Asia Week Ahead: Singapore Unveils Budget For FY19

The outcome of the ongoing US-China trade negotiations will set the tone for Asian markets next week. Singapore’s proactive macro policies give authorities some wiggle room to cushion the economy from the trade-related global slowdown. Indonesia's central bank meets next week too but despite the raised hopes of a policy cut, we think it'll stay on hold.

Source: Shutterstock

Singapore: Embarrassment of riches

Next week in Asia kicks off with Singapore’s trade data for January on Monday, followed by the budget statement by the country’s finance minister later that day. An outsized slump in non-oil domestic exports (NODX) in December suggests some retracement of that is in order while the likely front-loading of shipments ahead of the Lunar New Year holiday should have helped the bounce. However, with semiconductors remaining a weak spot – taking a cue from the large fall in Korea’s chip exports in January – our baseline remains a persistent weak NODX trend.

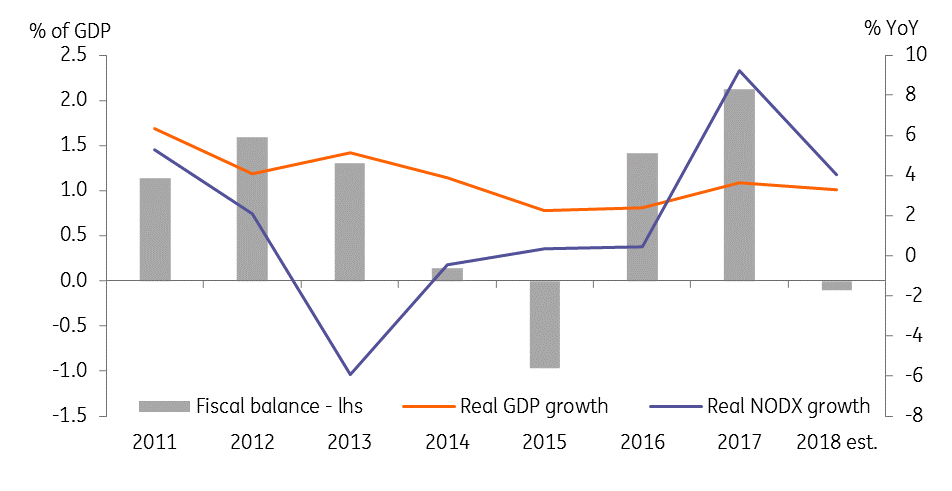

Undoubtedly, the FY19 budget will focus on supporting the economy from the adverse impact of the widely-anticipated slowdown in global demand this year. The public finances have surpassed the government’s expectations in recent years. With decent 3.3% GDP growth and better revenue performance so far, the budget is likely to produce a surplus contrary to the initial forecast of a fiscal deficit in 2018, and this leaves scope for more growth supportive fiscal policy in 2019.

Among the popular budget measures in 2019, there are more incentives for the workforce to improve their skill set, more help for low-income households, increase in provision for healthcare for the elderly, possibly a sugar tax, and greater support for small-and-medium enterprises towards digital transformation.

Singapore: Wide fiscal surplus allows for growth-friendly budget

Source: CEIC, ING

Indonesia: Central bank to leave policy on hold

Indonesia's central bank meets next Thursday (21 February), and we expect no change to the policy rate of 6.0%. A total of 175 basis points rate hikes over June-November 2018 was aimed at curbing the depreciation pressure on the rupiah. Although the Indonesian rupiah has been an Asian outperformer so far in 2019, the depreciation risk from widening current account deficit prevails and could be further intensified by political uncertainty surrounding the elections in April.

The year-to-date rupiah performance combined with well-behaved inflation has raised hopes of policy rate cuts. However, the deputy governor Dody Waluyo recently thrashed such hopes, noting still ‘cautious’ policy preference to financial stability over growth. We aren’t ruling out further rate hikes this year. But for now, we think BI policy will take a backstage until the political uncertainty is lifted.

Thailand: 4Q18 report card arrives

Thailand’s GDP data for the final quarter of 2018 is due on Monday. Underlying our view of a pick-up in growth to 3.5% year-on-year from 3.3% in 3Q18 is improved manufacturing growth even as exports continued to weaken. It’s still not an exceptional starting point for the government looking for 4% GDP growth in 2019.

Besides global factors depressing exports, political uncertainty is likely to overshadow the economy this year. We expect annual GDP growth to slide to 3.8% in 2019 from an estimated 4.1% in 2018. We don’t think this will be a sufficient reason for the Bank of Thailand to reverse December’s 25bp rate hike, while persistently large current account surplus supports the baht's outperformance.

Asia Economic Calendar

Source: ING, Bloomberg, *GMT

Disclaimer: The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial ...

more