AUD/USD Weekly Forecast: Dismal NFP Led To 0.7450, RBA Ahead

Image Source: Unsplash

- The AUD/USD pair remains bullish after dismal US NFP figures and greenback weakness.

- Australian data, including company profit and manufacturing PMI, beat expectations.

- The RBA’s stance next week is expected to stay cautious amid the spread of the Delta variant.

The AUD/USD weekly forecast is bullish amid broader weakness in the US dollar and strong Australian fundamentals. On Friday, the AUD/USD pair traded at 0.7477, the highest level since mid-July, and rallied for the second week in a row. As investors sold the dollar amid a slow recovery in employment, the pair benefited from dollar weakness.

US NFP

US nonfarm payrolls for August were mixed, but the overall numbers were disappointing considering the country created only 235,000 new jobs in a month despite the expected 750,000 number. While unemployment fell to 5.2%, employment remained unchanged at 61.7%. It was speculated that the US Federal Reserve would be forced to support ultra-weak monetary policy with the US dollar for a longer period because of the unfavorable numbers.

Better Australian Fundamentals

Meanwhile, Australia’s recent economic data was more optimistic than expected. A 7.1% increase in gross operating profit was reported in the company’s second-quarter, and the company’s GDP was 0.7%, higher than the expected 0.5%.

There was 12,117 million in trade surplus in July, while the manufacturing PMI for August stood at 52. In contrast, the AIG index was well below the previous 60.8 at 51.6, while the Commonwealth Services PMI fell to 42.9 due to recent restrictions in the country.

Key Data Releases from Australia during the Week of Sept. 6-10

![]()

Investors are mostly anticipating a cautious stance from the Reserve Bank of Australia on Sept. 7. Due to the ongoing coronavirus outbreak, the RBA is certain to maintain its massive fiscal stimulus program.

Key Events from the US during the Week of Sept. 6-10

![]()

![]()

![]()

The important events next week include the JOLTS job opening due on Wednesday ahead of Fed William’s speech in the US. Moreover, weekly unemployment claims are also important to note. Other than that, US PPI month-over-month data may also trigger volatility on Friday. The figure is expected to slide to 0.6% against the previous month’s reading at 1.0%.

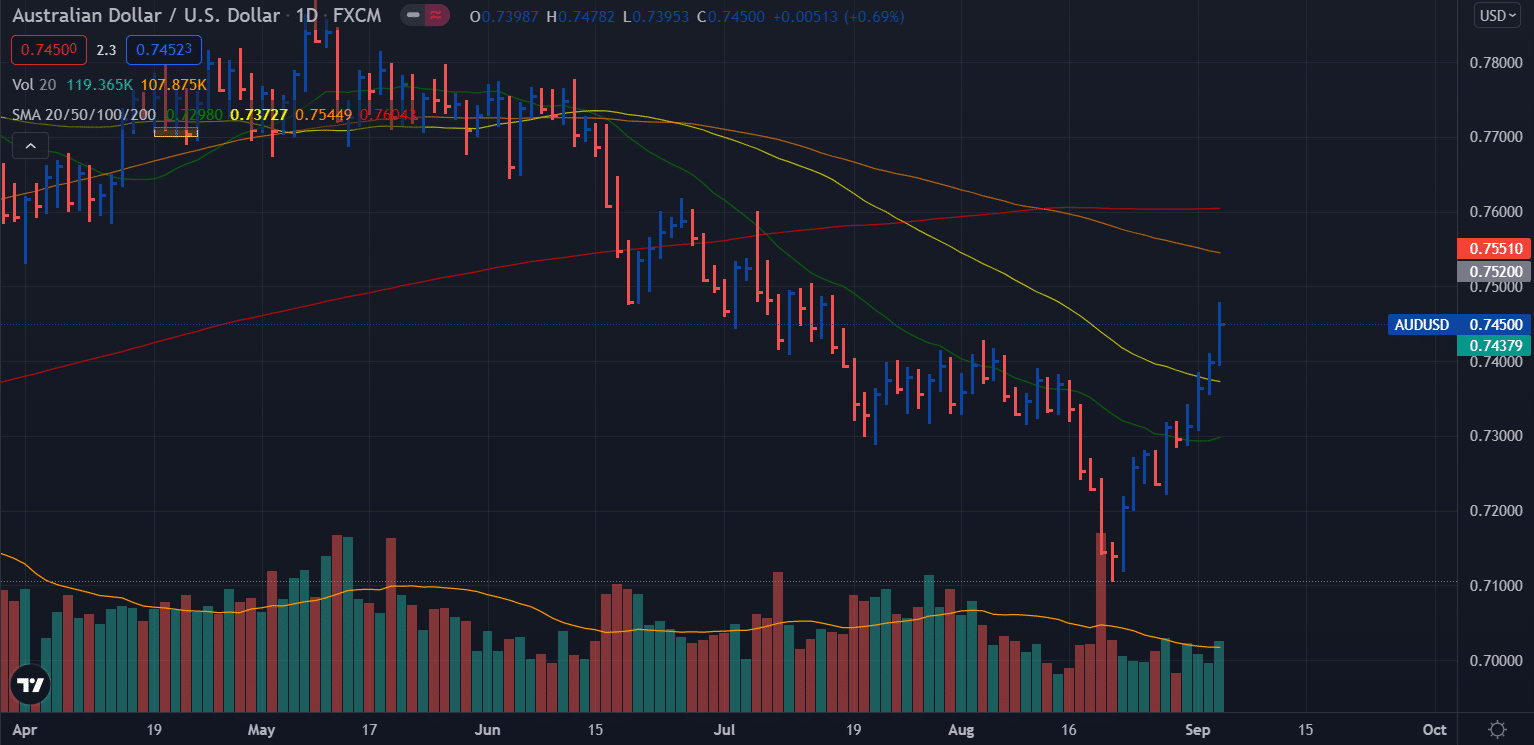

AUD/USD Weekly Forecast – Daily Chart

AUD/USD Weekly Technical Forecast: Aiming for 100/200 DMAs

The AUD/USD pair managed to break above the 20-day and 50-day moving averages, while the next upside targets could be 100-day and 200-day moving averages around 0.7545-0.7600 zone. The volume, however, is showing a decline while Friday’s bar closed off the highs. Thus, it is very likely for the pair to correct the downside in the coming week. The downside movement may find support at 0.7400 ahead of the 9.7370 level (50-day moving averages).

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more