Australian Dollar May Wobble If Chinese And Tech Stocks Keep Sinking

The sentiment-linked Australian Dollar spent most of this past week trading lower as a decline in relatively stretched equity markets fueled a ‘risk-off’ trading dynamic. On Wall Street, the Dow Jones and S&P 500 still rose for the week. But, the tech-heavy Nasdaq Composite fell about 2.4%. Meanwhile, the 10-year Treasury rate fell after 7 weeks of consecutive gains amid solid demand for bonds at multiple government auctions.

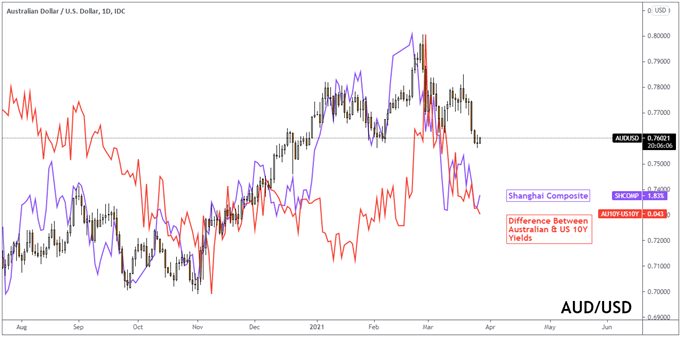

Meanwhile, the haven-linked US Dollar has been capitalizing on some risk aversion as demand for safety saw investors chase Treasuries. But, this was also seen around the world. In fact, comparing the 10-year rate spread between the United States and Australia, the latter has been underperforming the former – see chart below. As such, it is not too surprising to see the Aussie pullback broadly against its major counterparts.

While US equities have been under pressure in recent weeks, the Aussie seems to be paying more attention to what’s going on in China. The Shanghai Composite flirted with correction territory this past week. China’s central bank, the PBOC, has been slowly tapering policy this year amid a rebounding economy. This is as the government has been trying to address what it thinks is a market bubble.

China is Australia’s largest trading partner, so economic developments in the former can often make their way into the latter. So if the world’s second-largest economy is slowly trying to put the brakes on its economy to prevent inflation from taking off, then that too can domino outward. Ahead, AUD will be eying Australian private sector credit, trade, and retail sales data – check out the DailyFX Economy Calendar for their updates.

While the RBA has expressed concern about rising longer-term bond yields and has stepped up on yield curve control recently, Treasury yields could still climb in the United States. The Fed has remained fairly sanguine about them. This is as the central bank is anticipated to not extend the emergency supplementary leverage ratio ahead, likely opening the door to less Treasury buying from banks which may push up yields.

Still, persistently soft core inflation in the United States could offer some life for the Australian Dollar. Last week, the Fed’s preferred measure of inflation, the PCE core deflator, clocked in at 1.4% y/y versus 1.5% anticipated. That may tame a rise in longer-term Treasury yields. But, a relatively solid non-farm payrolls report could risk boosting bond rates next as well.

AUD/USD VERSUS SHANGHAI COMPOSITE & AUSTRALIAN/US 10Y YIELD SPREAD – DAILY CHART

Disclosure: See the full disclosure for DailyFX here.