As Trade War Rages, Apple Plans To Shift Up To 30% Of Production Outside China

Since the trade war began last year, analysts have been closely parsing every production-related decision by Apple and its suppliers, seeing them as bellwethers of the global consumer-tech industry: Will the American tariffs permanently restructure the global supply chain? Increasingly it's looking that way. Because not long after a Foxconn executive warned that the largest manufacturer of iPhones in mainland China was ready to help Apple shift production elsewhere, Nikkei reports that suppliers for iPhones, iPads, MacBooks and Apple Ear Pods have all drawn up plans to move 15%-30% of production outside of the mainland, with India, Vietnam, Mexico, and Malaysia looking like the top alternatives.

At this point, even if Washington doesn't follow through with plans to slap tariffs on another $300 billion in goods, companies, including Foxconn, Pegatron, Wistron, Quanta Computer, iPad maker, Compal Electronics, and AirPods makers Inventec, Luxshare-ICT and Goertek have all been asked by Apple to evaluate options outside of China.

Other suppliers are watching these companies, and monitoring where they go.

"We need to know where those big assemblers are heading to so that we can initiate our plan too," an executive at an Apple component supplier told Nikkei.

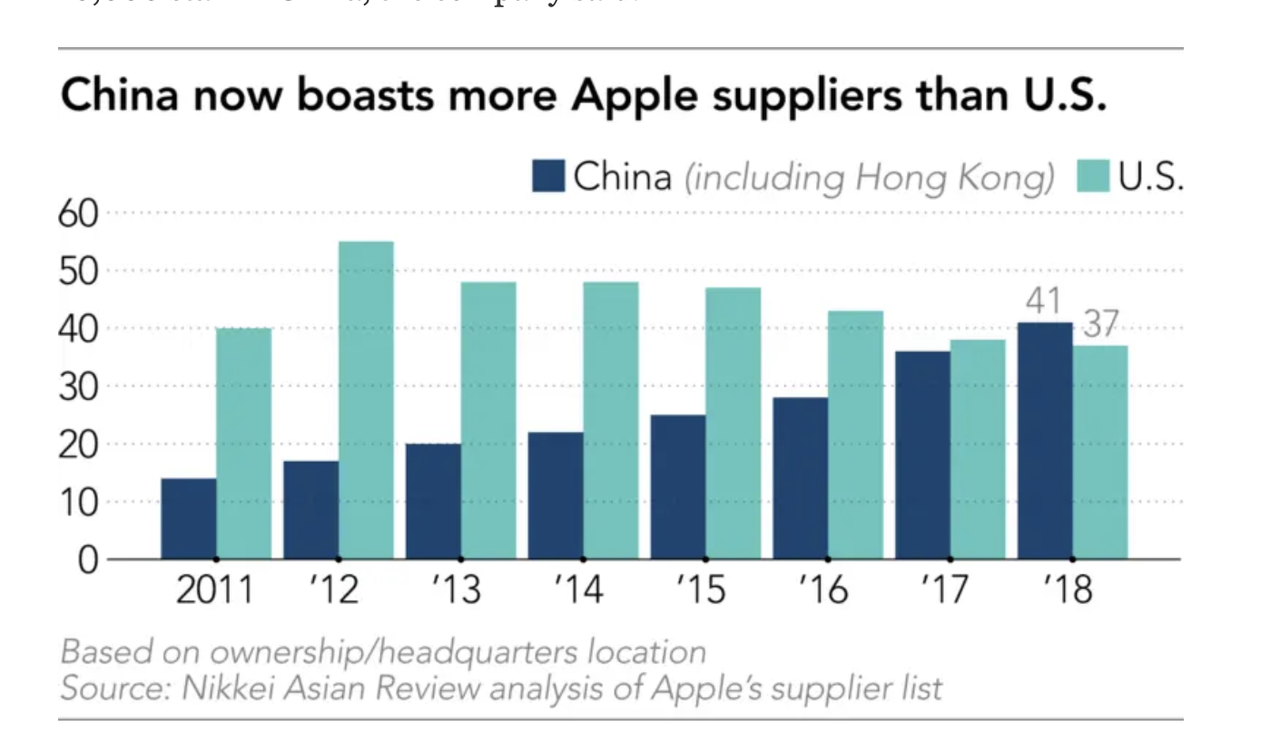

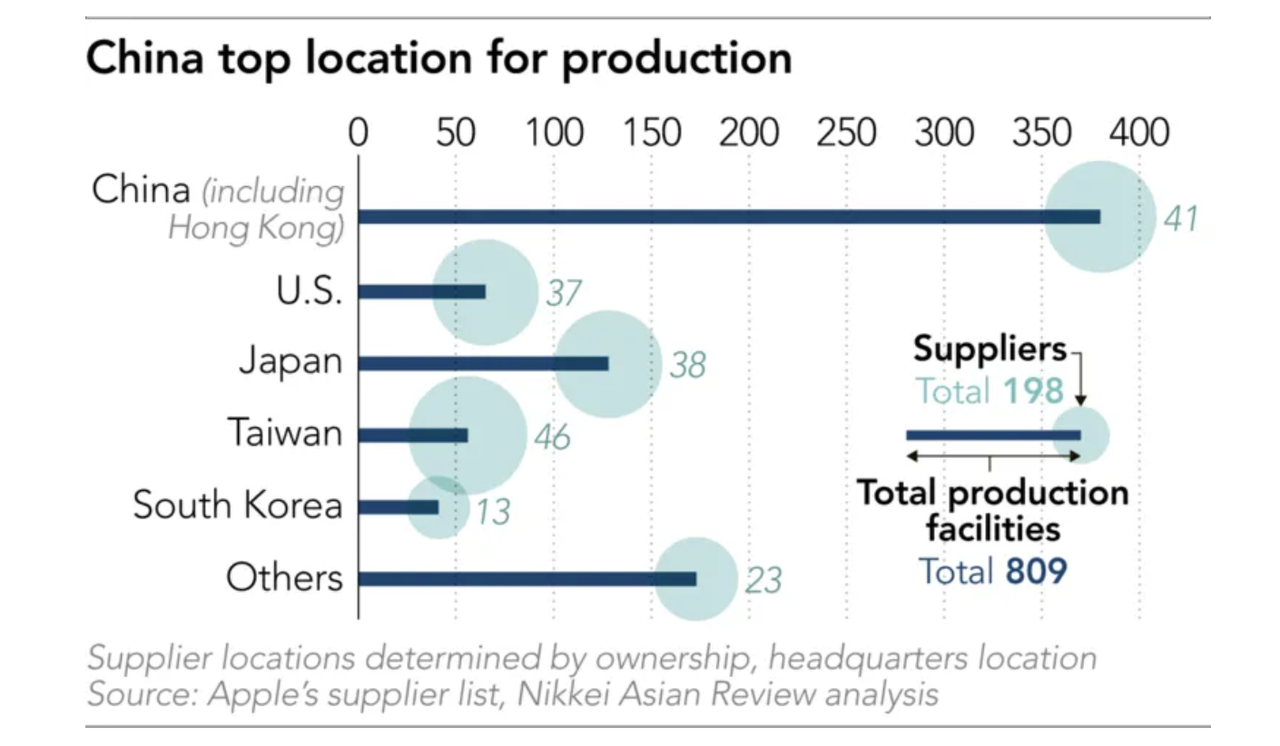

Apple supplier Wistron has assembled cheaper iPhones in India since 2017, and Foxconn started assembling more iPhones there this year, but volumes have been very small. More than 90% of Apple's products are still assembled in China. And last year, the number of mainland Chinese and Hong Kong-based suppliers surpassed the number from the US and Japan for the first time, accounting for 41 of the top 200 suppliers.

This is the biggest reason why Apple needs its suppliers to write up plans for long-term "diversification" of production. But trade tensions aren't the only issue with China: Apple also raised demographic issues like lower birth rates. Ultimately, millions of jobs in China are at risk.

The California-based tech giant's request was triggered by the protracted trade tensions between Washington and Beijing, but multiple sources say that even if the spat is resolved there will be no turning back. Apple has decided the risks of relying so heavily on manufacturing in China, as it has done for decades, are too great and even rising, several people told Nikkei.

"A lower birthrate, higher labor costs and the risk of overly centralizing its production in one country. These adverse factors are not going anywhere," said one executive with knowledge of the situation. "With or without the final round of the $300 billion tariff, Apple is following the big trend [to diversify production]," giving itself more flexibility, the person added.

