Australia’s Central Bank To Stand Pat, With A Possible Dovish Tilt

Having taken quite a hawkish position at the last meeting, we can't see rates being cut this month, but the Reserve Bank of Australia may well take a more dovish tone, which could remove the floor below the Australian dollar. The cash rate is still at risk of a reduction in the second quarter.

Source: Shutterstock

February was about stoicism

The RBA may have differed from our forecast view of a cash rate cut in February, but to be fair, Governor Philip Lowe and the rest of his rate-setting team have been some of the more considered and consistent central bankers in recent turbulent times.

Our arguments for a cut last time rested on a differing view than the consensus on the latest labor data, which despite headline strength, we felt was fairly disappointing overall. We also felt that the bushfires would take a fairly hefty chunk out of both fourth and first-quarter GDP and that the resulting shortfall of growth would likely merit some offsetting policy easing. In the likely absence of any meaningful boost from fiscal policy, this left the RBA to shoulder the burden. We were also perhaps taking a more serious view of the emerging coronavirus outbreak, given that we were sitting in the middle of it.

Clearly, Phillip Lowe saw it differently. On the bushfires, he was quite outspoken about this in the US, arguing that the Australian spirit was unlikely to be hit too hard and the average Australian would just "get on with it". Such stoicism is probably accurate, though we still think the GDP results will show a noticeable impact.

As far as the domestic labor data goes, well what goes up one month goes down the next. The mood has swung from positivity to disappointment, though again, we think the consensus has got the wrong end of the stick and taking the two months together, there isn't all that much going on.

How things have changed

Indeed, the main flavor of the minutes of the February meeting was one of optimism. There was talk of the phase one deal with the US on trade, and a general sense that the drags to growth in 2019 would, if not reverse in 2020, move to a more neutral setting.

Domestically, the newsflow had been somewhat mixed. The preceding labor report was generally regarded as being positive (which in our view was a controversial interpretation of some very mixed numbers) and inflation had done nothing to move closer to its target-range midpoint.

On this latter point, Lowe is clear that he sees the room for monetary policy as limited, and the discussion on the possibility for some further easing is very sensibly couched around concerns that it could do more harm than good - a lesson that seems to have eluded some Northern Hemisphere central bankers.

But things have very evidently moved on since early February. We still await confirmation of the economic damage caused by the bushfires, but in our view, although this may be confined to the first quarter, it will have been quite meaningful.

Of course, the biggest change has been in terms of the Covid-19 outbreak. Here, the news for Australia is not good.

Covid-19 cases low, exposure high

At only 23 cases at the time of writing, Australia is not raising too many eyebrows on the daily check for new covid-19 cases. That may provide a sense of calm. But even if the direct impact of the outbreak is limited (so far), the indirect impact could be very far-reaching.

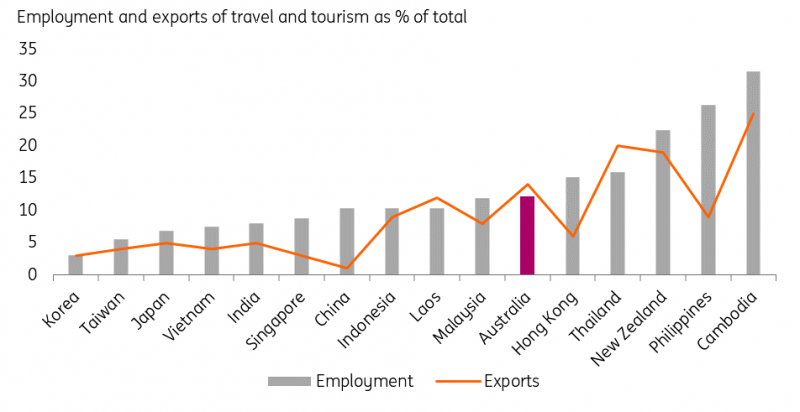

In our recent look at the tourism industry in the Asia-Pacific region, Australia was one of the more affected economies in terms of the importance of tourism revenue from China to the rest of the economy.

