Australian Economy Recovers Strongly

A decent bounceback led by household spending in 3Q20 will take pressure off the Reserve Bank of Australia (RBA) to deliver more monetary easing.

Full year 2020 growth will fall less than 3%

3Q20 GDP grew by 3.3% from the previous quarter, a bit stronger than the 2.5% "guesstimate" from forecasters (ING f 2.5%), though there was a fairly wide spread of estimates, and the consensus probably didn't contain much information.

Assuming that our 1.5% QoQ forecast for 4Q20 is on the mark, this should deliver a contraction for the full year of only 2.9% - an improvement on the 3.2% fall we had previously been pencilling in, and a robust performance when compared with other developed economies.

Together with ongoing improvements in the labour force (notwithstanding the small hiccup in the last unemployment rate release), this should also ease the Reserve Bank of Australia's plight. They have remained under some pressure to keep delivering more easing. Sure, there can be further tweaks to the yield curve control and quantitative easing programmes - a wider pool of assets can be considered than Australia's shallow government and state bond markets - but all sensible monetary tools have now already been deployed. Anything further is just finesse in our opinion.

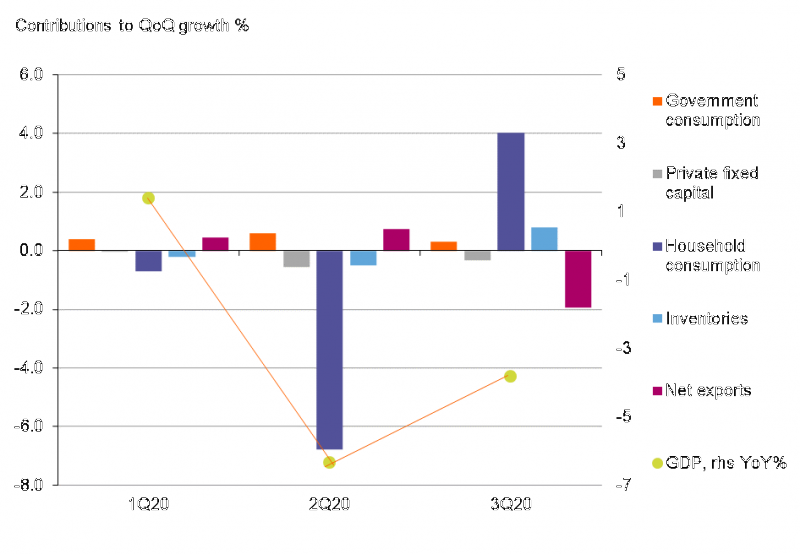

Contributions to QoQ GDP growth (pp)

Source: CEIC, ING

Household consumption in the driving seat

The breakdown of GDP by expenditure shows that households are the main force behind the recovery, with a 4 percentage point contribution to the 3.3% total - not a bad outcome when you consider that this period overlaps with lockdowns in the state of Victoria, so this could provide some further pent up demand in 4Q as these lockdowns ended in October.

Inventory rebuilding played its part in the upside surprise in these figures, contributing a further 0.8ppt, though we should probably not expect such a large contribution in 4Q.

Government spending doesn't appear to have done a lot, though with much of this aimed at supporting incomes of furloughed workers, most of the government's fiscal support is showing through the strength in household spending, so this isn't such a big surprise. Nor is it particularly surprising to see private fixed capital formation dragging slightly on the total, this will be one of the last components to pick up in our view.

Net exports prevented the headline from being larger, dragging on the total to the tune of 1.9ppt. Rising imports reflect the strength in consumer demand, and this will still be a feature of 4Q, though perhaps smaller. We would also hope to see some small improvement in the export side, which remains very soft, so a more modest household contribution in 4Q20 might be partially offset by less drag from the external sector.

AUD to keep appreciating

The Australian dollar (FXA) was initially stronger on the GDP release, rising as high as 0.7390 at one stage, but it has drifted lower again since then. We expect the AUD to make further gains over the coming year, with an end-2021 forecast for AUD/USD of 0.77.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more