image to enlarge)

As Nordea confirms "this is bad news for an already struggling ECB and clearly on the low side to the ECB’s own projections. If old patterns hold between wage growth and inflation, the ECB may be in for a rough ride during the beginning of 2021. It is possible to manage a truckload of debt but not in an outright deflationary environment."

While a fresh surge in deflation won’t surprise the ECB - Lagarde has flagged such declines for the coming months - some policymakers have started sounding the alarm. ECB Executive Board member Fabio Panetta an uber dove has argued that the risk of providing too much stimulus is smaller than being "too shy," and Bank of Spain Governor Pablo Hernandez de Cos said weak price pressures show there is “no room for complacency.”

Economists expect the ECB to boost its 1.35 trillion ($1.6 trillion) emergency bond-buying program later this year, most likely in December when new forecasts become available.

Meanwhile, according to the ECB’s own forecasts, inflation is unlikely to reach its target of just under 2% for the foreseeable future, with a stronger euro an additional burden.

As Bloomberg notes, Lagarde and many of her colleagues, including ECB chief economist Philip Lane, will speak during a conference on Wednesday.

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more