Thursday, March 25, 2021 6:48 PM EDT

The usual end- and start-of-the-month activity releases pack the Asian economic calendar in a holiday-shortened week.

Soft data – Purchasing Manager Indices

The typical focus around this time of the month is the manufacturing and service sector PMIs. Released earlier this week, the advance PMIs for March from developed economies (the US, eurozone and Japan) revealed firmer activity in both manufacturing and non-manufacturing areas. We hope to see the same in Asian PMIs next week.

China’s PMIs are the usual standouts and are expected to follow their developed market counterparts higher. If you want a sense of how these could go -- industrial profits data for February due over the weekend (27 March) should be a good guide. As for most other February indicators, the low base effect likely swelled profit growth.

Among other soft indicators coming our way, are Japan’s quarterly Tankan Survey for 1Q21 and Korea’s Business Survey Indices for April, both expected to show some pick-up over the previous periods.

Hard data - Exports and manufacturing

Markets will also be swamped with hard activity releases on trade and manufacturing, which come as guides to the post-Covid recovery.

Korea’s exports for March, the first export data for this month from the region, will be an interesting insight into the semiconductor cycle as the global chip shortage continues to make financial headlines. A 14% year-on-year rise in Korean chip exports in the first 20 days of the month was good news that the full-month data should testify to. Meanwhile, Korean industrial production for February is likely to show some retracement of growth, though that’s clearly a distortion from the Lunar New Year holiday rather than underlying weakness.

Japan and Thailand are other countries reporting industrial production and Malaysia is going to release its trade data -- all for February, We see nothing particularly exciting in these.

Lastly, Korea and Indonesia's consumer price data may be something worth watching as inflation worries are mounting elsewhere. We don't think a sharp rise in inflation will be a cause for concern at the Bank of Korea just yet, while Bank Indonesia remains relaxed on this front.

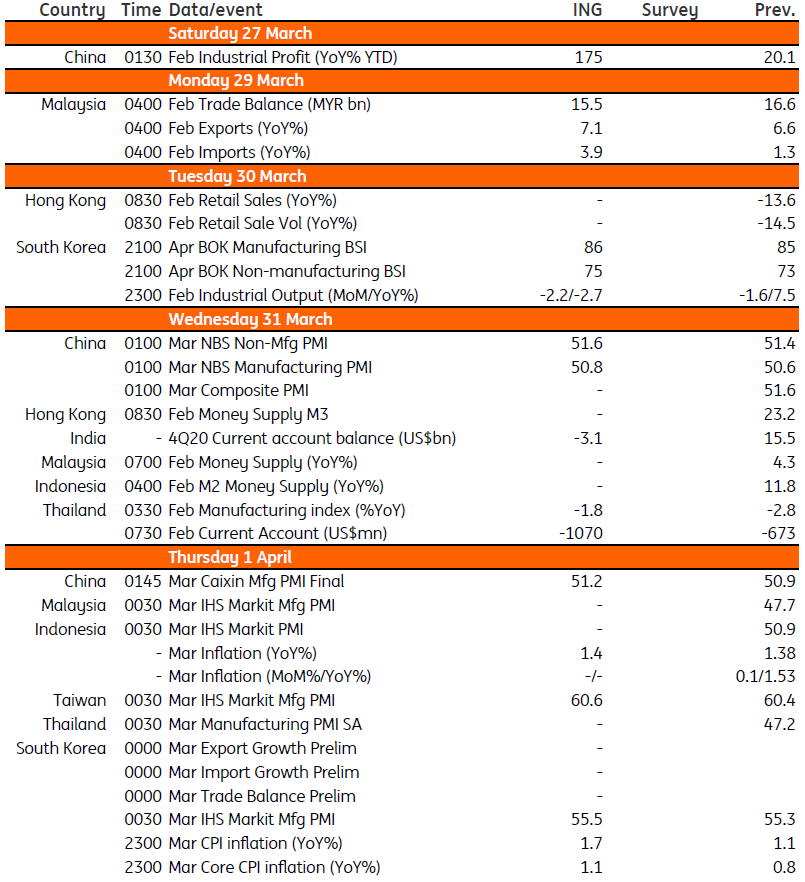

Key events in Asia

(Click on image to enlarge)

Source: Refinitiv, ING

Disclosure: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more

Disclosure: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. ING forms part of ING Group (being for this purpose ING Group NV and its subsidiary and affiliated companies). The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved. ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam). In the United Kingdom this information is approved and/or communicated by ING Bank N.V., London Branch. ING Bank N.V., London Branch is deemed authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.. ING Bank N.V., London branch is registered in England (Registration number BR000341) at 8-10 Moorgate, London EC2 6DA. For US Investors: Any person wishing to discuss this report or effect transactions in any security discussed herein should contact ING Financial Markets LLC, which is a member of the NYSE, FINRA and SIPC and part of ING, and which has accepted responsibility for the distribution of this report in the United States under applicable requirements.

less

How did you like this article? Let us know so we can better customize your reading experience.