Australian Dollar Outlook: AUD/USD Drops To Fresh Two-Month Low

AUD/USD PRICE OUTLOOK: AUSTRALIAN DOLLAR SUPPORT IN SIGHT, BUT AUSSIE SELLING PRESSURE COULD SUSTAIN AS MARKET VOLATILITY BUILDS

- AUD/USD oscillated on Thursday in a 56-pip trading range only to close slightly lower

- Australian Dollar bulls search for support as spot prices drop to fresh two-month lows

- The Aussie could fall further against its US Dollar peer amid rising market volatility

AUD/USD price action fluctuated with the ebb and flow of popular stock indices on Thursday. The sentiment-linked major currency pair dropped to fresh two-month lows early on as risk aversion ramped headed into the New York opening bell, but as trading progressed, critical technical levels held and market sentiment subsequently improved.

AUD/USD PRICE CHART: DAILY TIME FRAME (29 APR TO 24 SEP 2020)

This facilitated a pullback in the safe-haven US Dollar and a rebound by spot AUD/USD off the 0.7020-price level. The Australian Dollar clawed back most of its losses to close nearly flat on the day after bouncing off this area of technical support, which is also underpinned by the 38.2% Fibonacci retracement of the May to August bullish leg.

AUD/USD PRICE CHART: WEEKLY TIME FRAME (JUL 2018 TO SEP 2020)

Recent AUD/USD selling pressure might start to subside here with the 0.7000-handle close by as Australian Dollar bulls attempt to stand their ground around this confluent zone. We previously highlighted this support level as a potential downside target following a breakdown of the 0.7200-price level earlier this week.

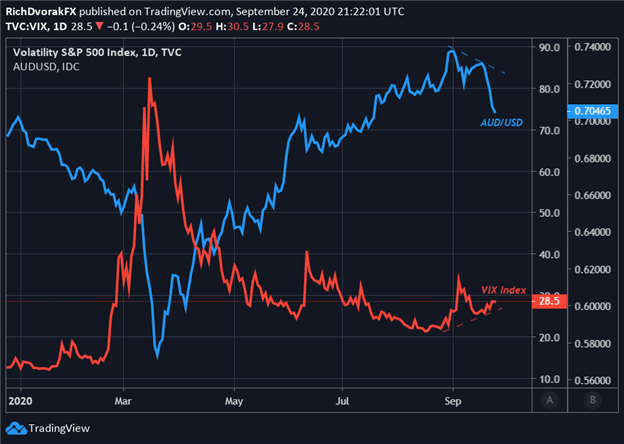

AUD/USD PRICE CHART WITH VIX INDEX OVERLAID: DAILY TIME FRAME (DEC 2019 TO SEP 2020)

Chart created by @RichDvorakFX with TradingView

Potential for an Aussie relief bounce could grow more likely if Thursday’s recovery in risk appetite continues into Friday’s trading session. This brings to mention month-end and quarter-end rebalancing flows right around the corner, which could unwind some of the recent selling across risk assets. That said, the pro-risk Australian Dollar could resume its slide if the S&P 500 VIX Index, or fear-gauge, keeps snapping higher amid resurgent volatility and deteriorating market sentiment.

AUD/USDBEARISHData provided by IG

| CHANGE IN | LONGS | SHORTS | OI |

| DAILY | 5% | -6% | -1% |

| WEEKLY | 24% | -25% | -5% |

Disclosure: See the full disclosure for DailyFX here.