Moreover, it will still be some time before China's industrial sector is back to full strength, and in the meantime, demand for Australia's commodity output is likely to remain weak, and prices low.

On the services side, the impact of the outbreak on exports of education to Chinese and other Asian countries could also be significant.

In short, we think the worst is yet to come.

(Click on image to enlarge)

Source: Bloomberg, ING

Room for easing limited

Sensibly, the RBA is clear to note that cash rates may be nearing the point where further cuts begin to do more harm to domestic demand than good - a lesson that some of their Northern Hemisphere counterparts might want to think about a little more.

Lowe has also been very clear that there is a limit to how much of the gap between the current unemployment rate and one consistent with target inflation can be met with easier monetary policy.

That's why we don't think the RBA will cut rates this month. However, we do think that the discussion will have moved on, and will now take a more downbeat assessment of the first half of the year, raising the prospects of some easing next quarter.

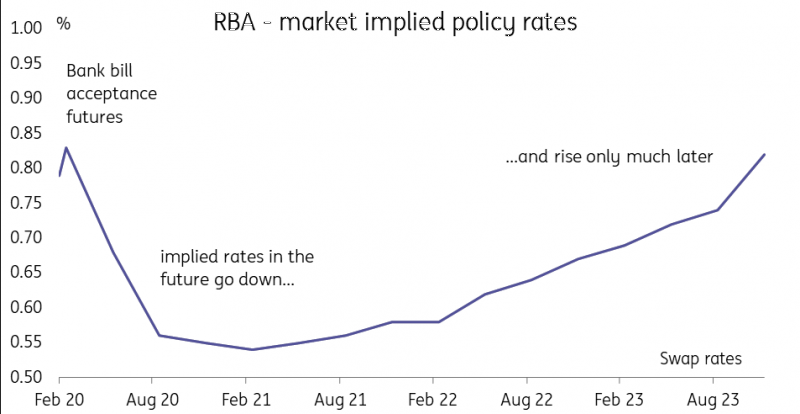

Bank bill futures in the last seven days have moved to price in an additional 11 basis points of easing by the end of the year. And though second-quarter pricing still seems a bit hesitant, with a rate cut more obvious only by September, this leaves room for some further shift in market sentiment if the next RBA meeting provides a more somber assessment for the economy.

(Click on image to enlarge)

Source: Bloomberg, ING

AUD: Not all negatives in the price

The Australian dollar has led losses within the G10 space over the past few days and AUD/USD has dropped by more than 4% in the spot market since the Covid-19 outbreak became public. While this may appear like a sizable loss for the currency, we think it has actually been relatively contained. A hawkish tone by the RBA in the February policy statement and broadly supportive data flow have likely curbed the currency's losses. The above-mentioned negative implications of the Covid-19 outbreak on the Australian economy and the additional downside risks stemming from the extended bushfire emergency would have probably warranted AUD/USD around the 0.64 area.

Looking ahead, how much the virus will eventually spread (or, has spread) among developed economies will determine the short-term fate for AUD, but looking at the other drivers, we note that the AUD may not find much additional support. As we have highlighted above, it will be difficult for the RBA to deliver another hawkish surprise in light of the Covid-19 outbreak, which has spread to such an extent that the number of cases outside of China now exceeds those inside the country. On the domestic side, the employment picture has remained quite mixed.

In general terms, we suspect there is a divergence between the number of downside risks to the Australian economic outlook and those embedded in the current RBA message. Governor Lowe may well retain his sanguine tone at this meeting, but the bar for a hawkish surprise seems high. We think the RBA is less likely to provide further support to the Aussie dollar and expect any AUD weakness to be mostly channeled through a lower AUD/NZD, where the monetary policy differential may be more evident (given a neutral RBNZ) than in AUD/USD (considering mounting expectations around Fed easing). We expect AUD/NZD to approach 1.03 in the coming weeks, also helped by a more aligned positioning - as highlighted in "FX Positioning: The big Kiwi short".

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more