Asia Week Ahead: China And Japan Data Dominate

The activity data from around the region, a lot of it from China and Japan, will be parsed for GDP growth prospects in the fourth quarter. Unfortunately, the downside risk has grown with accelerating Covid-19 infections.

Source: Shutterstock

China data dump

Released earlier this week, China’s Purchasing Manager Indices for November painted a rosy picture of the economy, driven by a broad-based recovery in both the manufacturing and services sectors. We will know next week whether the hard data validates this view.

The key Chinese data on the calendar are trade on Monday, followed by inflation at mid-week and monetary indicators towards the end of the week. The strong recovery in Chinese exports experienced over recent months is at risk of tapering as resurgent Covid-19 infections force some of its main trading partners into lockdown again. But domestic demand continues to recover, supporting expectations of firmer imports and new bank lending growth. All this without stoking any inflation.

Japan data dump

The Japanese releases include a revised third-quarter GDP estimate. The second GDP estimate typically doesn’t differ much from the first (+5.0% QoQ in 3Q) so the markets will likely pay more attention to indicators on growth in the current quarter. There are plenty of these due next week, including October labor earnings, household spending, machinery orders, and the current account.

However, the downside growth risk has probably intensified with accelerating Covid-19 caseloads, both locally and globally.

And the rest

Taiwan’s November trade figures may provide more insight into the electronics cycle. Released earlier this month, the more than 16% year-on-year surge in Korea's semiconductor exports in November bodes well here. Electronics are also a dominant part of the Philippines' exports and October figures will be out next week. Philippine exports have been the weakest in Asia this year with about a -14% YoY fall in the first nine months of the year, a trend which is likely to continue for the rest of the year. Our house forecast for October is -8%.

India and Malaysia’s industrial production releases for October come as early indicators of GDP growth of these economies in the final quarter of 2020. We see IP growth swinging back into negative territory in both, following on from renewed export weakness there.

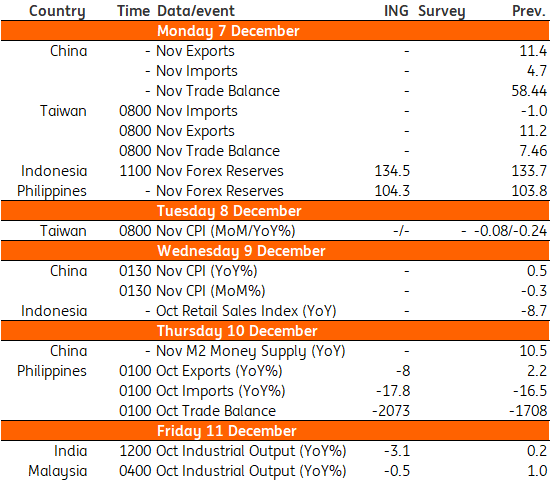

Asia Economic Calendar

Source: ING, Refinitiv, *GMT

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more