Asia Week Ahead: Riding The Wave Of Easing

Heavy central bank calendar

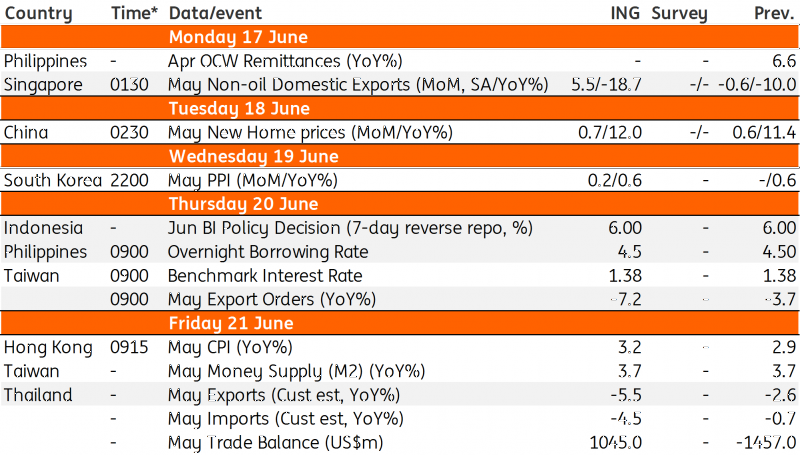

Four Asian central banks – Japan, Taiwan, Indonesia, and the Philippines meet next week alongside their counterparts in the UK and the US – all announcing their policy decisions on Thursday (20 June). While we expect all these meetings to be largely non-events, Bank Indonesia and Philippines central bank meetings could be of some interest.

A surprise inflation spike in Indonesia and the Philippines in May has dashed hopes of rate cuts by their respective central banks. We view high inflation as an aberration from the low inflation trend these economies have been enjoying this year. The Philippines central bank started easing policy in May while Indonesia's central bank isn't quite there yet, but it’s probably just looking for the right timing.

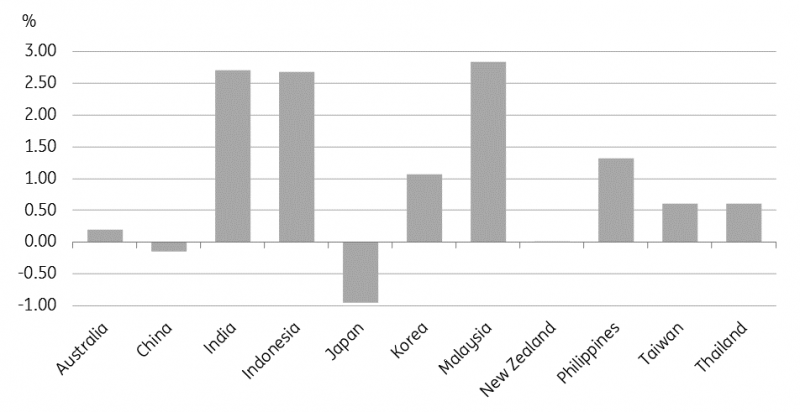

The policy dilemma of these central banks comes from their high real interest rates among Asian economies. Even though high real interest rates provide scope for easing, which is the need of the day with the prevalent growth concerns stemming from the trade war, but rate cuts weigh down on currencies impaired by high trade deficits.

With increased odds of the Fed easing, we don’t think Asian central banks will resist easing pressure for too long, while subdued inflation provides room to support growth with lower interest rates. We now see most Asian central banks riding a wave of easing by the next quarter.

Real interest rates

(Click on image to enlarge)

Source: Bloomberg, CEIC, ING

Central bank policy interest rate minus the latest inflation rate.

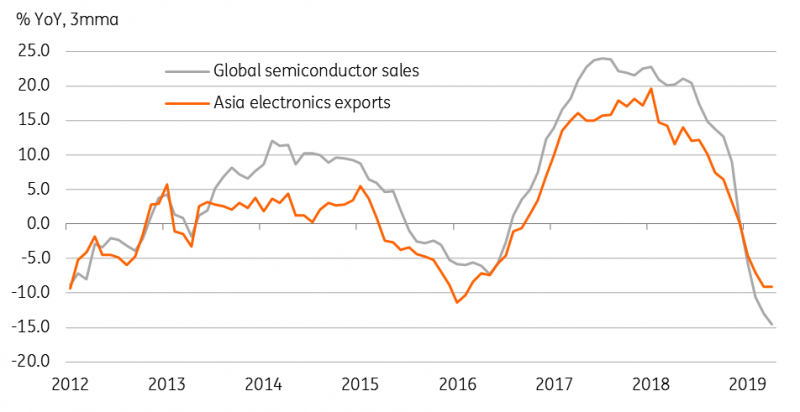

And lots of trade figures

Lots of May trade data from Japan, Taiwan, Singapore, and Thailand will be interesting for what it says about the trade war. It’s no longer just a trade war, but also a technology war aggravating the ongoing slump in the global tech sector. With Asia's heavy reliance on electronics exports, we see nothing in the forthcoming releases calming the nerves of regional exporters and markets.

We anticipate accelerated export weakness in most reporting economies next week. Of most interest will be Singapore’s non-oil domestic export growth - an economy at the forefront of the tech downturn. The forecast by our in-house Singapore watcher, Rob Carnell, of about 19% year-on-year NODX contraction is the worst reading in over six years. But he isn’t alone; the consensus estimate (as of this writing) is -20.4%. If this is correct, the data will push the Monetary Authority of Singapore towards easing in October.

Asia following the global tech downturn

(Click on image to enlarge)

Source: Bloomberg, CEIC, ING

Asia Economic Calendar

(Click on image to enlarge)

Source: ING, Bloomberg, *GMT

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more