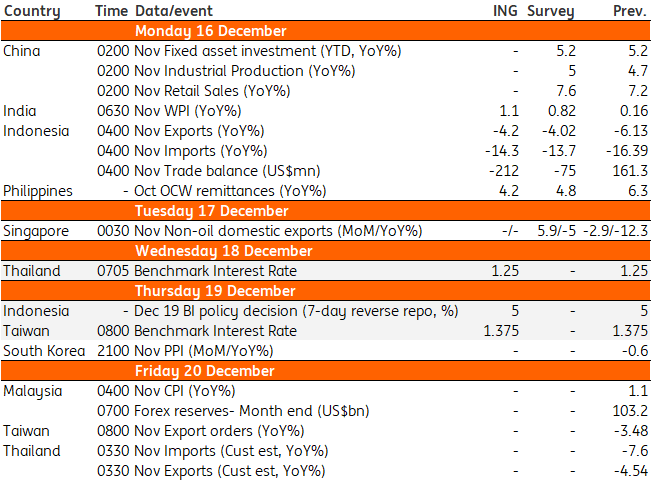

Asia Week Ahead: Central Banks Getting Busy Again… For Nothing

Central banks in Japan, Taiwan, and Thailand meet next week but rest assured there won't be much action if any at all.

Source: Shutterstock

Busy doing nothing

Central banks in Japan, Taiwan, Thailand, and Indonesia meet next week and all are expected to leave policies on hold.

In Japan, last week’s announcement of US$121 billion in fresh stimulus has taken the juice out of the Bank of Japan meeting, which otherwise also was going to be a boring event anyway with no ammunition left to support growth. Taiwan’s central bank hasn’t done any easing in this cycle so far and, with GDP growth holding up pretty well, we don’t expect it to alter the existing policy settings anytime soon.

In Thailand, prolonged weak growth prospects ahead warrant some more Bank of Thailand rate cuts on top of two 25bp cuts this year, while inflation continues to be absent. Indeed, the Bank of Thailand has doors open for more cuts, though it’s likely to cite an additional US$3.3 billion worth of fiscal stimulus announced in late November as a reason to stay on hold next week.

The next batch of China’s November economic data – industrial production, fixed-asset investment, retail sales, and home prices – will be an interesting watch for GDP in the current quarter. A surprising bounce in both manufacturing and non-manufacturing purchasing manager indexes foreshadowed November to be a better activity month after a holiday-distorted October.

Finally, Australia’s jobs report will give some idea about the depth of the economic weakness in the current quarter, following a disappointing 3Q19 growth merited further Reserve Bank of Australia rate cuts in early 2020. A turnaround in the employment growth in November after an unexpected 19,000 fall in the previous month could upset central bank policy expectations.

Source: ING, Bloomberg

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more