Australian Employment Preview: Solid Jobs Report To Revive AUD/USD’s Bullish Momentum

The Australian labor market recovery is likely to strengthen in January, as the firms seem to have kept up the hiring pace amid additional monetary support provided by the Reserve Bank of Australia (RBA) to stimulate the economic recovery. The January employment report, due to be published by the Australian Bureau of Statistics (ABS), will drop in at 0030GMT on Thursday.

Australia’s economy has fared way better in handling the coronavirus crisis when compared to its Western peers, which is likely to reflect in the improvement in the employment data.

Image Source: Pixabay

A drop in the unemployment rate enough?

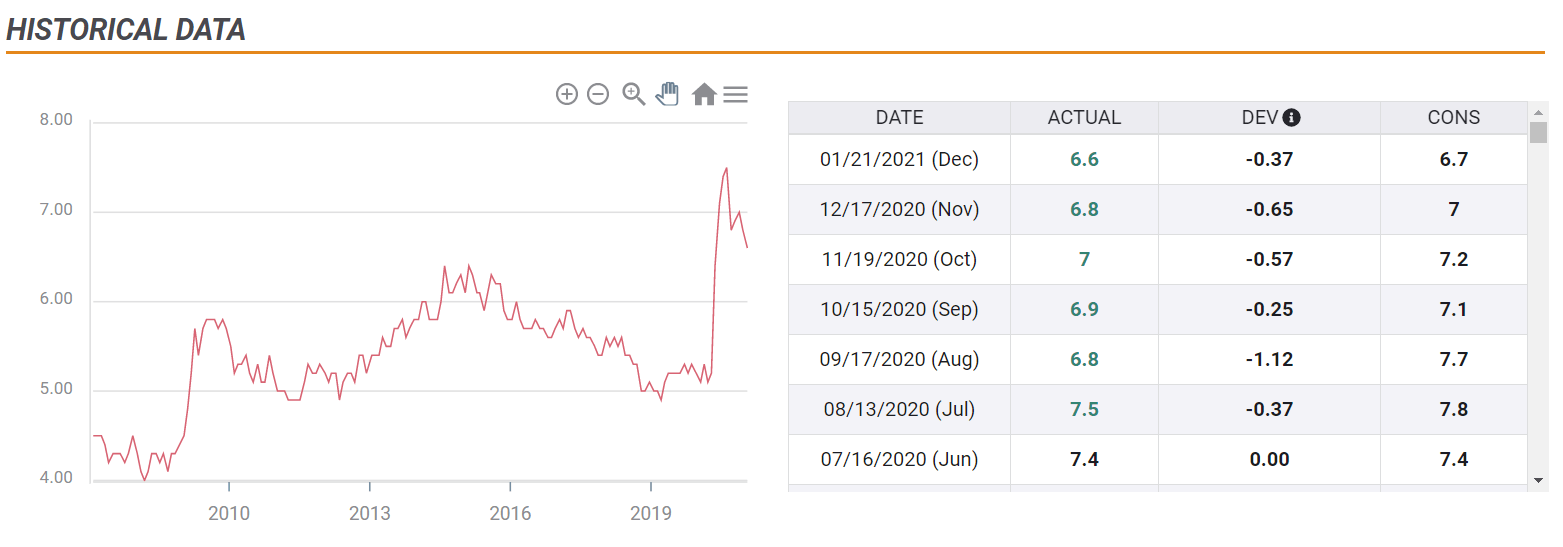

The OZ economy is seen creating 40K jobs in January after registering a job gain of 50K in December. The participation rate is expected to hold steady at 66.2% in the reported month despite the re-opening of the state of Victoria from coronavirus outbreak-led lockdown. The Unemployment Rate is expected to continue its declining trend, foreseen at 6.5% in the first month of 2021 vs. December’s 6.6%. The jobless rate could hit the lowest since April 2020.

