Asia Week Ahead: Bank Of Korea - Will It, Or Won’t It?

China: Trade war impact is coming through

The week kicks off with China’s industrial profits for April. Keeping in line with the trend of slowing exports and production, industrial profits have been shrinking. As such, surprisingly strong 13.9% annual industrial profit growth in March appears to be an aberration from a weak trend, while the cumulative profits in the first three months were still down 3.3% from a year ago. Both exports and industrial production growth slowed sharply in April, pushing the profits growth back to negative territory.

China's economic downtrend will undoubtedly exacerbate further with the escalation of the trade tensions this month. The upcoming data on purchasing manager index for manufacturing and non-manufacturing sectors will shed light on this.

Korea: Mixed market signals on BoK policy

The market isn't pricing a Bank of Korea rate cut next week and neither is the latest Bloomberg poll suggesting anything of sorts. But the Korean Won’s (KRW) recent underperformance, with close to 5% depreciation against US dollar since the central bank’s last meeting on 18 April, seems to suggest that a rate cut is just around the corner.

We believe the poor trade environment and ongoing tech slump will continue to depress Korea’s growth, making it difficult for the central bank to defy easing. The 1.8% YoY GDP growth in 1Q19 was the lowest since the global financial crisis. This combined with negligible inflation, running well below 1% currently, underpins our outlier view of a 25bp BoK rate cut.

India: The best of election-related market rally is behind

The odds of prime minister Narendra Modi winning the elections in India cheered the markets there most of this week. Indeed, his Bharatiya Janata Party is leading with an absolute majority in the vote count, still going on at the time of writing this piece, and it looks set to form the government with existing coalition partners. We believe the best of election rally is behind and the economy will be back to re-assert its influence on the markets - almost negatively amid prevailing risk-off sentiment globally.

India’s economic slowdown gained speed in the final quarter of the financial year 2018-19 ended in March, for which GDP data is due next week (31 May). If true, our forecast of a slowdown of growth to 6.0% from 6.6% in the previous quarter will make it the slowest growth quarter in two years. While this will validate the Reserve Bank of India's two rate cuts this year, we expect the potentially higher inflation will keep it from easing again at the next meeting in early June.

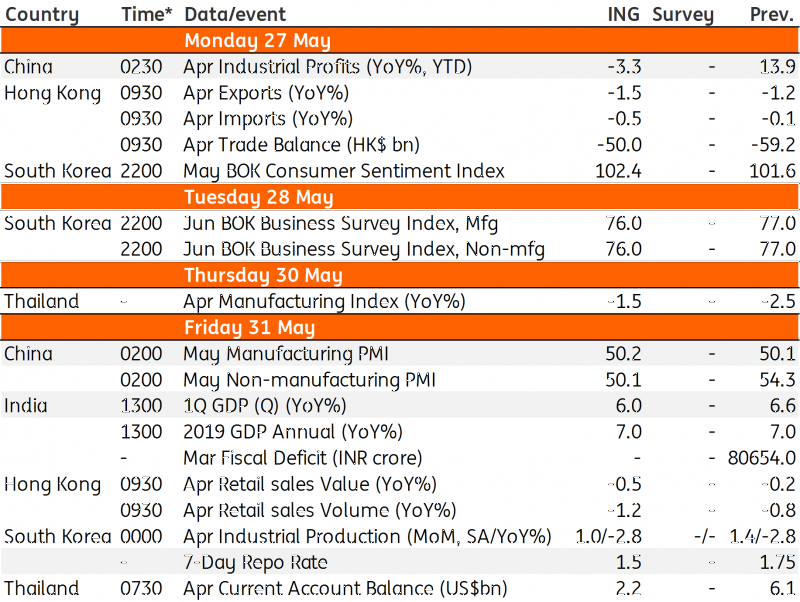

Asia Economic Calendar

(Click on image to enlarge)

Source: ING, Bloomberg, *GMT

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more