AUD/USD Weekly Forecast: Long-Term Bears To Prevail Under 0.7400

Image Source: Unsplash

- The AUD/USD pair managed to post gains on Friday as the US dollar showed weakness.

- The Aussie failed to find traction.

- Australia’s CPI fell below expectations, which weighed on the pair.

The weekly forecast for the AUD/USD pair is mildly bearish as there is no fundamental backdrop that supports the Aussie at the moment. For the third week in a row, the AUD/USD pair traded virtually unchanged, around 0.7370, consolidating July losses. Over the past month, the pair has been in a narrow range between the annual lows of 0.7288 and 0.7426, and attempts to break the 0.7400 level quickly stopped.

As Wall Street continues to hit record highs, the Australian dollar has failed to attract investors. Traders do not seem to be worried about the Federal Reserve’s ultra-weak monetary policy.

Obviously, they have an excellent reason for this. The Senate passed a trillion-dollar bipartisan infrastructure bill this week after months of deliberation. Furthermore, Congress prepared the basis for the adoption of a $ 3.5 trillion democratic budget. As a result, AUD/USD is not in danger of collapsing due to new inflows to US markets.

Australians, however, have little to celebrate. A large part of this is the government’s overconfidence in closing the borders last year, which has caused the economy to lag behind major competitors. It was already too late for the authorities to join the vaccine train when they realized that this measure could not last forever. A global lockdown has resumed, and macroeconomic data continues to reflect a weak economy. Nevertheless, the hopes of the country are still alive as it catches up. Approximately 20% of Australia’s population is fully vaccinated at this point.

As a result of the US’s July inflation report, expectations for a tightening temporarily waned. Based on the CPI, the base price shrank to 4.3% year-over-year, as expected. During the same period, IMF data reported an unexpected increase in producer prices of 7.8%.

Preliminary estimates indicate that the dollar declined on Friday following a drop in the consumer sentiment index in Michigan to a nearly 10-year low of 70.2. In the last quarter of the year, the Federal Reserve is expected to begin cutting back on lending.

Data reports from Australia were extremely disappointing as the NAB business confidence index fell from 11 to -8 in July, and Westpac’s consumer confidence index increased from 1.5% to -4.4% in August. Finally, consumer inflation expectations fell to 3.3% in August, while new home sales fell 20.5% mom in July, according to the HIA.

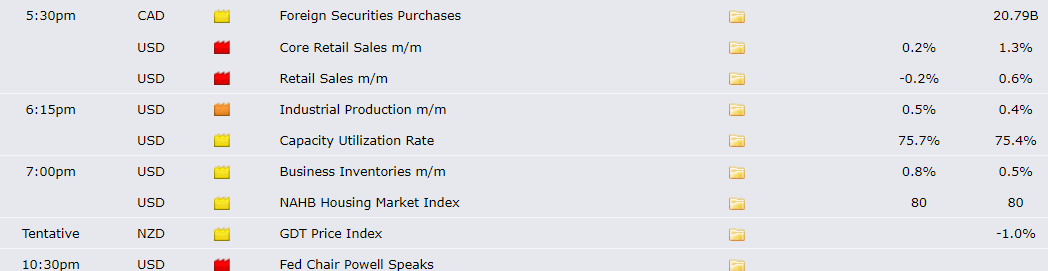

United States' Key Events During the Week of Aug. 16-20

Next week, there will be some great macro events. Retail sales in the US are set to decline by 0.2% month-over-month on Tuesday. In addition, the minutes of the Federal Reserve's most recent meeting will be released on Wednesday.

Australia’s Key Events During the Week of Aug. 16-20

Australia’s Reserve Bank will release its most recent meeting minutes, along with the country’s second-quarter wage index and employment data for July. In one month, the economy is expected to lose 45,000 jobs.