(Click on image to enlarge)

RBA to remain dovish despite encouraging data

Australia’s payroll jobs have returned to near pre-pandemic levels, the latest data published by the ABS showed on Tuesday. The number of payroll jobs increased by 1.3% in the last fortnight of January.

Despite a likely improvement in the Australian labor market, unemployment is expected to take two to three years to return to pre-pandemic levels. Therefore, the Reserve Bank of Australia’s (RBA) is likely to maintain its dovish stance on the monetary policy until its inflation and unemployment targets are achieved.

The February RBA meeting’s minutes showed that the board members expect that “very significant” monetary support will be needed for some time.

“The bond purchase program had helped to lower interest rates and had contributed to a lower exchange rate than otherwise. Given this, it would be premature to consider withdrawing monetary stimulus,” the RBA minutes revealed Tuesday.=

With the country’s job keeper programme ending in March, easing of the lockdown restrictions and the rollout of the covid vaccine, the RBA reiterated that it would be too early to consider the stimulus withdrawal.

AUD/USD probable scenarios

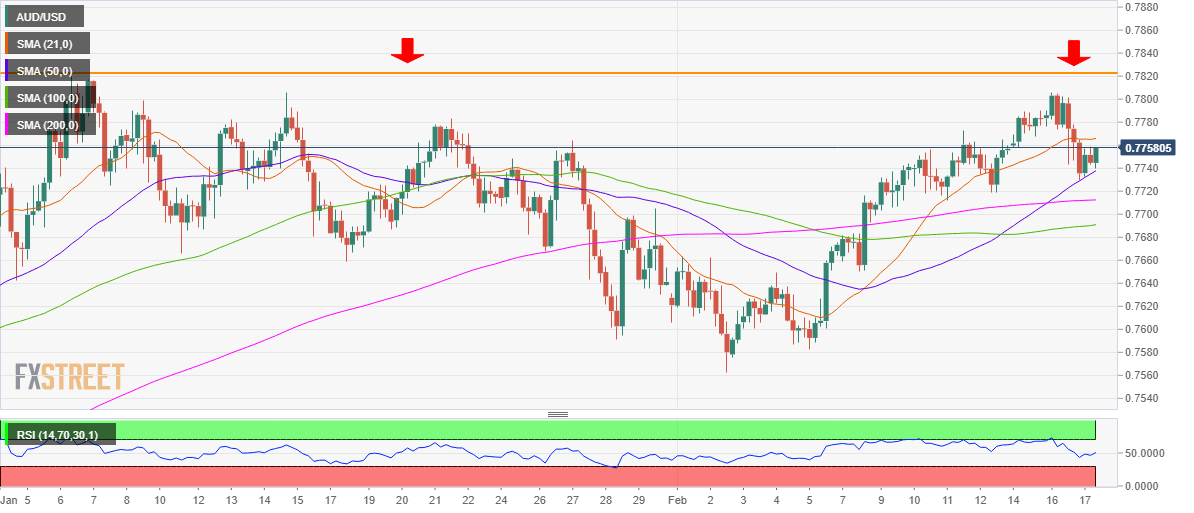

Ahead of Thursday’s employment report, AUD/USD has eased off the five-week highs, reached at 0.7806 on Tuesday. The surge in the US Treasury yields, amid the US stimulus and covid vaccine optimism-led reflation trade, dulls the attractiveness of the aussie as an alternative higher-yielding asset.

However, a bigger-than-expected drop in the Australian jobless rate could revive the bullish momentum in the aussie dollar, which could bring the 2021 tops at 0.7820 back in play. At the moment, AUD/USD holds above the bullish 50-Simple Moving Average (SMA) on the four-hour chart, placed at 0.7737. A downside surprise in the jobs data could trigger a sustained break below the latter, exposing the horizontal 200-SMA at 0.7712.

The aussie’s reaction to the data could also depend on the risk tone prevalent during the time of the release, as China returns from a week-long Lunar New Year holiday.

Four-hour chart

(Click on image to enlarge)

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more