Asia And The Reflation Trade

A lot has been written about the possible impact of rising US Treasury yields on equities and other risk assets, but what about bond markets in Asia? How have they fared?

A woman buys fruits at a supermarket in Manila, the Philippines Source: Shutterstock

ASEAN bond markets hardest hit, but with one exception, not excessive

The first point to note is that so far, outside Asia-Pacific, the US Treasury yields move has been received in a fairly orderly fashion. This has not been a one-way move and has still left most risk assets close to all-time highs. There is no sense, for example, that central banks anywhere need to step in to protect investors, many of whom are still up massively over the last 15 months or so. Analysts’ forecasts continue to suggest that regional monetary authorities (with the odd exception) will ride out the current bond rout and keep policy rates unchanged.

That said, there has been a significant impact on local currency bond yields in the APAC region which will inevitably exert some downward pressure on recovery prospects as it feeds through into higher borrowing rates. This has been most notable in ASEAN markets, where 10-year yields have broadly tracked those of US Treasuries, with a slight tendency for local currency government bond yields to rise more than respective USTs. This is the case for Malaysia, Indonesia, and Singapore.

But even in developed markets, such as Australia, the same tendency is shown. This does not appear to be an emerging market vs developed market story. At least not yet. New Zealand has seen a smaller increase in its benchmark 10-year government bond yields. But that mainly stems from new government measures to dampen their booming housing market, reflected in a failed quantitative easing operation recently which suggests that local bond investors already believe the sell-off has gone far enough. In contrast, there has been a proportionately much smaller rise in bond yields in North Asian economies - Korea, Taiwan, and Japan.

Standing out from all the others, Philippine bonds have been extremely hard-hit, with the 10-year bond yield charging higher by 147 basis points since the beginning of the year. Both Bangko Sentral ng Pilipinas (BSP) and Bank Indonesia (BI) have active bond purchase mechanisms that have been deployed to limit the increase in yields. But in the case of the Philippines, this does not seem to have made much difference.

10Y APAC bond yields since 1 Jan (relative to UST10s)

Source: CEIC, APAC central banks, High charts, ING

APAC bond yields relative to USTs

Wrong place / wrong time for Philippine inflation?

The Philippines continues to suffer one of the longest lockdowns anywhere globally and was recently extended as new variants have pushed up daily case numbers, blotting the prospects for an imminent economic reopening. But Indonesia and Malaysia have also experienced difficulties with the pandemic in recent months. This is probably not what is causing the Philippine bond market's problems.

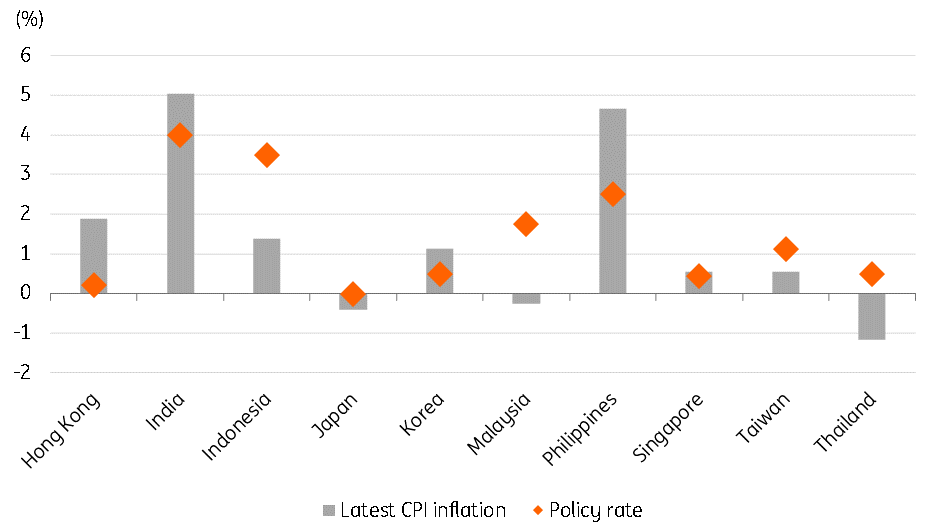

The one indicator that sticks out above all others among ASEAN markets is the Philippines’ above-target inflation rate. Within the ASEAN group, the Philippines is the only economy facing surging inflation while also suffering from the worst recession (-9.5% year-on-year in 2020). Outside the ASEAN, India too has seen inflation push up again to 5% in February, towards the upper end of its 2-6% target range. But the RBI was the first central bank in the region to tighten policy with its 50bps cash reserve ratio increase in February. Bond markets may be rewarding the RBI for its proactive approach.

Supply-side factors together with some slightly higher energy (oil-related) prices are almost entirely to blame for the inflation surge in the Philippines (an African swine fever outbreak has pushed up pork and other meat prices). And the most recent reading for Philippine headline inflation of 4.7%, has resulted in a negative real policy rate of 2.7%.

In contrast, both Thailand and Malaysia are experiencing disinflation due to weak domestic demand while Indonesia’s inflation has slipped below the 2-4% target of Bank Indonesia (BI).

APAC inflation and policy rates

Source: CEIC, ING

How the future looks

But while the Philippines has bucked the trend in terms of bond markets so far, the outlook might not be so bleak. Many countries in the region saw inflation dip sharply in 2Q 2020 as the pandemic struck home. And as a result, will be facing spiking inflation rates in the coming months. Not only did the Philippines not echo this experience, it saw supply chain interruptions push inflation up at that time and will benefit from the unwinding of that during 2Q/3Q21. Moreover, the supply shock from African swine fever will also eventually cease to be a factor, and falling pork prices will also help moderate headline inflation even as other countries see their inflation rates pick up.

None of which alters the fact that higher bond yields will hit Philippine and more broadly ASEAN growth prospects harder than those of North Asian economies in 2021. But the Philippines' status as a bond market outlier may cease to be as stark as we move into the second and third quarters.

Disclosure: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more