China has been the production base on which Apple's global success has been built over the past two decades. The country has not only been able to rally hundreds of thousands of skilled workers at short notice to fill rapidly rising orders as the company grew, but an extensive and complex ecosystem of components, logistics and talent has built up in and around Apple manufacturing sites.

Some 5 million Chinese jobs rely on Apple's presence in the country, including those of more than 1.8 million software and iOS App developers, according to a study available on the company's website. Apple itself employs 10,000 staff in China, the company said.

If Apple and its suppliers decide to follow through, the changes won't happen right away: In any case, Apple moving 15% of its iPhone production out of China would be a "gargantuan endeavor," laden with risks like supply-chain disruption and higher costs according to Wedbush. The Wedbush team estimates it would take two-to-three years to pull off. Suppliers appear to agree.

Suppliers admit that replicating this network elsewhere will take time, and China is likely to remain Apple's most important manufacturing base for the foreseeable future. "It's really a long-term effort and might see some results two or three years from now," said one supplier.

"It's painful and difficult, but that's something we have to deal with."

But the trade war has prompted Apple to seriously consider meaningful diversification for the first time, say several sources. At the end of last year, the company began to expand its so-called capital expense studies team, according to sources familiar with the matter.

The team of more than 30 people is discussing production plans with suppliers and negotiating with governments over financial incentives they might be willing to offer to attract Apple manufacturing, as well as regulations and the local business environment.

But at this point, it looks like nothing short of the complete reversal of trade war tensions would stop Apple from directing suppliers to move at least some production elsewhere on a permanent or semi-permanent basis. Which means that whatever Trump and Xi decide in Osaka, best case scenario, it will be too little too late for China, leaving China's dominance of the tech components and assembly business in jeopardy.

As often as Beijing insists that Washington will feel the greater sting from the trade tensions, this is a major area of vulnerability for China.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

Sounds like a smart move by #Apple to me. No one likes uncertainty. $AAPL