![]()

![]()

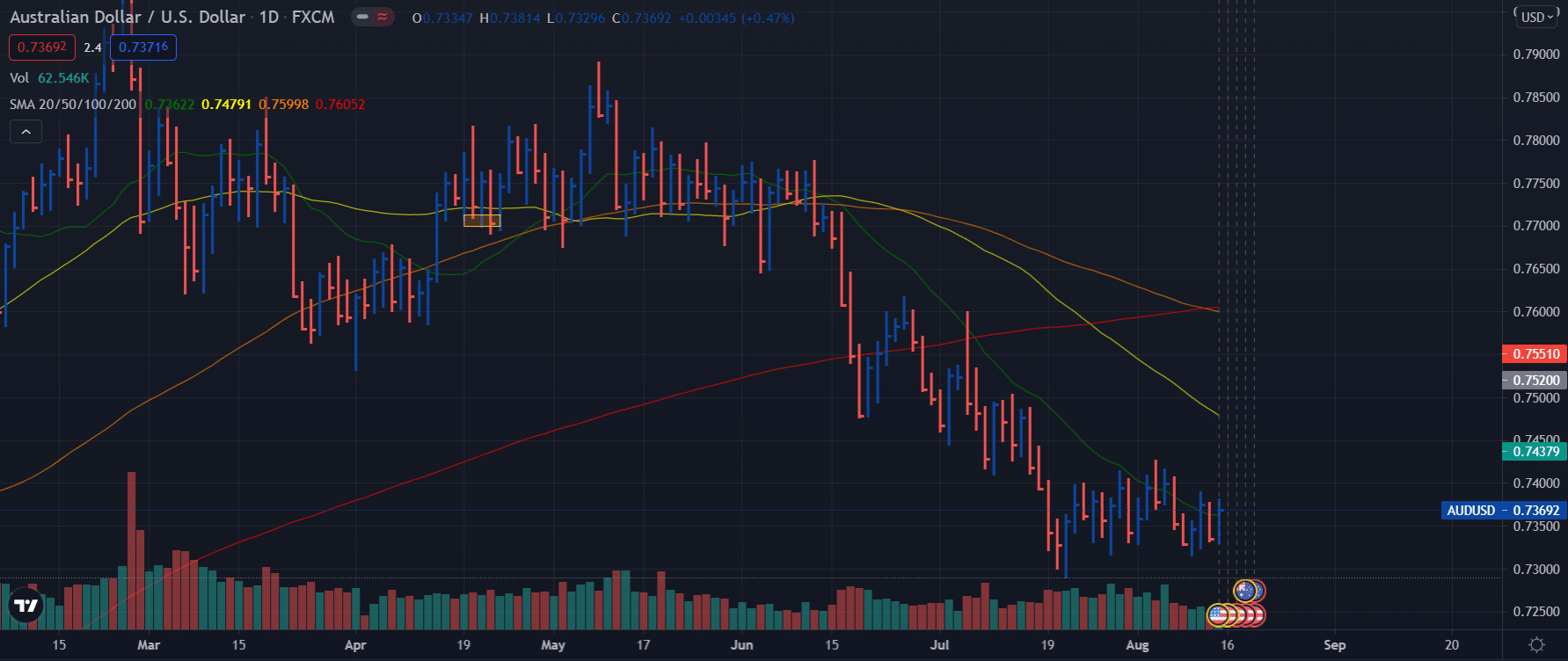

AUD/USD Weekly Forecast – Daily Chart

AUD/USD Weekly Technical Forecast: Bearish Cloud Still Hovering

The AUD/USD pair has been consolidating for several days within a short price range. The pair managed to close above the 20-day SMA on Friday. However, the death crossover of 200-day and 50-day SMAs continues to pressure the price fall.

The 100-day SMA is also pointing downwards and may act as a strong resistance. Despite the broad dollar weakness, we can see the resumption of a downtrend in the Aussie as the pair has no follow-through momentum to continue the bullish movement.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

moreComments

No Thumbs up yet!

No Thumbs up yet!